With a dividend payout ratio of 10% – equivalent to shareholders receiving 1,000 VND per share – and approximately 9.4 million shares currently in circulation, GLT is estimated to distribute around 9.4 billion VND as dividends. The payment is expected to be made to shareholders on September 9, 2024.

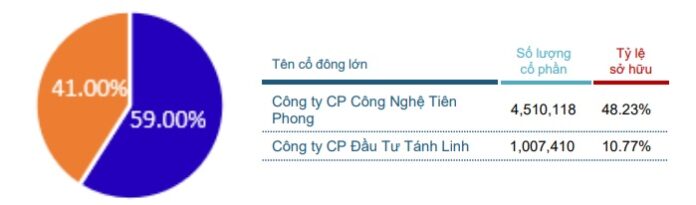

The majority of this amount will go to the largest shareholder, ITD, a technology company listed on the Ho Chi Minh Stock Exchange (HOSE: ITD). As of June 30, 2024, ITD held 48.23% of GLT‘s charter capital and is expected to receive more than 4.5 billion VND in dividends. Another major shareholder, Tanh Linh Investment Joint Stock Company, which owns 10.77% of GLT, is estimated to receive over 1 billion VND. Notably, Tanh Linh is also related to ITD as its Chairman, Nguyen Huu Dung, is concurrently the Chairman of Tanh Linh and a member of ITD’s Board of Directors.

|

Shareholding structure of GLT

Source: GLT

|

The dividend payout ratio of 10% is relatively low compared to GLT‘s historical payouts (25% in 2022 and 20% in 2021). While the company’s Board of Directors proposed a 25% payout for 2023, at the 2024 Annual General Meeting of Shareholders, the Chairman, Nguyen Huu Dung, mentioned upcoming large-scale projects requiring significant capital investment. As a result, a dividend payout ratio of 10% was suggested and approved by the shareholders, given the substantial holdings of the major shareholders.

Recently, GLT underwent a change in its leadership. On June 28, 2024, Nguyen Vinh Thuan, the Chairman of GLT‘s Board of Directors, submitted his resignation in alignment with ITD’s organizational restructuring. Following Mr. Thuan’s departure, ITD appointed Nguyen Ngoc Trung as his replacement. Mr. Trung holds a bachelor’s degree in electronic engineering and is currently the Director of Thanh Thien Technology Joint Stock Company. He also serves as a member of ITD’s Board of Directors and a major shareholder, holding 6% of ITD’s charter capital, equivalent to nearly 1.5 million shares. Additionally, Mr. Trung previously chaired GLT‘s Board of Directors from 2015 to 2017.

In terms of financial performance, GLT experienced a significant decline in its fiscal year 2023 (April 1, 2023, to March 31, 2024) compared to the previous year. The company’s consolidated revenue reached only 83 billion VND, an almost eightfold decrease from the previous period. This substantial drop in revenue was the primary reason for the sharp decline in net profit, which stood at 5.2 billion VND, a 77% decrease year-over-year. GLT attributed the revenue decline to the inclusion of additional revenue from the electrical and mechanical sector associated with the VNG project in 2022. When compared to pre-pandemic years, GLT‘s revenue for fiscal year 2023 was also notably lower (136 billion VND in 2020 and 168 billion VND in 2021).

For the fiscal year 2024, GLT has not yet disclosed its second-quarter results. In the first quarter, the company reported a net profit of 392 billion VND, a 66% decrease compared to the same period last year. This decrease was attributed to a significant drop in revenue from its subsidiary, Global – Sitem Joint Stock Company.

| Financial performance of GLT |