Export-import activities also witnessed a positive recovery, with July’s exports increasing by 6.7% and imports surging at a faster pace of 11% compared to the previous month. Photo: H.P |

The economy is on a solid path to recovery.

The Purchasing Managers’ Index (PMI), the Index of Industrial Production (IIP), and export figures all indicate a robust rebound, suggesting that Vietnam’s economy, heavily reliant on manufacturing and exports, is on the right track.

The latest PMI data reinforces the positive trajectory of Vietnam’s manufacturing sector. In July 2024, Vietnam’s manufacturing PMI reached 54.7, maintaining the highest level since May 2022. This signifies continuous expansion in the manufacturing sector, marked by growth in new orders and export orders.

Notably, new orders have increased for four consecutive months, although the pace has slowed compared to the recent record high in June. Manufacturers have ramped up production activities, with the expansion rate being the second-highest on record. To meet the rising demand, businesses have increased their purchasing of raw materials and stepped up hiring, despite a slower pace of employment growth compared to the previous month.

|

Leading indicators such as PMI, IIP, and export figures all point to a smooth economic recovery, which is expected to be reflected in confirming indicators such as GDP, total retail sales, and services in Q3 and the entire 2024. |

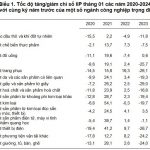

The IIP also shows a corresponding recovery, with a 0.7% increase in July 2024 compared to the previous month.

Export-import activities have also witnessed a positive recovery, with July’s exports increasing by 6.7% compared to the previous month, while imports surged at a faster pace of 11%. The faster import growth indicates that businesses are actively sourcing raw materials to prepare for year-end orders.

Overall, the leading indicators suggest a smooth economic recovery, which is anticipated to be reflected in confirming indicators such as GDP and total retail sales and services in Q3 and the full year 2024.

Production costs in the manufacturing sector are experiencing high inflation.

In terms of inflation, the other key economic indicator, the trend is less favorable. While inflation has remained under control in recent months, pressures persist as the consumer price index (CPI) inches closer to the National Assembly’s inflation target. Data from the General Statistics Office shows that the CPI in July 2024 increased by 0.48% compared to the previous month. On average, the CPI rose 4.12% in the first seven months of 2024.

In addition to the consumer sector, inflationary pressures have also emerged in the production sector in recent months. According to PMI data, input cost inflation surged in June at the fastest pace in nearly two years and continued to remain high in July. This increase is partly due to rising import prices, especially for raw materials such as oil, metals, and other basic commodities.

At this point, high input cost inflation will negatively impact businesses’ production activities. This is because companies are using their inventories to meet new orders, leading to a significant reduction in stock levels. As a result, Vietnamese manufacturers will need to purchase additional raw materials to continue fulfilling new orders in the coming months. Higher input costs also mean that businesses will face narrower profit margins on year-end orders.

In summary, elevated production cost inflation will erode the gains from the recovery in manufacturing, thereby impacting the overall economic rebound’s quality.

A policy shift scenario is possible.

As the economy gradually returns to its growth trajectory, inflationary pressures persist. This sets the stage for a potential policy shift scenario.

Specifically, once the economy has returned to a normal state, economic stimulus measures will be scaled back to prevent overheating. Consequently, monetary and fiscal policies will transition out of the accommodative phase witnessed over the past two years or so, signaling a rise in policy interest rates and an end to tax and fee reductions.

Businesses should take note of this potential shift as they prepare their production and business plans for the last few months of 2024 and beyond, including contingency plans for the discontinuation of tax and fee support measures, as well as financial strategies in anticipation of rising interest rates.

Trinh Hoang

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.

CPI in January 2024 rises by 0.31%, core inflation increases by 0.21% compared to the previous month

According to a report from the General Statistics Office, the average retail electricity price and domestic rice price continued to increase in January 2024, following the export rice price. These are the main reasons for the Consumer Price Index (CPI) in January 2024 to increase by 0.31% compared to the previous month. Compared to the same period in 2023, the January CPI increased by 3.37%; the core inflation in January 2024 increased by 2.72%.

PMI January 2024: Increase in Production and New Order Volume

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI), a key indicator for the industry, has returned to above the 50-point threshold in the first month of the year, rising to 50.3 from December’s 48.9. The PMI result suggests an improvement in the health of the manufacturing sector for the first time in months, although the improvement is only modest.