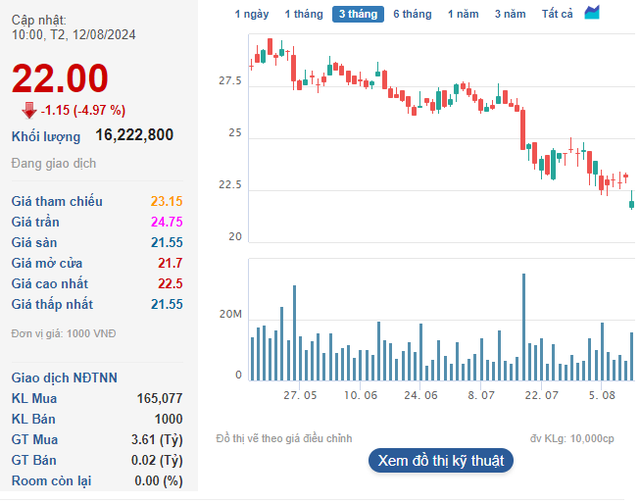

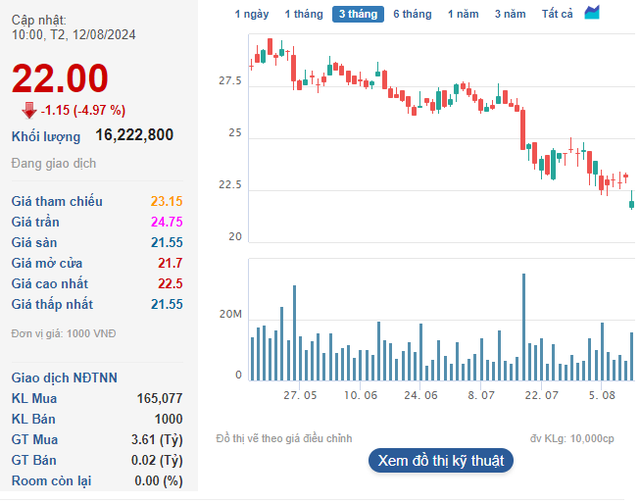

The stock market witnessed a gloomy trading session for Total JSC for Investment and Construction Development (DIC Corp, code: DIG) on the first day of the week. Selling pressure weighed heavily on DIG’s market price from the start of the session, with the stock even hitting the floor price at one point before recovering slightly.

As of 10:00 am, DIG shares were trading at VND 22,000 per share, down nearly 5% from the previous session. Since its 2-year high in mid-April 2024 (VND 33,600 per share), DIG’s market price has fallen by nearly 35% in 4 months. Market capitalization also decreased to VND 13,400 billion.

