The recent conflict in Bangladesh has disrupted the apparel supply chain as the country is currently the world’s third-largest apparel exporter.

Agriseco and SSI Securities in their latest report provided an assessment of the impact on the apparel industry and Vietnam’s export enterprises in light of the events in Bangladesh.

According to Agriseco Research, the unrest in the country disrupts the apparel supply chain and will significantly affect the business operations of global apparel companies, especially those with production bases in Bangladesh such as H&M, Zara, and others.

Echoing this sentiment, SSI Research notes that leading fashion brands from Europe (H&M, Zara, etc.) are among the key exports of Bangladesh. Many factories had to shut down, leading clients to consider shifting orders to other countries such as China, India, and Vietnam. As a neighboring country supplying cotton to Bangladesh, SSI believes India is the biggest gainer in this short-term volatility.

Multiple advantages for Vietnam’s apparel industry

Regarding the domestic apparel industry, Agriseco Research assesses that the Vietnamese apparel industry will benefit from the aforementioned unrest in Bangladesh as export enterprises can attract orders shifted from that country. Currently, it is also the peak season for apparel exports to serve the year-end holiday season.

In the long run, FDI enterprises will definitely consider finding an alternative country to Bangladesh in the apparel supply chain due to instability and potential disruption risks. Meanwhile, Vietnam possesses many advantages, including cheap and skilled labor, attractive policies for FDI enterprises, and improving infrastructure.

SSI Research states that domestic apparel manufacturers with the highest contribution ratio from the European market and a high ratio of CMT orders (a competitive advantage of Bangladesh) may benefit from this change. SSI also notes that Bangladesh’s market share of apparel exports to the US has remained stable at 7.1% from 2023 to the first half of 2024, and the US is still the largest market for Vietnam’s apparel exports (Vietnam’s market share in the US is 15%).

Which textile and garment stocks will benefit the most?

Vietnam’s textile and garment enterprises that benefit are those with sufficient production capacity to accommodate new orders shifted from the Bangladesh market. Agriseco Research highly regards enterprises with a high ratio of FOB orders in their revenue structure, such as MSH and TNG.

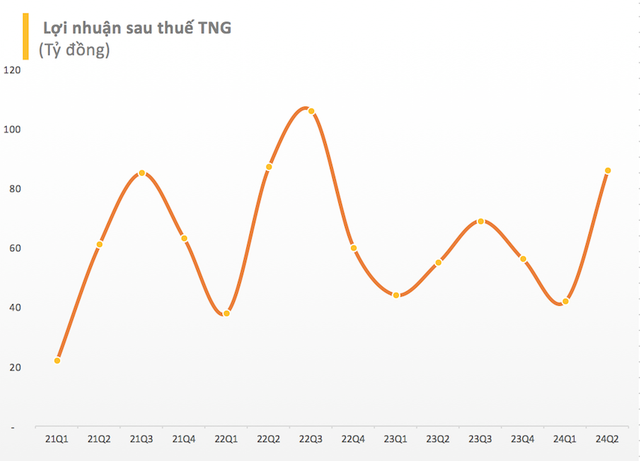

Thus, among the textile and garment stocks, in addition to the recent gains in textile and garment stocks in the past few days, the SSI Research team believes that TNG will benefit the most due to its high contribution ratio from the European market and a higher ratio of CMT orders compared to its peers, including TCM and MSH.

In the first half of 2024, TNG announced revenue and net profit growth of +6% and +30%, respectively, over the same period last year. The management attributed this performance partly to the shift in orders from Bangladesh since the beginning of the year. In Q2/2024, TNG’s revenue increased by 61% compared to the previous quarter. TNG has enough orders until the end of the year and is negotiating prices for 2025 orders.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.

Vietnam’s Irresistible ‘Specialty’ That China Desperately Wants to Revive: Highly Popular from the US to Asia, Bringing in Millions of Dollars

Vietnam is one of the largest exporting countries in the world, along with China and the Philippines.