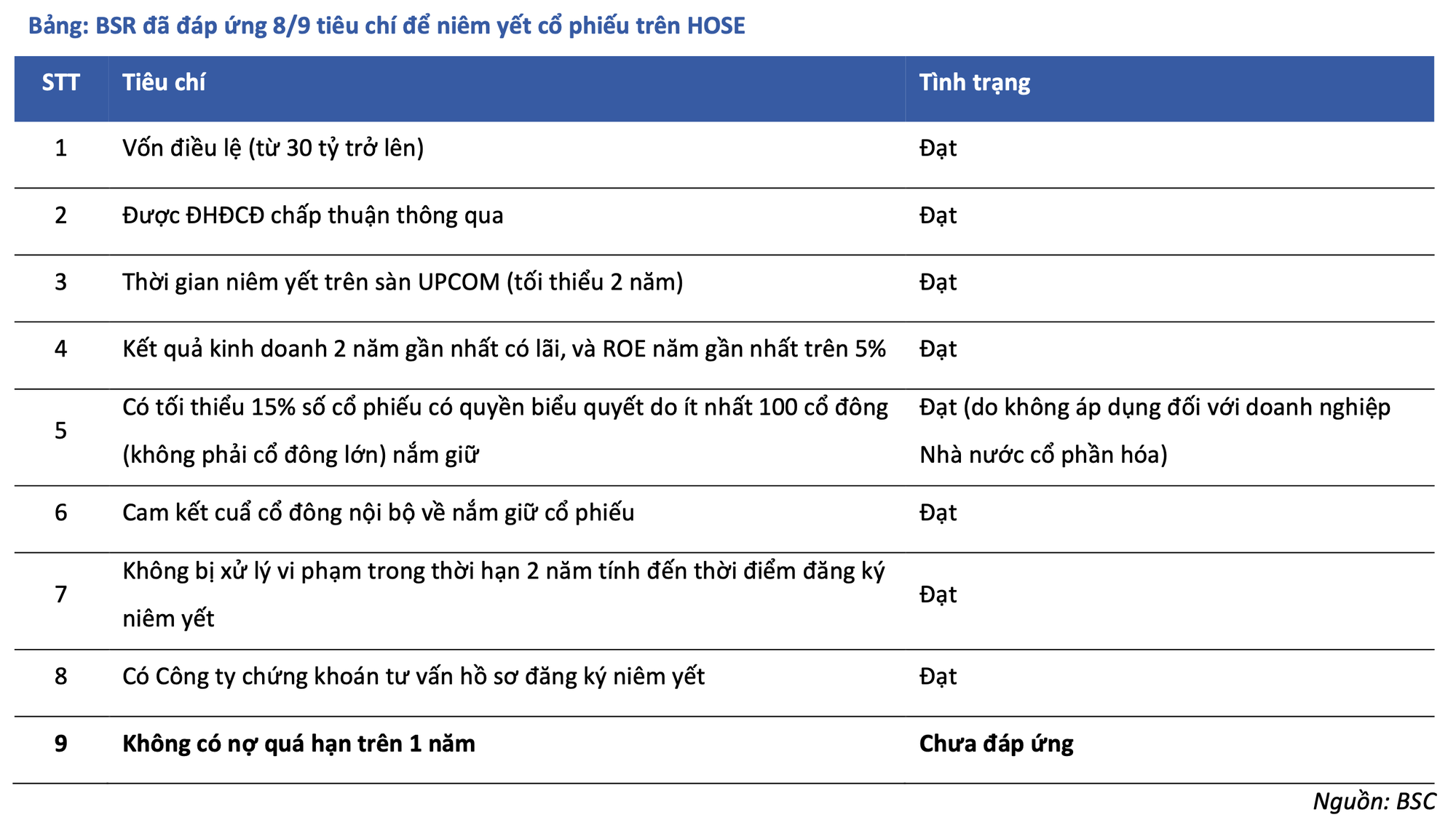

BSR Joint Stock Company (BSR) has announced its plans to list its shares on the Ho Chi Minh City Stock Exchange (HoSE). The decision was made by the company’s Board of Directors, who will now work on finalizing the list of shareholders and preparing the necessary documentation for the listing.

