Noi Bai Aviation Catering JSC (stock code: NCS) recently announced its Q2/2024 financial report, recording a revenue of over 162 billion VND, a 19% increase compared to the same period.

Excluding expenses, the company reported a net profit of 12.1 billion VND, a 51.8% increase compared to the previous year.

For the first six months of 2024, Noi Bai Aviation Catering JSC achieved a revenue of 340 billion VND, a 20% increase compared to the same period, and a profit after tax of over 27 billion VND, a 45% increase.

Explaining the significant increase in profit, the company attributed it to the full recovery of the international aviation market and its growth compared to the pre-COVID-19 period in 2019.

In the first half of the year, the international flight network continued to expand, with airlines increasing flight frequencies and enhancing service standards. The domestic market remained stable with slight growth.

The company continued to provide non-aviation products such as pork pies for the Lunar New Year, bubble tea, mooncakes, and other bakery products.

“As a result, revenue and profit for Q2 and the first six months of 2024 were significantly higher than the same period last year,” the company explained.

Noi Bai Aviation Catering JSC is known as one of the largest inflight catering providers in the market. It is also the company that currently supplies bubble tea to Vietnam Airlines.

As of June 30, the company had short-term receivables from Vietnam Airlines of 38.4 billion VND, the largest proportion of Noi Bai Aviation Catering’s receivables from customers.

In the first half of the year, the total cost of salaries for management staff and labor of Noi Bai Aviation Catering was 95 billion VND, a 27% increase compared to the beginning of 2024. The total number of employees as of June 30 was 746.

Thus, on average, each employee of the company received about 21.2 million VND per month, which is 3.5 million VND more per month compared to the same period last year.

As of June 30, Noi Bai Aviation Catering had a non-term bank deposit worth 46.7 billion VND, 3.5 times higher than at the beginning of 2024. Owner’s equity was at nearly 155 billion VND, a 21.3% increase.

Meanwhile, payables stood at 303 billion VND (down 9% from the beginning of 2024), of which total loans and finance leases accounted for 61.7% (187 billion VND). Thus, payables are nearly twice the equity, indicating that the company may be facing risks in debt repayment.

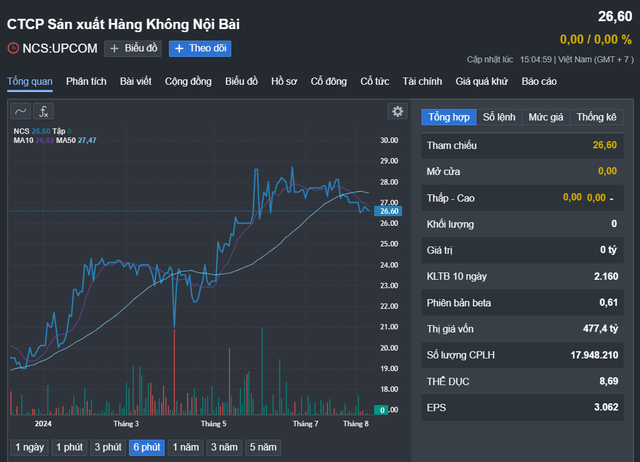

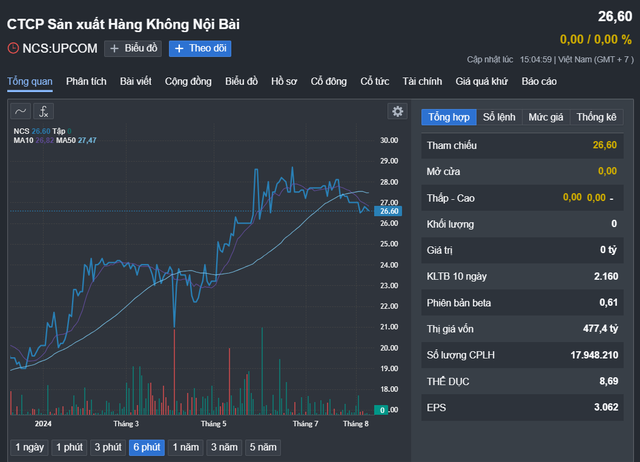

In the market, NCS shares have continuously increased over the past several months and are currently trading at 26,600 VND per share, 32.34% higher than at the beginning of the year.