The Board of Directors of TNH Hospital Group (stock code: TNH) has approved a contract addendum to extend the loan term with its board members to the tune of VND 92 billion. This loan was taken out by the company to repay bonds issued in 2020.

The extension will last until March 31, 2025. This delay is necessary as the company needs to finalize the procedure for issuing shares as per the resolution of the 2023 Annual General Meeting and secure new capital to repay the loan as per the signed contract.

This is the third time TNH has requested a postponement of the repayment date to its leadership, citing the same reason each time. The loan is unsecured and carries an interest rate equivalent to the 12-month term deposit rate offered by the Joint Stock Commercial Bank for Investment and Development of Vietnam as of September 1, 2022.

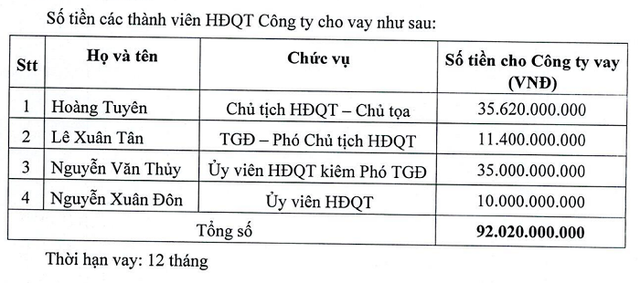

The board members who lent money to TNH include: Mr. Hoang Tuyen – Chairman of the Board of Directors (VND 35.6 billion); Mr. Le Xuan Tan (VND 11.4 billion); Mr. Nguyen Van Thuy (VND 35 billion); and Mr. Nguyen Xuan Don (VND 10 billion).

During the 2023 Annual General Meeting, the company’s shareholders approved a plan to offer more than 15.2 million shares at a price of VND 10,000 per share. The proceeds from this offering (VND 152 billion) are intended to repay the loans to the aforementioned individual board members, with the remaining amount to be used for working capital and to repay debts to credit institutions.

TNH had hoped to implement this share offering plan by the end of 2023, but it has not yet been completed.

In terms of business performance, in the first half of 2024, the TNH Hospital Group recorded a revenue of VND 222.5 billion, a 3.1% decrease compared to the same period last year. After-tax profit reached VND 53.6 billion, a 13.5% drop year-on-year. Notably, the gross profit margin decreased significantly from 44.5% to 36.3%.

For the full year 2024, TNH set a revenue target of VND 540 billion and an after-tax profit goal of VND 155 billion. Thus, as of the end of the first half of 2024, TNH has achieved 34.6% of its annual plan.