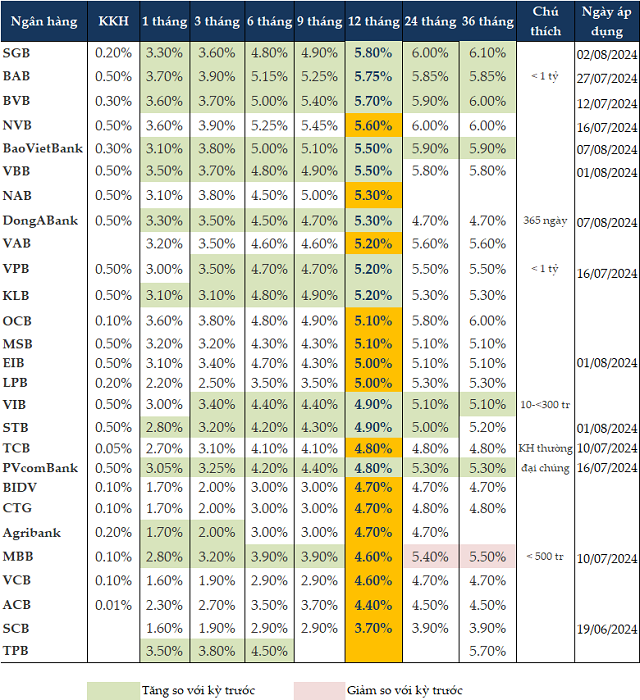

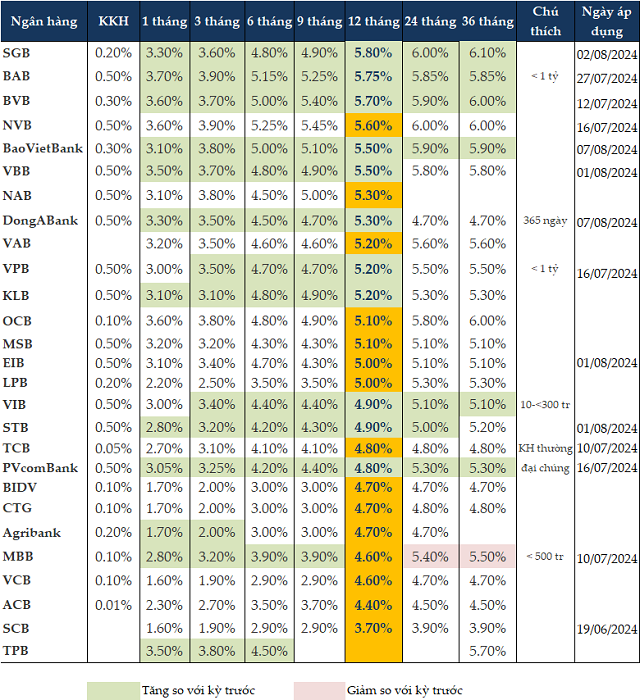

Since late July, banks have continued to raise savings deposit rates by 0.1-0.8 percentage points across all tenors, including SGB, BAB, BVB, VBB, VIB, STB, and MBB.

Effective August 2, 2024, SGB increased deposit rates by 0.2-0.8 percentage points for all tenors. Specifically, the 1-month rate rose by 0.8 percentage points to 3.3% p.a., the 3-month rate also increased by 0.8 percentage points to 3.5% p.a., the 6-month rate went up by 0.7 percentage points to 4.8% p.a., and the 12-month rate climbed by 0.5 percentage points to 5.8% p.a.

From August 7, 2024, BaoVietBank introduced a new deposit rate schedule, with increases ranging from 0.2 to 0.6 percentage points compared to the previous period. The bank now offers a 3.1% p.a. rate for 1-month deposits, 5% p.a. for 6-month deposits, 5.5% p.a. for 12-month deposits, and 5.9% p.a. for over 12-month deposits.

Meanwhile, VIB made a slight increase of 0.1-0.2 percentage points in deposit rates for tenors of 3 months and above. Specifically, for deposits ranging from 10 million to less than 300 million VND, VIB offers a 3.4% p.a. rate for 3-month tenors, a 4.4% p.a. rate for 6 to 9-month tenors, and a 5.1% p.a. rate for 12-month and above tenors.

