Since trading on UPCoM in 2018, Dagarco has consistently paid annual dividends to its shareholders, ranging from 10-30% in cash. Most recently, the 2022 dividend was set at 20%.

Dagarco, formerly known as May X2 Enterprise, initially specialized in manufacturing military uniforms for the army and was a state-owned enterprise. In 2005, the company underwent privatization, focusing primarily on garment manufacturing, and import-export of garments, and related raw materials. Headquartered in Bac Ninh city, Bac Ninh province, Dagarco employed 3,370 people as of the end of 2023.

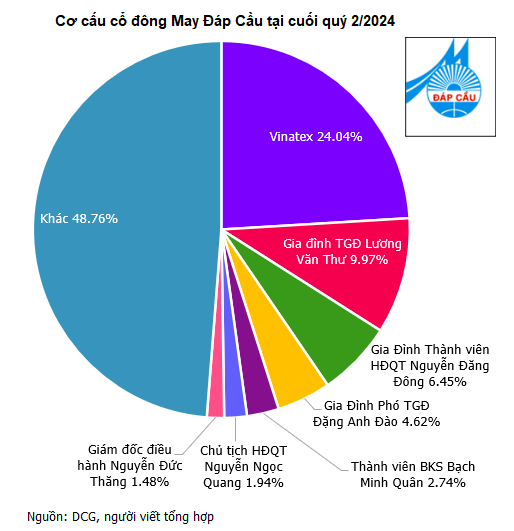

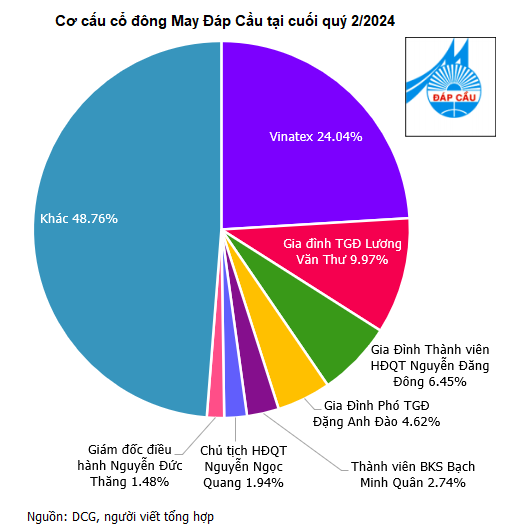

The company’s chartered capital currently stands at over VND 68 billion, with the largest shareholder being the Vietnam Textile and Garment Group (Vinatex, UPCoM: VGT), holding 24.04% of DCG‘s capital. Additionally, several company executives and their relatives also hold significant stakes, ranging from tens of thousands to hundreds of thousands of shares. Notably, CEO Luong Van Thu owns 5% of DCG‘s capital; Deputy CEO Dang Anh Dao holds 4.19%; Board member Nguyen Dang Dong has 3.76%; Supervisory Board member Bach Minh Quan holds 2.74%; and Chairman of the Board Nguyen Ngoc Quang owns 1.94%.

In terms of business performance, May Dap Cau has maintained a consistent streak of revenue above VND 500 billion since its first information disclosure in 2011, with the highest revenue recorded at VND 886 billion in 2013. The company has averaged a net profit of VND 19 billion per year but experienced negative growth in 2022 and 2023. Specifically, the net profit for 2023 was VND 12 billion, the lowest in over a decade, and a decrease of nearly 43% compared to the previous year.

For 2024, Dagarco aims for a net profit of at least VND 18 billion and plans to distribute dividends of no less than 15% of its charter capital.

|

May Dap Cau’s Financial Performance from 2011 to 2023 |

In the stock market, DCG‘s share price has remained stagnant at VND 13,800 per share for the past half-month, a decrease of over 26% since the beginning of the year. DCG shares have consistently experienced low liquidity, except for a rare surge in trading volume on July 29, with a matched volume of 46,200 shares.

|

Share Price Movement of DCG Since the Beginning of 2024 |

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.