The second quarter of 2024 comes to a close with impressive results, as the overall after-tax profit for the market surged by 26% year-on-year. This growth was driven by the Non-financial group, which witnessed a remarkable 32.9% increase, thanks to significant contributions from sectors with strong recovery stories: Steel, Aviation, Telecommunications, Fertilizers, Retail, and Real Estate. The latter two sectors, in particular, benefited from wholesale project sales and recognition of financial investment income.

Within the Financial group, after-tax profits rose by 20.6% year-on-year. Banks remained the primary growth pillar, with a 21.6% increase compared to the previous year and a 6% quarter-on-quarter growth. Meanwhile, Securities did not exhibit the same explosive growth as before, as the low base effect from the previous year wore off.

According to FiinGroup’s insights, the profit growth prospects remain favorable for the third quarter of 2024, given the low base in the third quarter of 2023, which was the lowest in the last six quarters. This is also the quarter when two key sectors, Banking and Real Estate, experienced weak financial results, and profits from other sectors, except for Steel, Securities, and Oil & Gas, remained largely stagnant or recovered very slowly.

A positive recovery trend is evident in numerous sectors within the Non-financial group, while the Financial group maintains a stable profit margin. Specifically, the Consumer Goods sector stands out with exceptional after-tax profit growth year-on-year, driven by revenue growth and improved EBIT margins, led by prominent retailers MWG and FRT. Meanwhile, Dairy (VNM), Beverages (SAB), Food (MSN), and Personal Goods (PNJ) posted growth rates below the Non-financial group’s average but still exceeded expectations.

With consumer demand expected to bounce back stronger and profit margins continuing to expand due to effective control of input costs, the growth outlook for the second half of 2024 remains positive for most of these sectors, except for Personal Goods, as gold prices are unlikely to surge significantly in the near future.

Regarding the prospects for the Sugar and Livestock industries, FiinGroup does not foresee any significant supportive factors for profit growth in the latter half of the year.

For the Electricity and Oil & Gas Production sectors, profits are at their lowest in the last six quarters. The outlook for the Electricity sector is not particularly optimistic, as electricity demand is not expected to surge in the short term. Meanwhile, the Oil & Gas Production sector will likely witness a further deep dive in profits in the next quarter due to the lack of signs of recovery in refining margins.

In terms of export-oriented sectors, there are indications that consumer demand in Vietnam’s key export markets, including the EU and the US, is weakening. Consequently, after-tax profit growth in the Export group is expected to remain highly divergent in the coming quarters.

Specifically, the business outlook remains subdued for the Seafood (VHC, ANV, FMC) and Chemicals (DGC) industries. While there has been growth in shrimp and catfish exports, it has been modest due to limited purchasing power from importers, coupled with intense competition from other low-cost suppliers, causing VHC and FMC to struggle to improve their EBIT margins. As for the Chemicals sector, profits may have bottomed out and are expected to recover in the coming quarters, but stock prices have already factored in this potential recovery, leading to potentially inflated valuations.

On the other hand, the Textile sector witnessed a remarkable 47.4% surge in after-tax profits in the first quarter, thanks to a low base effect from the previous year and improved EBIT margins, notably in VGT, TCM, MSH, and TNG. The recovery trend in revenue will become more pronounced in the next quarter, as order volumes have started to pick up again. However, it’s important to note that the pace of recovery in profit margins is slow due to low-value-added products, rising input costs, and increasing labor expenses.

Most textile stocks are currently trading at high valuations compared to their three-year averages. As profit growth has fallen short of expectations, many textile stocks have come under pressure to adjust in the last month. With the recovery still on the horizon, this group of stocks deserves attention when valuations are discounted to more reasonable levels.

For the Rubber sector, the upward momentum may slow down, as rubber prices are not expected to surge significantly, as seen in the early part of the year.

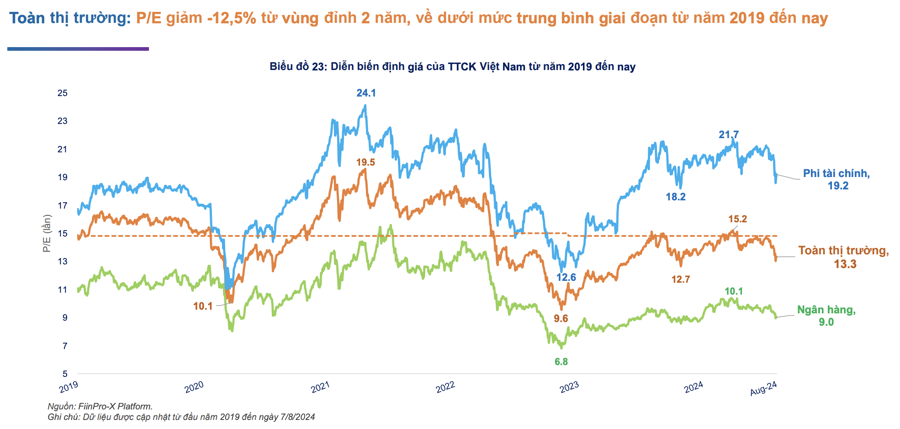

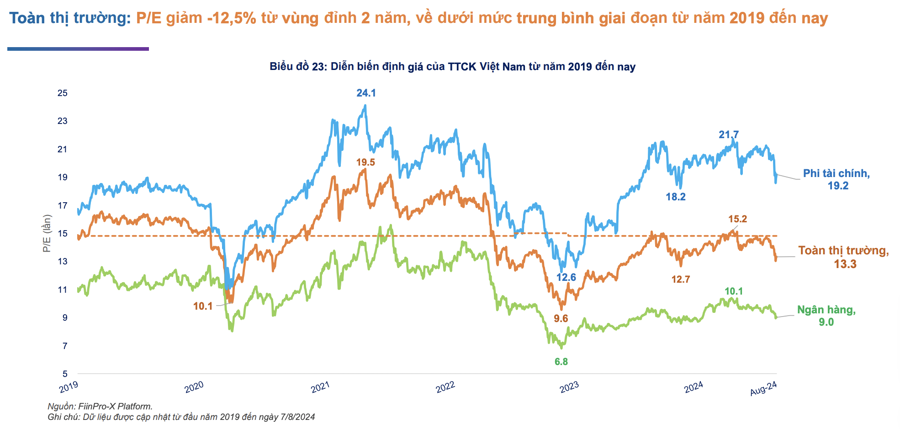

In terms of market valuation, the overall market P/E ratio stands at 13.3x, below the average of 14.8x observed from 2019 to the present and a 12.5% decrease from the two-year peak reached in early April 2024. Within this, the Non-financial group’s P/E ratio decreased by 11.5%, while the Banking sector’s P/E ratio dropped by 14.3%.

With after-tax profit growth expected to surpass 20% in the second half of 2024, driven by the ongoing recovery in the Non-financial group, the P/E ratio is likely to dip even lower as the market adjusts, presenting opportunities in sectors or stocks with room for valuation expansion and robust growth prospects.