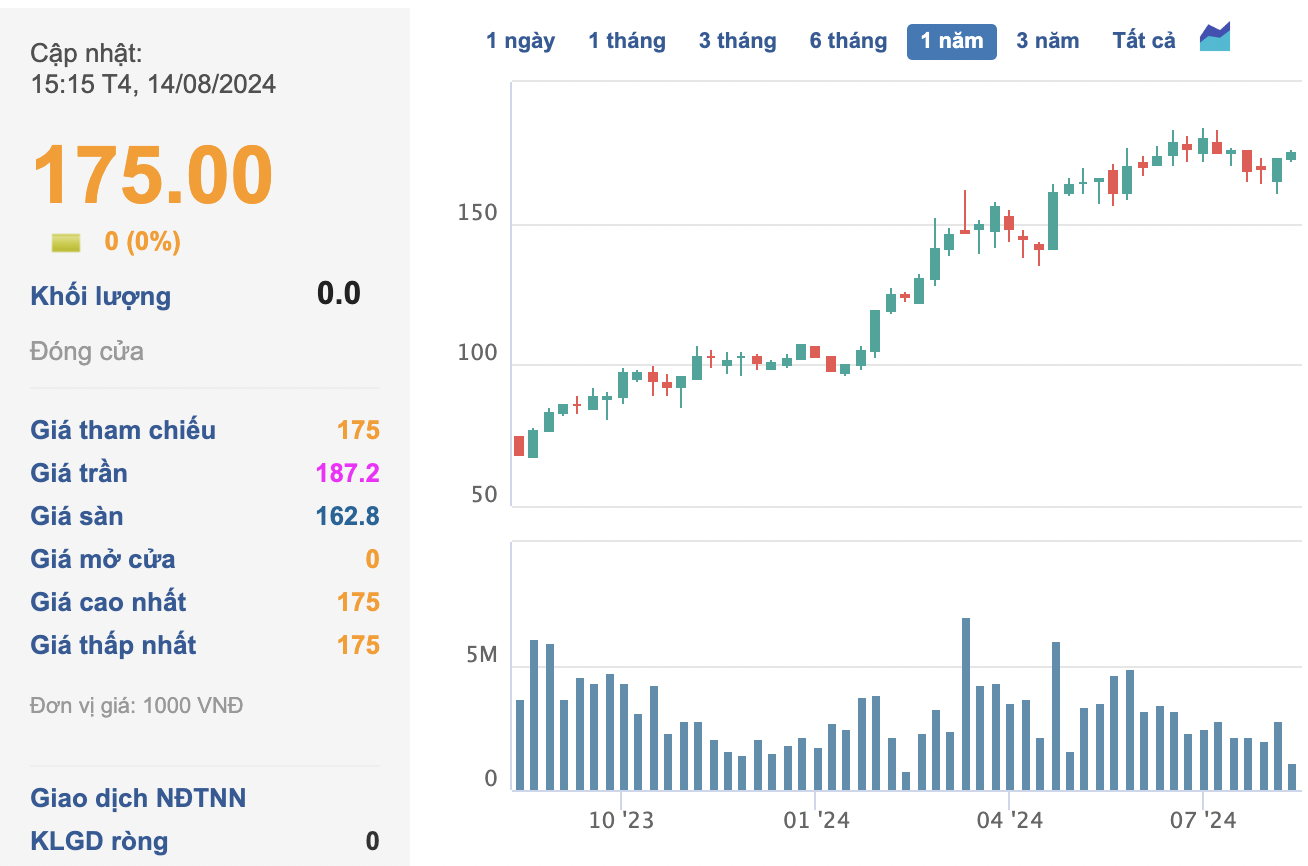

FRT and MWG, two prominent retail businesses in Vietnam, have witnessed impressive stock price surges, with FRT reaching an all-time high of VND 175,000 per share, tripling its price from a year ago, and MWG rebounding to its peak at VND 66,000 per share, doubling its value since last October.

This upward trajectory is notable as both companies have shifted their focus from price wars to developing their unique strengths, indicating a strategic evolution in the competitive landscape.

FRT: Long Châu’s robust growth, plans for capital raising, and riding the wave of ‘2G to 4G’

FRT’s performance is bolstered by the Long Châu pharmacy chain, which has become an increasingly significant contributor to the Group’s growth. In Q2 2024, the company recorded consolidated revenue of VND 18,281 billion, a 22% increase year-on-year. Notably, the FPT Long Châu pharmacy chain achieved a remarkable 67% growth in revenue, contributing VND 11,521 billion, or 63% of FRT’s total revenue. The chain has maintained its operational efficiency, with an average revenue of approximately VND 1.2 billion per pharmacy per month, even as FRT continues to expand by opening new outlets.

This year, Long Châu is also in the process of selling its shares. FRT has established a new legal entity, FPT Long Châu Investment Company, with a chartered capital of VND 673.65 billion. The stated purpose of this move is to restructure the ownership of Long Châu through an investment company to facilitate future capital raising efforts, without any overall consolidated profit or loss implications.

Image: FRT’s Q2 2024 business performance.