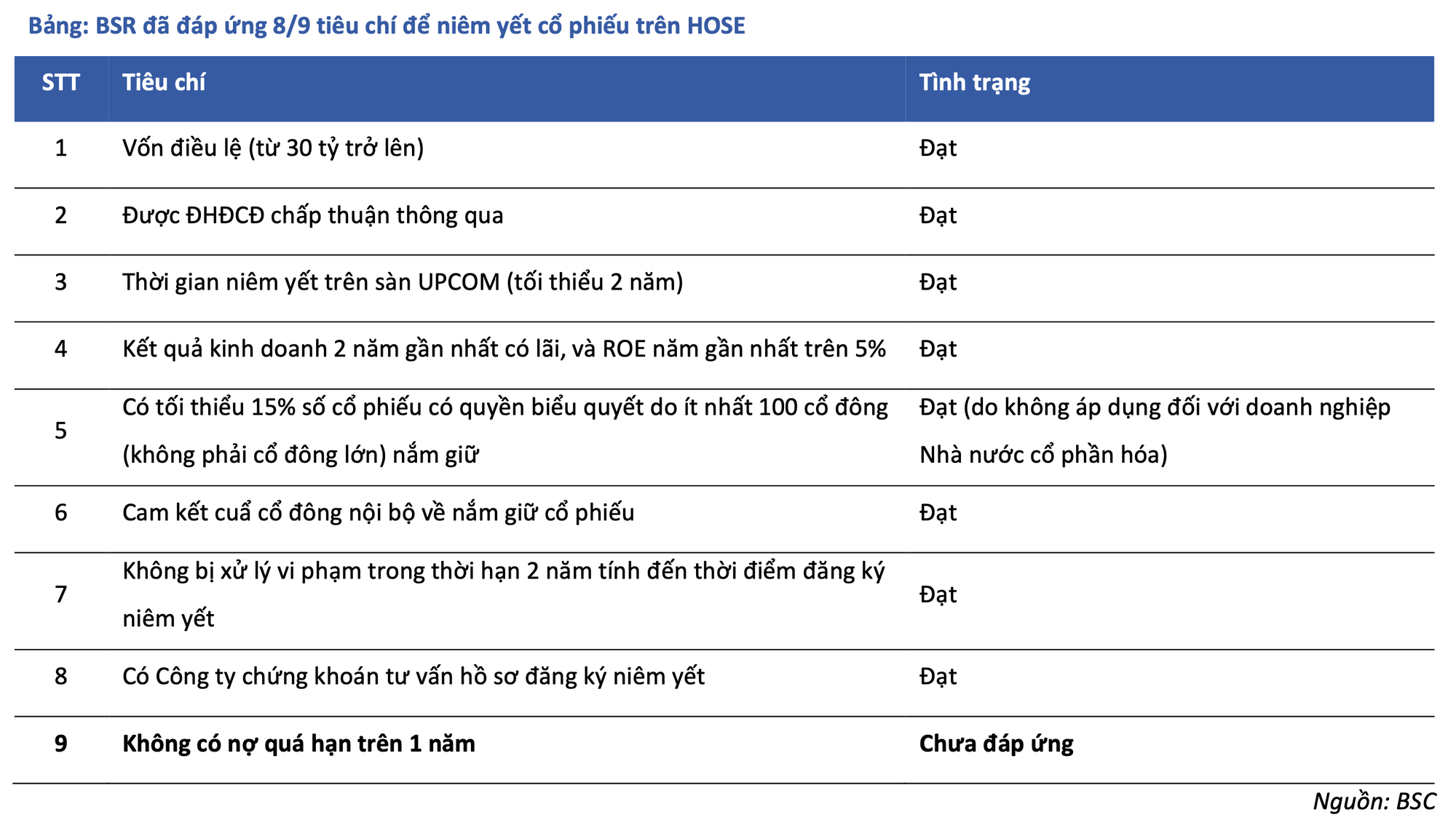

According to a report by BIDV Securities (BSC) in late June, the decision to change stock exchanges has been a long-standing goal for BSR, and the prospects for this move are now looking more certain. The company is awaiting a court decision regarding the bankruptcy procedure for BSR – BF, which will help address the last of the nine conditions for the exchange transfer.

By addressing this final condition, BSR will be able to improve its transparency and increase its appeal to larger investors, both domestic and foreign. Additionally, BSC believes that the listing on HoSE could lead to the stock’s inclusion in the VN30 index.

