Techcombank Demonstrates Strength in Capital Mobilization and Liquidity

“Techcombank’s capital and liquidity profile has shown improvement since the initial credit rating, thanks to the Bank’s continuous efforts to enhance stable capital sources and maintain sufficient liquidity, as evidenced by FiinRatings’ stress test results.”

The bank’s ability to meet capital requirements from its stable capital sources, including customer deposits, equity, long-term interbank loans, and other long-term borrowings, has improved. Techcombank has been proactive in developing products and features that enhance customer engagement and promote deposits while also strengthening its capacity to raise foreign and capital market funds. This has resulted in growth in stable capital components and reduced reliance on less stable short-term wholesale funding.

Additionally, Techcombank has continuously increased its stable capital sources from retail customers. Customer deposits (excluding pledged deposits) grew by 28.8% compared to the end of Q2/2023, reaching over VND 475 trillion, maintaining stability at around 53% of the bank’s total capital and mobilized funds. The bank has also introduced the Bao Loc deposit certificate, a floating-rate term deposit product, attracting additional individual and corporate deposits. With a balance of nearly VND 58 trillion in Bao Loc deposit certificates as of the end of Q2/2024, the adjusted ratio (as per FiinRatings’ calculation) of customer deposits to total capital and mobilized funds reached 59.4%. FiinRatings estimates that the ratio of customer deposits to total stable capital sources will remain at around 65%-75% over the next two years.

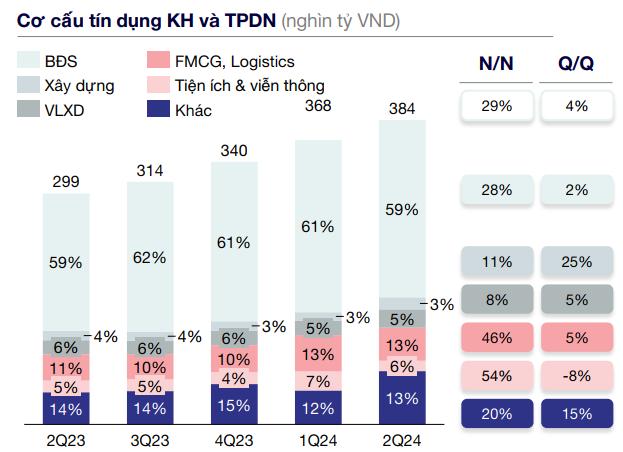

Techcombank has leveraged its core strengths, including its extensive customer base and a more diversified lending strategy, contributing to the bank’s stability and business diversification. FiinRatings noted that the bank’s diversification efforts are also evident in its corporate lending activities, with loans to non-real estate sectors becoming the primary driver of credit growth in 2023-2024 and expected to remain a key strategic focus in the medium term.

Strong Risk Management Capabilities Relative to the Industry Average

According to FiinRatings, Techcombank’s risk position is maintained at the “Adequate” level, reflecting its superior risk management capabilities compared to industry peers. The bank’s recent diversification efforts in its lending policies have helped mitigate concentration risks associated with lending to the real estate, construction, and related sectors. Techcombank’s profitability has remained above the industry average, supported by its robust retail foundation and continuous improvement in fee income. The bank’s profitability indicators have consistently outperformed the industry average. Notably, the bank’s NIM ratio recovered to 4.4% and remained among the industry’s top performers in the first half of 2024 (the industry average was 3.2%).

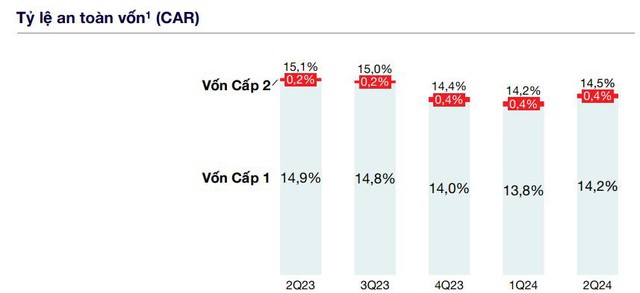

Techcombank’s capital structure is sustainable, with 98% comprised of Tier 1 capital, underpinned by the management team’s robust internal controls in both normal and stressed scenarios. Given the bank’s focus on closely managing and monitoring its CAR ratio and setting internal alert levels, FiinRatings expects Techcombank to maintain its CAR ratio above the industry average, in the range of 14-15%, during 2024-2025.

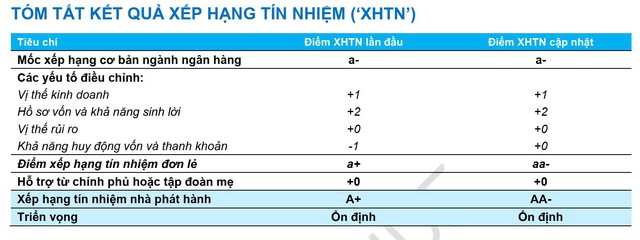

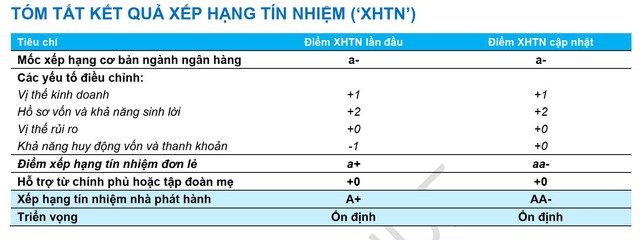

FiinRatings assigns a baseline rating of ‘a-‘ to the banking industry in Vietnam, reflecting the macro-environmental risks and industry-specific risks faced by banks operating in the country. The credit outlook for Vietnamese commercial banks is expected to remain stable, supported by government policies and expected medium-term economic recovery, despite near-term challenges.

While individual credit ratings for Vietnamese commercial banks are also expected to remain stable, FiinRatings notes some differentiation in asset quality, impacting capital sources and profitability across banks.

Techcombank ended the first half of 2024 with approximately 14.4 million customers, adding nearly 1.0 million new customers during the period. 55% of individual customers were onboarded through digital channels, while 44% joined through branches, particularly through the merchant customer group expansion program.

According to CEO Jens Lottner, Techcombank’s superior strategy has been recognized by leading international organizations, underscoring the bank’s asset quality, advanced risk management practices, and robust balance sheet.

Bank stocks plummet after overnight financial report release on January 31st.

The banking stock group, which has been leading the market in the first weeks of the year, experienced a collective downturn today.