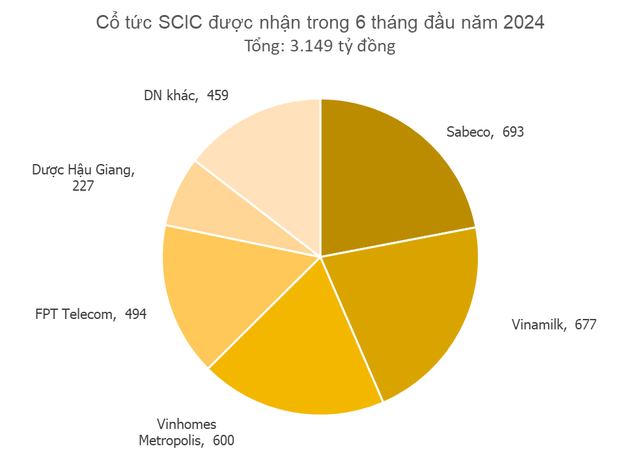

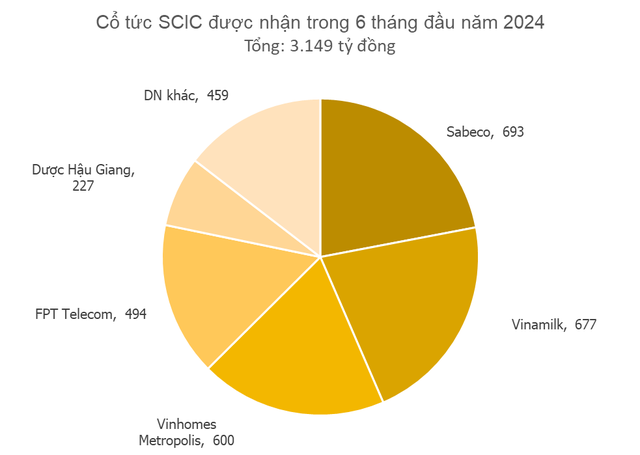

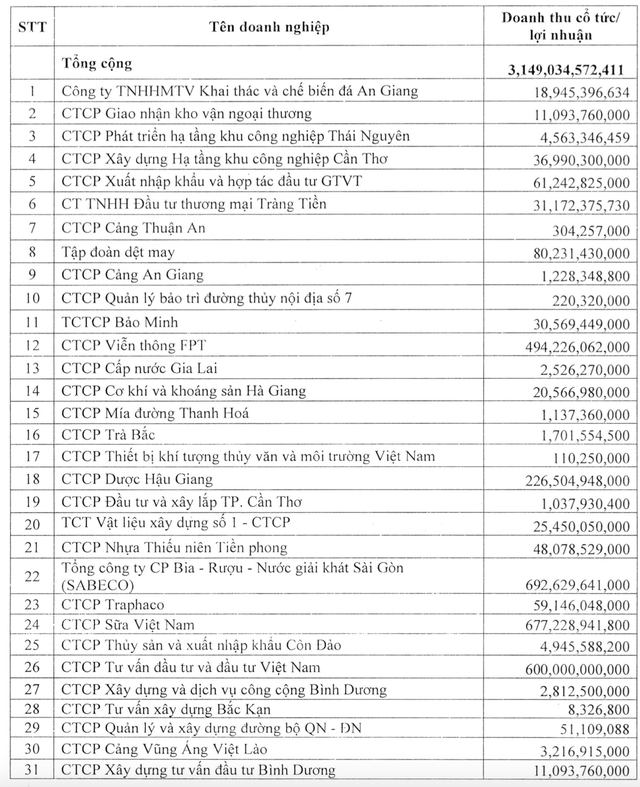

State Capital Investment Corporation (SCIC) has released its governance and organizational structure report for the first half of the year. The report reveals that SCIC received a substantial 3,149 billion VND in dividend and profit-sharing revenue from 31 companies within its system.

