Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDirect Securities Corporation, shared that major Asian stock markets experienced negative trends on August 5th, with VN-Index being no exception, dropping by 3.9% to 1,188.1 points, the lowest since April 23rd.

Providing a more detailed analysis, Mr. Hinh cited that the number of declining stocks far outnumbered the advancing ones, with 448 stocks decreasing compared to only 24 increasing, including 91 stocks that hit the daily limit down.

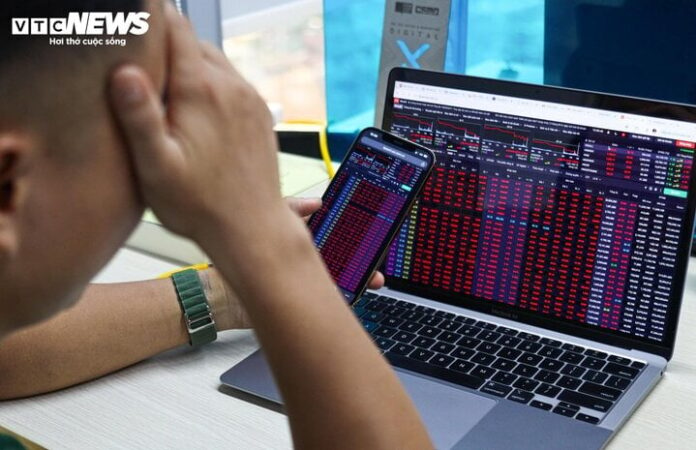

The stock market witnessed an unfavorable week. (Illustrative image: Cong Hieu)

The banking sector was among the main contributors to the decline, with notable decreases in BID (-3.5%), TCB (-5.1%), CTG (-4.4%), VPB (-3.2%), VCB (-2.0%), and HDB (-6.1%). Foreign investors resumed net selling with a value of 750 billion VND, focusing on HPG, FPT, MWG, and STB stocks. VN-Index rebounded on August 6th, gaining over 22 points to reach 1,210.3.

Stocks that positively impacted the index included VNM (+4.8%), GVR (+4.2%), MSN (+3.8%), BID (+1.4%), BCM (+5.2%), and FPT (+1.9%). Notably, VNM contributed 1.7 points to the VN-Index and reached its highest price in the past ten months. On August 7th, the VN-Index continued its upward trend, increasing by nearly 0.5% to 1,215.9 points. However, market liquidity showed signs of weakening, decreasing gradually over the sessions.

Real Estate, Chemicals, and Oil & Gas sectors led the market with strong gains in VHM (+6.9%), GVR (+3.8%), and BSR (+3.2%). Notably, VHM hit the ceiling price as Vinhomes announced the purchase of 370 million treasury stocks, equivalent to 8.5% of the circulating shares.

The VN-Index witnessed a positive morning session on August 8th, but selling pressure dominated in the afternoon, causing the index to decline by 0.6% to 1,208.3 points. VCG (+5.7%) recovered from its downward trend since the beginning of July, as its half-year post-tax profit surged by 260% compared to the same period last year.

Foreign investors net sold 1.16 trillion VND, focusing on VJC, VHM, and TCB stocks.

The trading session on August 9th alleviated concerns about a potential downward trend as the VN-Index rose by 15.3 points, reclaiming the 1,220-point level.

The market was dominated by green colors, with a ratio of 329 advancing stocks to 86 declining ones. Foreign investors net bought over 56 billion VND, focusing on FPT, MWG, and CTG stocks. For the week, the VN-Index decreased by 1.1% to 1,223.6 points, the HNX-Index fell by 0.9% to 229.4 points, and the UPCOM-Index dropped by 1% to 92.8 points.

“Weekly liquidity increased by 6.1% to 17,048 billion VND per session. Foreign investors net sold 3,994.3 billion VND on all three exchanges, including 3,943.5 billion VND on HoSE, net bought 6.3 billion VND on HNX, and net sold 57.1 billion VND on UPCOM,”

emphasized Mr. Hinh.

Experts believe that the market is gradually rebalancing, and investors should consider restructuring their portfolios for medium and long-term investment goals. (Illustrative image)

What’s in store for next week?

Providing insights into the stock market for the upcoming week, Mr. Dinh Quang Hinh stated that the market is gradually rebalancing, and investors should consider restructuring their portfolios for medium and long-term investment goals.

According to Mr. Hinh, after a significant correction at the beginning of the week, domestic stock indices witnessed a technical rebound as the market received supportive information.

Specifically, the US Department of Labor announced that the number of people filing for initial jobless claims was lower than expected, easing concerns about a potential recession in the US economy. This new data contrasted with the disappointing employment data released the previous Friday, indicating that the US economy is “not as weak as the way the market reacted during the last session of the previous week and the first session of this week.”

Following this positive news, US stock indices recorded their strongest gains in two years, oil prices rebounded, and yields on US government bonds recovered to 4%. All these developments suggest that market sentiment has gradually stabilized after the shock at the end of the previous week.

Domestically, the market also received supportive news as the second-quarter business results of listed companies exceeded expectations.

According to VNDIRECT’s Analytics team, the net profit of listed companies in the second quarter of 2024 grew by over 20% year-on-year, surpassing the market’s previous forecast of 5-10%. Additionally, after the sharp correction, the market’s valuation became more attractive, with the P/E of the VN-INDEX touching -1 standard deviation at one point, stimulating bottom-fishing cash flow.

“With the recent fluctuations in the domestic and international financial markets, we maintain a positive view on the prospects of the Vietnamese stock market in the medium term, from 6-12 months, thanks to the positive second-quarter business results, which reinforce our forecast that the market’s total profit may grow by 18% this year,”

said Mr. Hinh.

Additionally, with the scenario of the Fed cutting its policy rate by 2-3 times by the end of the year becoming more likely, this could ease pressure on exchange rates, and the State Bank of Vietnam could have more flexibility to inject liquidity into the system, especially in the fourth quarter (through the OMO channel and USD purchases). This would help maintain attractive domestic interest rates to support economic growth.

We maintain our view that the VN-INDEX could close the year 2024 in the range of 1,300-1,350 points (base case scenario) and, in a positive scenario (Fed cuts policy rates as expected by the market and SBV eases monetary policy), the VN-INDEX could close above 1,400 points this year.

Therefore, if the VN-INDEX retests the 1,200-point support level, long-term investors should consider increasing their stock allocation and building their investment portfolios for a 6-12 month perspective.

“Prioritize sectors with improved business prospects, such as Banking and Export (garment, seafood, steel). However, investors should maintain a reasonable portfolio allocation (60-70% stocks) and avoid using leverage to manage risks as the market still faces the risk of strong fluctuations in the short term,”

Mr. Hinh advised.