According to the World Bank, global trade is expected to gradually improve in 2024-2025 due to recovering consumer demand, declining inventories, a returning technology cycle, and accelerating investment growth.

Purchasing power in key export markets is expected to rebound stronger in the second half of 2024.

In its latest report, Petro Securities (PSI) believes that the economic recovery of Vietnam’s major trading partners this year will boost exports.

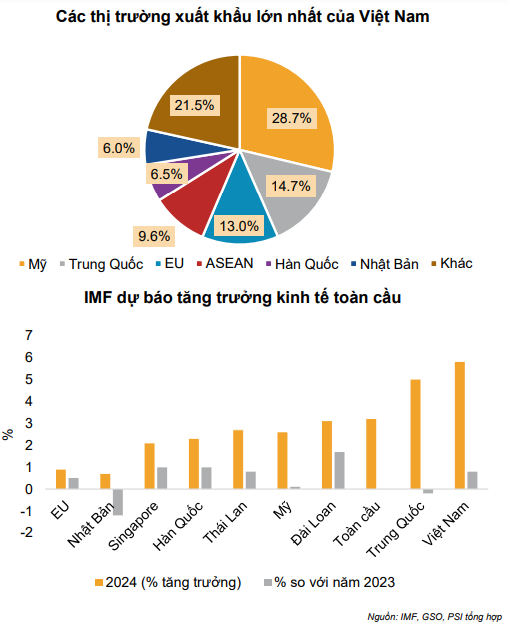

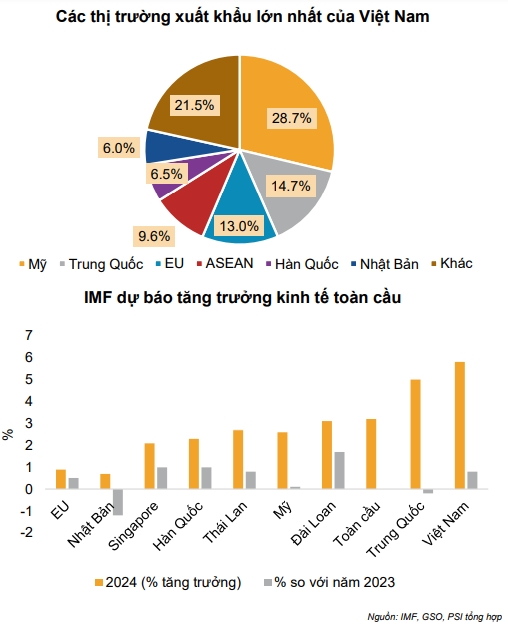

According to the IMF, the global economic outlook for 2024 is more optimistic than previously expected. The GDP of most of Vietnam’s major trading partners is forecast to grow higher than last year. Among them, the GDP of the US, Vietnam’s largest export market, is expected to reach 2.6%. China’s GDP is also expected to grow by 5%, while the Eurozone’s GDP is expected to slow down with projected growth of less than 1%.

In terms of prices, global inflation is falling rapidly, partly due to the hawkish monetary policies of central banks, along with the recovery of global supply chains in China. This is expected to positively impact consumption in these markets.