Leading the way in dividend and profit distribution to SCIC is Saigon Beer, Alcohol and Beverage Joint-Stock Company (Sabeco), with nearly 693 billion VND. Sabeco is the largest enterprise in Vietnam’s beer industry, boasting 26 subsidiaries and 18 affiliated companies. With 26 breweries across the country, Sabeco has an annual capacity of 2.4 billion liters. The company has a robust distribution network, including 11 commercial companies that manage over 600 distributors and 200,000 retail outlets nationwide. In addition to its domestic presence, Sabeco also exports its products to 30 countries. For 2024, Sabeco has set ambitious targets, aiming for 34,397 billion VND in revenue and 4,580 billion VND in post-tax profits.

Following closely behind is Vietnam Dairy Products Joint Stock Company (Vinamilk), contributing 677 billion VND. Vinamilk is a dominant force in the Vietnamese dairy industry, holding over 50% of the market share. With the largest production scale in the country, Vinamilk owns 15 high-tech farms, a total herd of over 140,000 cows, and 16 factories with a capacity of 1 billion liters of milk per year. While currently, over 80% of Vinamilk’s revenue comes from the domestic market, the company is actively working to expand its exports to global markets. In the first half of 2024, Vinamilk recorded impressive financial results, with revenue reaching 30,790 billion VND, a nearly 6% increase year-over-year, and post-tax profits surging by 19% to approximately 4,309 billion VND.

Another notable contributor is Vietnam Investment Consulting and Investment Joint Stock Company (Vietnam INCO), distributing 600 billion VND. Vietnam INCO is a member of the VinGroup conglomerate and is known for its investment in the Vinhomes Metropolis project at 29 Lieu Giai, considered the prime location in Hanoi. Vinhomes Metropolis, which broke ground in 2016, spans 3.5 hectares and comprises three luxury apartment towers, two office buildings, the Vinschool educational system, and the Vincom commercial center. SCIC currently holds a 30% stake in Vietnam INCO. The total amount distributed by the company in 2024 amounts to 2,000 billion VND, an impressive 33 times its charter capital of 60 billion VND.

Vietnam INCO did not pay dividends in 2023. However, according to SCIC’s report, the company may have paid SCIC approximately 300 billion VND in dividends in 2009 and 600 billion VND in 2022.

Combined, these top three contributors have provided nearly 2,000 billion VND, accounting for almost 63% of SCIC’s total dividend and profit-sharing revenue for the period.

Additionally, FPT Telecom Joint Stock Company and DHG Pharmaceutical Joint Stock Company (DHG) also distributed substantial dividends and profits, with FPT contributing 494 billion VND and DHG contributing 226.5 billion VND.

In terms of SCIC’s business performance, the consolidated financial statements for the second quarter of 2024 show a 36% year-over-year decrease in revenue, totaling 1,264 billion VND. However, thanks to a significant increase in the reversal of provision for investment depreciation, the company’s gross profit rose to 2,718 billion VND. After deducting expenses, SCIC recorded a post-tax profit of 2,352 billion VND for the second quarter. For the first half of the year, SCIC achieved impressive results, with revenue reaching 3,947 billion VND, a 41% increase, and post-tax profit climbing to 5,917 billion VND, a 95% surge compared to the same period last year.

As of June 30, 2024, SCIC’s total assets stood at 62,310.5 billion VND, with equity amounting to 56,792 billion VND. The company holds 7,571.5 billion VND in cash and cash equivalents, along with nearly 27,893 billion VND in short-term bank deposits and over 4,000 billion VND invested in stocks.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.

Attracting talented individuals is challenging, but retaining them is even more difficult.

Not only is it about salary and benefits, but employees nowadays also have increasing desires for their working environment. Among them, what used to be considered as “additional perks” such as comprehensive healthcare programs, learning and development opportunities, and an environment to explore new things… are now being prioritized.