The reference price is based on the average of the closing prices of the 30 sessions before the delisting date at UPCoM. The price fluctuation band is +/-20%.

Previously, July 18 was the last trading day of GEE on the UPCoM trading system, with a closing price of VND 43,000/share.

The GEE Leadership Team performs the traditional gong-hitting ceremony to celebrate the first trading day of GEE shares on HOSE.

|

Established in August 2016, GEE has 8 subsidiaries, producing and providing a full range of products in the electricity industry’s value chain, from transmission to distribution and domestic appliances. Among them are reputable brands such as CADIVI electrical wires and cables, THIBIDI transformers, and EMIC electrical measuring equipment.

In terms of business results, according to the recently published second-quarter and semi-annual financial reports, GEE‘s consolidated net revenue for the first six months reached VND 9,030 billion, up 24.2% year-on-year; while its pre-tax profit surged 225.5% to VND 821 billion.

GEE manages the electrical equipment segment of the Gelex Group.

|

“Listing on the stock exchange offers us the opportunity to seek domestic and foreign partners with strong financial capabilities and, more importantly, advanced technology,” said Mr. Nguyen Trong Trung, CEO of GEE. “This will enable us to gather the necessary resources as we transform into a high-tech industrial company.”

The GEE leadership also pledged to maintain transparency in its information disclosure and fulfill all obligations as a listed company.

Mr. Nguyen Trong Trung also shared that GEE is currently directing its subsidiaries to focus on manufacturing high-value-added electrical equipment that is environmentally friendly and suitable for smart grids. The company is also exploring research collaborations to develop new high-tech products in fire protection, security, and surveillance.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

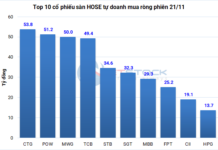

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.