Sacombank raised deposit rates for all tenors by 0.2-0.4 percentage points starting August 1, 2024. The bank increased its 3-month savings rate to 3.2% p.a., the 6-month rate to 4.2% p.a., and the 12-month rate to 4.9% p.a.

After a long period of stagnation, Agribank became the first state-owned bank to increase deposit rates, while the other three banks (Vietcombank, VietinBank, and BIDV) maintained their previous rates. At Agribank, the 1-month deposit rate increased by 0.1 percentage points to 1.7% p.a., and the 3-month rate also rose by 0.1 percentage points to 2% p.a., with the remaining tenors unchanged.

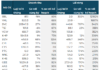

As of August 8, 2024, savings deposit rates for 1-3 month tenors ranged from 1.6% to 3.9% p.a., 6-9 month tenors ranged from 2.9% to 5.45% p.a., and 12-month tenors ranged from 3.7% to 5.8% p.a.

For the 12-month tenor, SGB offered the highest deposit rate at 5.8% p.a., followed by BAB at 5.75% p.a. and BVB at 5.7% p.a.

In the 6-month tenor, NVB maintained the highest rate at 5.25% p.a., followed by BAB at 5.15% p.a.

For the 3-month tenor, NVB and BAB offered the highest rates at 3.9% p.a.

|

Personal Savings Deposit Rates at Banks as of August 8, 2024

|

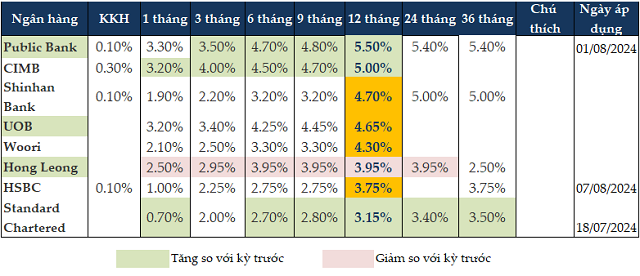

Foreign banks have also started to raise their deposit rates again. As of August 8, 2024, for the 12-month tenor, Public Bank offered the highest rate at 5.5% p.a. For the 6-month tenor, Public Bank also maintained the highest rate at 4.7% p.a. after the increase.

|

Personal Savings Deposit Rates at Foreign Banks as of August 8, 2024

|

Contrasting Predictions on Interest Rates

PGS.TS. Dinh Trong Thinh, an economic expert, opined that as the economy recovers, people’s investment demands will increase. To attract capital, commercial banks will have to raise deposit rates, which have been gradually increasing since April. When deposit rates go up, lending rates will follow suit. However, the State Bank of Vietnam (SBV) has instructed commercial banks to minimize expenses to cut lending rates by 1-2%. Therefore, lending rates are expected to remain stable or increase slightly in the coming time.

On the other hand, Dr. Nguyen Tri Hieu, a finance and banking expert, believed that banks might slightly increase lending and deposit rates towards the end of the year, as a few banks have already raised their deposit rates by 0.5-1% p.a. since the beginning of the year.

Contrarily, Mr. Nguyen Quang Huy, CEO of the Finance and Banking Faculty at Nguyen Trai University, argued that credit growth has not yet reached its plan for the year, and many banks have surplus capital that has not been disbursed, creating pressure towards the end of the year. Therefore, banks must compete on interest rates to disburse loans and maintain stable interest rates or even reduce them to attract and disburse loans to customers according to each bank’s preferences.

Additionally, as there is still undisbursed capital in the banks, competitive deposit rates will only increase capital costs and reduce business efficiency. Thus, Mr. Huy predicted that deposit rates would remain at current levels or could decrease further to optimize capital costs. However, the increase in deposit rates is only happening in a few banks, and state-owned banks will remain stable.

Looking at the economy as a whole, Mr. Huy assessed that there are many factors supporting the maintenance and reduction of both deposit and lending rates, such as the US Federal Reserve’s interest rate cut, the cooling down of exchange rates, the strong inflow of remittances towards the end of the year, a large trade surplus, significant FDI disbursements, ample room for credit growth, and a vast amount of savings in the population of 15 quadrillion VND. Therefore, capital sources will be abundant to serve production and business needs in the last four months of the year.

By Cat Lam

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banking: Huge Profits Yet Worried

Several banks have announced their 2023 financial results, showing outstanding growth. However, they are also facing increased pressure in setting aside provisions for credit risk.