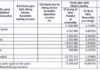

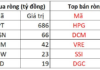

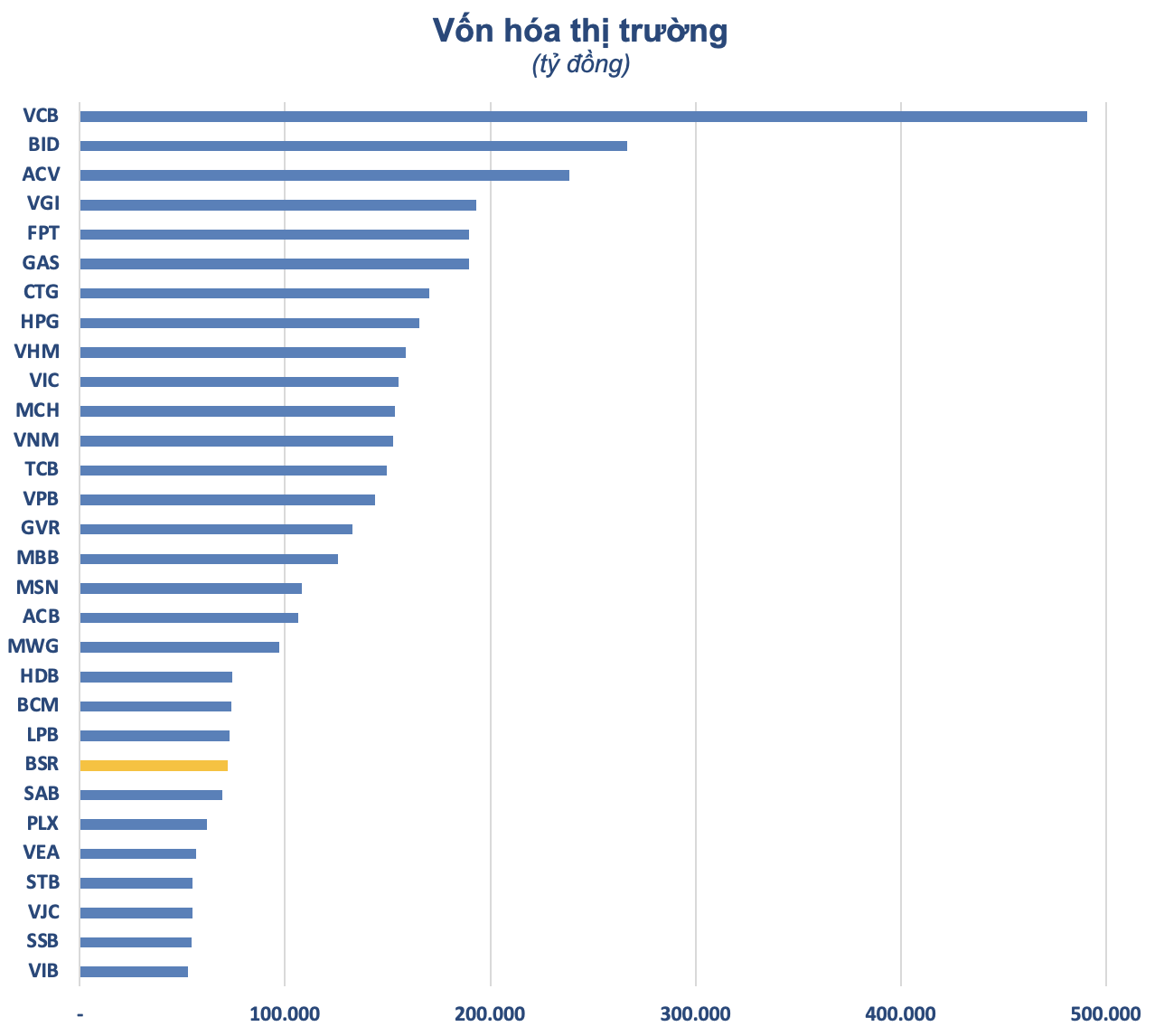

With a market capitalization of approximately 3 billion USD as of August 12, 2024, BSR is currently the 23rd largest company in the market. When compared to other companies listed on HoSE, only 19 have a higher market cap.

Data as of August 12, 2024

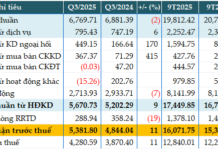

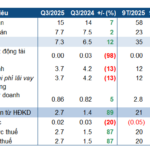

In terms of financial performance, BSR reported a 19% year-on-year decline in revenue and a 36% drop in after-tax profit for the first half of 2024. However, the company has already surpassed its full-year profit plan by 64%, thanks to strong results in the first half.

As of the second quarter of 2024, BSR’s total assets stood at 86,243 billion VND, slightly down from the beginning of the year. The company’s cash and short-term deposits have increased by over 1,800 billion VND compared to the end of last year, while its financial debt remains entirely in the form of short-term bank loans.

BSR’s stock price has seen a nearly 25% increase since the beginning of 2024, currently trading at 23,200 VND per share. However, this is still 24% below the historical peak reached in mid-2022.

Flexible Mechanisms and Solutions to Enhance the Stock Market in Vietnam

There is a real-life example of the flexibility in handling HOSE order congestion incidents that demonstrates the concentration, collaboration, technology investment, and resources of the company… can accelerate the stock market to meet the criteria of FTSE and MSCI in the upcoming evaluation periods.