**Topic: Margin Lending – A Strategic Move for Investors in Vietnam’s Stock Market**

**Heading:** *The Rise of Margin Lending: A Strategic Move for Investors in Vietnam’s Stock Market*

**Subheading:** *How JBSV is Leading the Way with Innovative Programs*

**Paragraph 1:** Margin lending has seen a significant surge in Vietnam’s stock market, with the latest reports indicating a record high. As per the financial reports for Q2 2024, the total margin lending balance of securities companies reached VND 227,657 billion, a 25% increase compared to the beginning of the year. This unprecedented level surpasses the previous peak in Q1 2022, indicating investors’ growing confidence in utilizing leverage to increase their positions during this period of discounted prices.

**Paragraph 2:** Financial experts attribute this trend to the improving macroeconomic landscape and positive economic data from the first half of the year. The prospect of the Fed lowering interest rates has also boosted investor sentiment. As the USD/VND exchange rate stabilizes, VND interest rates are expected to follow suit, allowing the State Bank of Vietnam (SBV) to adjust its monetary policy towards a more accommodative stance, thereby stimulating the economy and positively impacting businesses and the stock market.

**Paragraph 3:** Additionally, while there was a slight increase in deposit rates during Q2, it was primarily a strategic move by the SBV to counter the tensions in the USD/VND exchange rate. With the exchange rate stabilizing, interest rates are projected to decrease, incentivizing depositors to shift their funds to investment channels like the stock market and other asset classes.

**Paragraph 4:** The Vietnamese economy is exhibiting promising signs of recovery, with a forecasted GDP growth rate of 6-6.5%. Manufacturing activities are improving and expanding, as indicated by a PMI consistently above 50 points. Moreover, foreign investment and exports are also on an upward trajectory, presenting a favorable environment for businesses to recover and accelerate their growth in the latter part of 2024 and into 2025.

**Paragraph 5:** Given the positive macroeconomic outlook and easing interest rates, the margin lending trend on the stock exchange is expected to continue. According to the Vietnam Securities Depository (VSD), the number of new accounts is rapidly increasing, surpassing 7.4 million individual accounts by the end of July. Securities companies now have more room to introduce attractive policies and promotions, benefiting investors with diverse choices to optimize their investment returns in this “margin interest rate race.”

**Paragraph 6:** However, it’s important to note that the market is still in an accumulation phase, awaiting a breakthrough. Investors should carefully consider their stock picks and allocate a reasonable margin. Utilizing cost-saving products, such as low-interest loans and reduced transaction fees, can enhance overall investment efficiency during this period.

**Heading:** *JBSV – Your Trusted Partner in the Growth Race*

**Paragraph 1:** JBSV, a leading securities company, understands the importance of cost optimization and seizing market opportunities. With this in mind, they launched the innovative program, “Zero 30 Premium – Maximum Limit with a 30-day Interest-Free Privilege,” which runs from August 8, 2024, to November 8, 2024. This program offers one of the most attractive interest-free margin loan limits in the market, reaching up to nearly VND 30 billion.

Zero 30 Premium – Maximum Limit with a 30-day Interest-Free Privilege

**Paragraph 2:** Through this program, investors can enjoy complete interest exemption on margin loans for 30 days, with a maximum limit of VND 29.5 billion per customer. After this promotional period, a highly competitive interest rate of 9.7%/year will be applied to the Basic Margin product. JBSV further enhances this offering with additional benefits, including lifetime free trading and the potential to save up to VND 200 million in maximum interest costs, along with a diverse investment portfolio of nearly 200 stocks with attractive loan ratios.

**Paragraph 3:** This program is open to both new and existing Finavi account holders who have not previously incurred margin debt. It presents a golden opportunity for investors to maximize their profits by leveraging financial leverage in securities trading. Moreover, it underscores JBSV’s strong financial position and long-term commitment to supporting investors in their journey to conquer the market.

**Paragraph 4:** JBSV, a Korean securities company and a wholly-owned subsidiary of Kwangju Bank, which is part of the JB Financial Group (JBFG), brings not just substantial financial resources but also a wealth of experience and reliability to the table. With a skilled and dedicated team, JBSV offers effective financial solutions and becomes a trusted partner, helping investors optimize their profits and achieve their financial goals. Choosing JBSV is a smart move towards success in the world of securities investment.

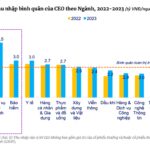

Unveiling the “Massive” Income of Chairpersons and CEOs in the Banking and Real Estate Sectors

The average income of a CEO in the real estate, securities, and insurance industries is an impressive 2.5 billion VND per year. This figure showcases the potential earnings of those at the top of these lucrative sectors. It is a testament to the rewards that come with leadership and expertise in these fields.

“Vinamilk’s Projected Profit Surge: A Double-Digit Growth Forecast for 2024”

Vietcap’s projection is significantly higher than Vinamilk’s initial plan, and if accurate, it would be the highest in three years.