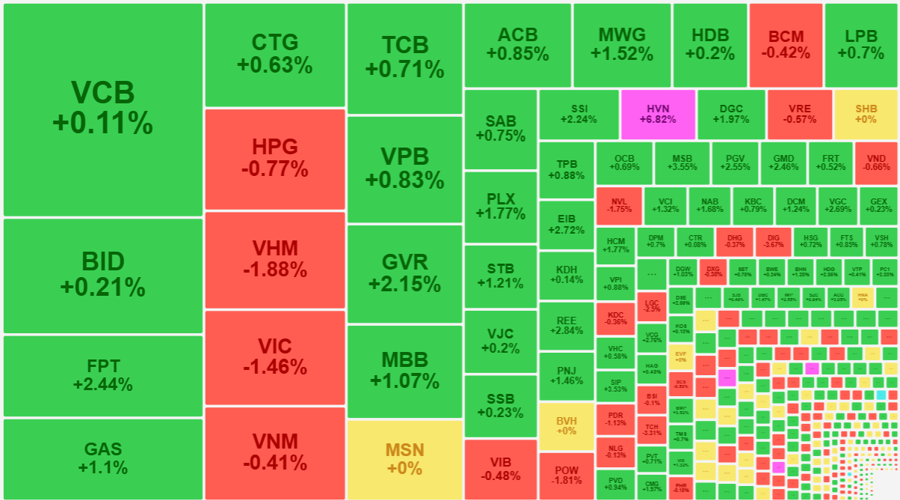

The market experienced another minor profit-taking spell at the start of the afternoon session, briefly pushing the VN-Index down by 2.5 points before bottom-fishers stepped in, lifting the index higher. The index closed at its intraday high, gaining 6.6 points (+0.54%). Foreign investors also turned net buyers, reversing their net-selling position from the morning session.

The VN-Index hit its intraday low at 1:45 PM with 158 gainers and 252 losers. This imbalance wasn’t too significant, and the blue chips didn’t decline further. Most of them had already touched their lows earlier in the morning. As buying interest picked up in this group, stocks started to recover, pushing the VN-Index back above the reference level. The HoSE floor also saw positive breadth, ending with 238 gainers and 168 losers.

The VN30-Index turned positive later than the VN-Index, turning green for the first time at 1:55 PM and only officially breaking higher around 2:05 PM. This was due to a few stocks performing better than the VN30 constituents, notably HVN (not a VN30 constituent) and BID. The breadth of the VN30 basket also only turned positive after 2 PM, with the index closing up 0.52% with 19 gainers and 8 losers.

Banking stocks among the blue chips staged an impressive recovery in the afternoon session. MBB, ACB, CTG, TPB, and VPB all rose over 1% compared to their morning closing prices. Additionally, GVR, SSI, and VJC also rebounded strongly. Turnover in the VN30 basket in the afternoon session increased by nearly 28% compared to the morning session, reaching approximately VND 3,333 billion. While this isn’t a large trading volume, it’s the lowest of the last four sessions, indicating very mild selling pressure.

The morning’s two pillars, FPT and GAS, didn’t gain much strength in the afternoon. FPT experienced a significant profit-taking spell in the first half of the afternoon session, falling to 1.42% gains at 1:45 PM (up 2.13% in the morning). GAS also struggled, narrowing its gains to 0.74% (up 1.72% in the morning). These two stocks were partly responsible for pushing the VN-Index below the reference level, even though other stocks didn’t decline much. In the final trading minutes, FPT managed to recover, ending the day 2.44% higher. GAS, however, failed to reclaim its morning price, closing up 1.1%. Their weakness was offset by the strong rebound of many other stocks in the basket.

Bottom-fishing demand was also evident in many other stocks on the exchange, as indicated by the significant change in breadth compared to when the VN-Index hit its intraday low and at the end of the morning session. Overall turnover on the HoSE floor in the afternoon session increased by 18.3%, reaching VND 6,526.4 billion. This suggests more active trading and price improvement by buyers, creating a recovery momentum for many stocks. Approximately 57% of the stocks that traded on the HoSE floor during this session closed more than 1% above their intraday lows. Notably, over 100 stocks reversed by more than 2%, many of them with high liquidity, reflecting the strong movement of bottom-fishing funds.

The HoSE floor closed with 95 stocks ending above the reference level, with gains ranging from 1% to over 1%. The turnover of this group accounted for 47.6% of the floor’s total matched volume. Many blue chips recorded high trading volumes, such as FPT, MWG, SSI, STB, MBB, and PLX. Additionally, mid-cap stocks like DGC, VIX, DBC, CSV, HAH, HCM, HDG, DCM, TCM, and VCI all had turnover exceeding VND 100 billion. Today’s recovery dynamics weren’t as impressive as last Friday’s afternoon session, but they still created significant price swings. This reflects the readiness of funds to enter the market when short-term profit-taking pressures emerge.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.