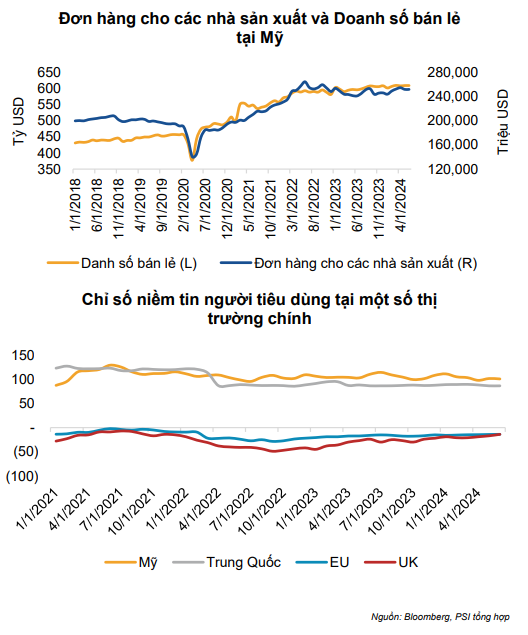

Additionally, Petro Securities noted that the consumer confidence index regarding economic conditions in key markets has shown positive signs. As a result, consumer sentiment seems to have stabilized and is showing a slight recovery (EU and UK markets). Moreover, in the US – Vietnam’s key export market – retail sales remain stable, while new orders from US manufacturers have increased, indicating optimism about future demand. Therefore, PSI expects purchasing power in the main export markets to rebound strongly in the second half of 2024.

At the same time, in the latter part of July and early August 2024, the US is expected to make a final decision on upgrading Vietnam’s status to a “market economy”. PSI’s analysts believe that this upgrade will bring significant benefits to Vietnamese exporting businesses as better tax mechanisms are applied or adjusted, and trade activities with the US are facilitated.

However, even without this upgrade decision, PSI maintains a positive view on Vietnamese exporting businesses this year as the US remains the largest export market.

Three sectors expected to achieve outstanding growth in the second half of the year

The forecast for the second half of 2024 is a “boom” period for Vietnam’s exports, and PSI identifies three key sectors with outstanding growth prospects:

First, technology products

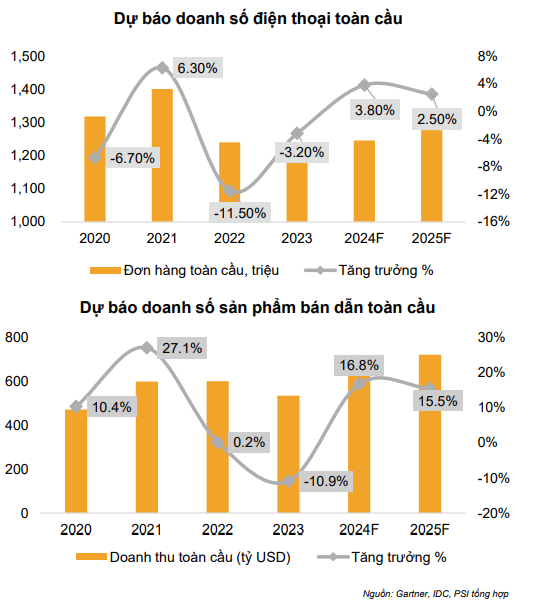

As of the end of the second quarter of 2024, exports of electronics, computers, telephones, and components have recovered quite well. In the context of global demand for telephone and computer products expected to increase by 4% in 2024, global telephone sales will improve, especially for 5G products.

Meanwhile, global computer sales are expected to increase again due to the integration of AI features, attracting more personal and business users, and many computers will need to be replaced before Windows 10 ends support in 2025.

Notably, the global semiconductor industry (accounting for 20% of Vietnam’s total technology product export turnover) is expected to grow by 17% in 2024 due to the increased deployment of processing acceleration tools to support artificial intelligence.

Therefore, PSI expects the export turnover of Vietnam’s technology products to grow stronger in 2024-2025, with the expectation of a reversal in the global technology product cycle.

Second, textile and garment industry

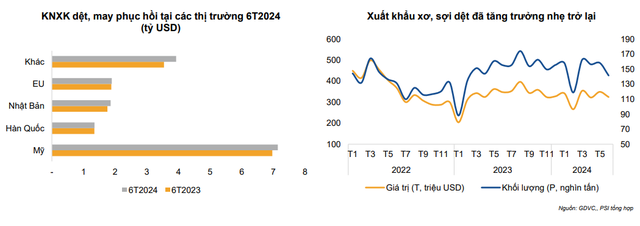

Easing inflation and recovering consumer spending have led to more favorable orders for textile and garment businesses in the first half of 2024.