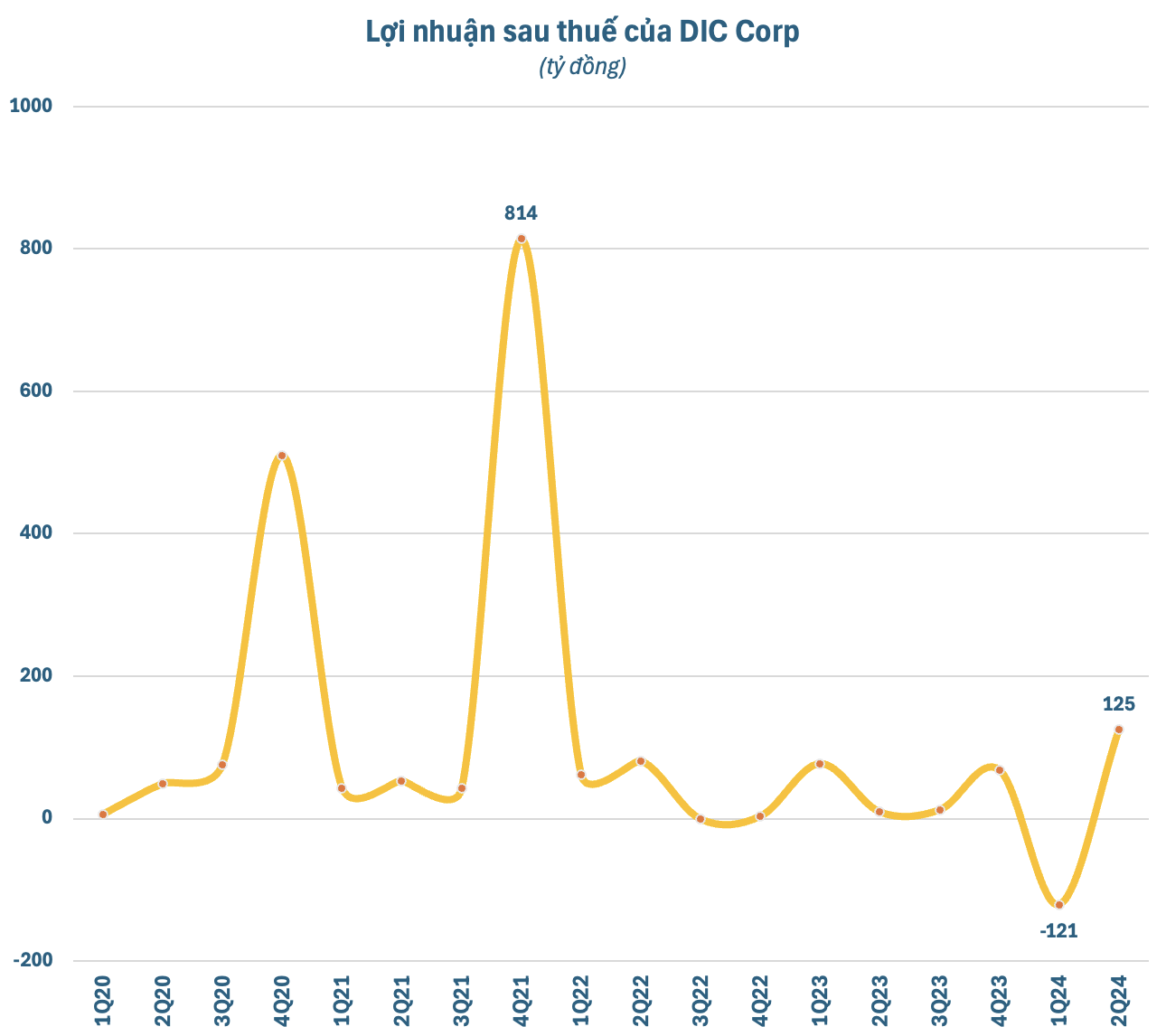

In terms of financial results, DIC Corp announced its Q2 2024 consolidated financial statements with net revenue of VND 821 billion, up nearly 410% over the same period last year, mainly due to real estate business activities such as the transfer of CSJ project apartments, transfer of rough houses in Dai Phuoc and Hau Giang projects.

After deducting cost of goods sold and expenses, DIC Corp’s pre-tax profit in Q2 was VND 168.8 billion, 9.8 times higher than the same period last year. Net profit reached over VND 123 billion, nearly 14 times higher than in Q2 2023, and the highest in 10 quarters since Q1 2022.

Despite being profitable, DIC Corp’s operating cash flow was heavily negative. The real estate enterprise’s net cash flow from operating activities was negative VND 1,200 billion in Q2, a significant change compared to the negative VND 108 billion in the same period last year.

For the first 6 months of the year, DIC Corp recorded net revenue of VND 822 billion, up 130% over the same period in 2023. However, pre-tax profit decreased by nearly 60% compared to the first half of last year, reaching VND 48 billion, mainly due to a heavy loss in the first quarter of this year. With these results, DIC Corp has achieved 26% of its revenue plan and 5% of its profit target for the year.

In 2024, DIC Corp set ambitious plans with revenue and pre-tax profit targets of VND 2,300 billion and VND 1,010 billion, respectively, representing increases of 72% and 509% compared to 2023. Last year, the real estate enterprise also set very high business targets but eventually failed to meet them.

DIC Corp’s management stated that the company has continued to make efforts to complete legal procedures in Q2 2024 as a basis for accounting for indicators in the last 6 months of the year to ensure a consolidated pre-tax profit of VND 1,010 billion.

DIC Corp’s 2024 profit is based on its business plan and accounting for the transfer of products at the following projects: Dai Phuoc Eco-Tourism Urban Area (Dong Nai); Lam Ha Center Point Urban Area (Ha Nam); DIC Nam Vinh Yen City Urban Area (Vinh Phuc); DIC Victory City Hau Giang Urban Area; Hiep Phuoc Residential Area Project; Vung Tau Gateway Apartment Project; and CSJ Phase 1 Project.

In another development, Mr. Nguyen Thien Tuan, Chairman of the Board of Directors of DIC Corp, passed away on August 10, at the age of 68. Mr. Nguyen Thien Tuan was born in 1957 in Thanh Hoa province and held a master’s degree in economics. He began his career at the age of 21 and after 10 years of work, he was promoted to important positions, becoming the director of the Ministry of Construction’s guesthouse in 1990.

In 2008, as a unit under the Ministry of Construction, DIC was equitized into Total JSC for Investment and Construction Development (DIC Corp), while also increasing its charter capital to VND 370 billion and having over 30 member companies.

At that time, Mr. Nguyen Thien Tuan, Chairman of the Board of Directors and General Director, represented 32.5% of state capital in DIC Corp. In August 2009, the Company officially listed on the stock exchange with the code DIG.

During his leadership at DIC Corp, Mr. Nguyen Thien Tuan not only led the Company to achieve breakthrough developments over the years but also contributed to the transformation of Vung Tau city with large-scale tourism real estate projects such as the Cap Saint Jacques Complex, DIC Star Landmark Vung Tau, and Pullman Hotels & Resorts Vung Tau.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.