In the first half of the year, the total import value of production materials such as fibers, yarns, and fabrics increased by 20.7% and 11.9%, respectively, compared to the same period last year, indicating that the situation of textile and garment export orders remains positive and promising for the second half of 2024.

According to PSI, some enterprises with advantages in diverse customer portfolios and ESG factors, such as TNG and Eclat Textile (FDI from Taiwan), have orders secured until the beginning of the fourth quarter of 2024. Meanwhile, MSH plans to put the new Xuan Truong 2 factory into operation from the end of 2024, reflecting the company’s confidence in the recovery of orders. The analyst group expects orders to continue to be secured and increased in the second half as the peak shopping season approaches in major markets.

PSI also noted that the main driver of the textile and garment industry will be the recovery of demand in the US market, especially during the year-end shopping season. US consumer spending is gradually recovering as inflation eases, and PSI expects orders for textile and garment enterprises to rebound significantly from the fourth quarter of 2024, as this is also the time when brands start preparing for the spring-summer season of 2025.

However, PSI also noted that the gross profit margin of textile and garment enterprises is unlikely to increase significantly due to rising labor costs, as the minimum wage increased by 6% from July 2024 (labor costs typically account for 30-50% of total production costs).

Third, seafood products such as pangasius and shrimp

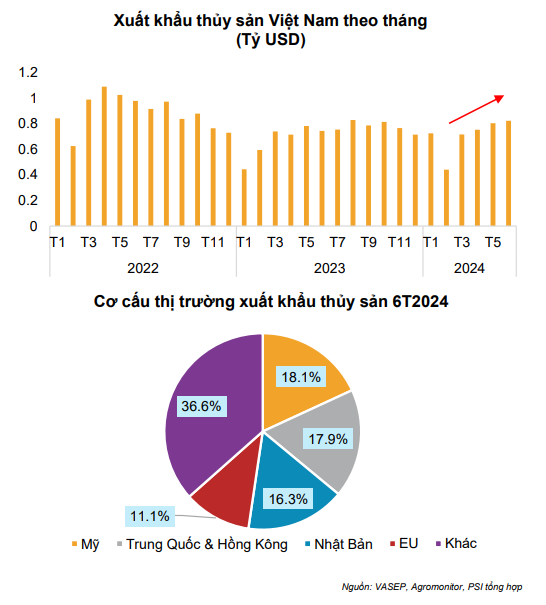

In June 2024, seafood exports were estimated at $875 million, up 1.5% from the previous month and up 14% from the same period last year. This was also the month with the highest export turnover since the beginning of the year. All major export products recorded growth from the low base in the same period last year. Pangasius exports increased by 4.8% to $920 million, while shrimp exports rose by 7% to $1.65 billion.

In the second half of 2024, PSI forecasts that pangasius export volume will recover strongly due to declining inventories in key markets, especially in the US, and retailers will need to replenish stocks before the year-end holiday season. Pangasius consumption is improving as inflation eases, and restaurant sales in the US are maintained at over $90 million. Notably, pangasius, with its reasonable price, is gradually replacing other wild-caught whitefish. Meanwhile, retail sales in China are also gradually recovering. In addition, the low anti-dumping tax rate (POR 19) is one of the factors driving the export of this product.

Regarding shrimp exports, the industry has experienced growth since March, mainly due to increased production volume, while selling prices in the markets have not improved significantly. PSI expects shrimp export prices to increase in the second half of the year, especially in the Japanese market due to its preference and low shipping costs. Meanwhile, in the US and Chinese markets, selling prices are unlikely to increase due to the competitive advantage of cheap shrimp products from India and Ecuador.

“We also expect that the US’s consideration of upgrading Vietnam’s status to a market economy in the near future will help remove trade barriers related to anti-subsidy duties on Vietnamese shrimp exports, supporting the recovery of Vietnam’s shrimp industry”, the report also stated.

Economic Outlook for Vietnam 2024: Promising Start and Continued Export Growth

According to HSBC, the Vietnamese economy is off to a prosperous start in 2024, with exports continuing to recover despite the underlying effects of the Lunar New Year.