Meanwhile, the FPT Shop chain is showing positive signs as the company has optimized its system by closing about 100 underperforming stores. Notably, FPT Shop is enhancing its business model by introducing new product and service offerings, such as home appliances, electronics, and developing FPT MVNO subscriptions, which contribute to improved gross profit.

Recently, FPT Shop simultaneously inaugurated ten electronics stores in various provinces across the country, signaling a significant investment in its strategy to expand in the electronics and home appliances sector. Regarding this move, Mr. Nguyen Viet Anh, Deputy General Director of FPT Retail, shared: “In terms of vision and long-term plans, we aim to continue expanding and aim to increase the number of electronics stores to 50 by 2024, becoming the most trusted and familiar destination for customers.”

Another opportunity for FRT arises from the announcement by the Ministry of Information and Communications that all telecom operators will officially discontinue 2G services from September 15. FPT Shop has proactively responded by launching a program to support the collection of old 2G phones and offering attractive incentives for customers who upgrade to 4G devices.

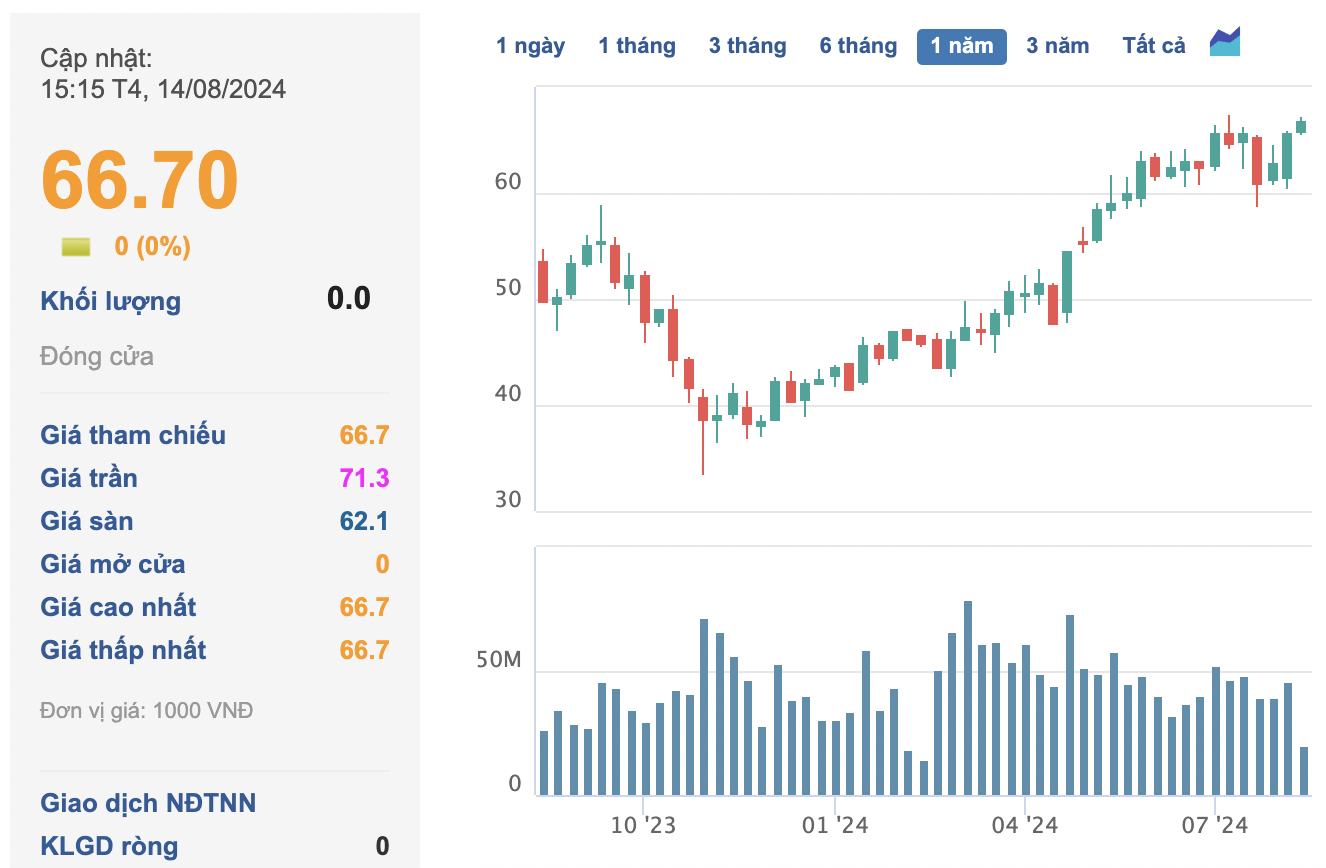

Image: FRT rebounding to its highest peak at VND 175,000 per share.

MWG: Positive developments from “rising stars” Bách Hoá Xanh and EraBlue

MWG, on the other hand, has also received two pieces of good news: Bách Hoá Xanh has turned profitable after years of investment, and the EraBlue electronics chain in Indonesia is performing better than expected, signaling the beginning of its expansion.

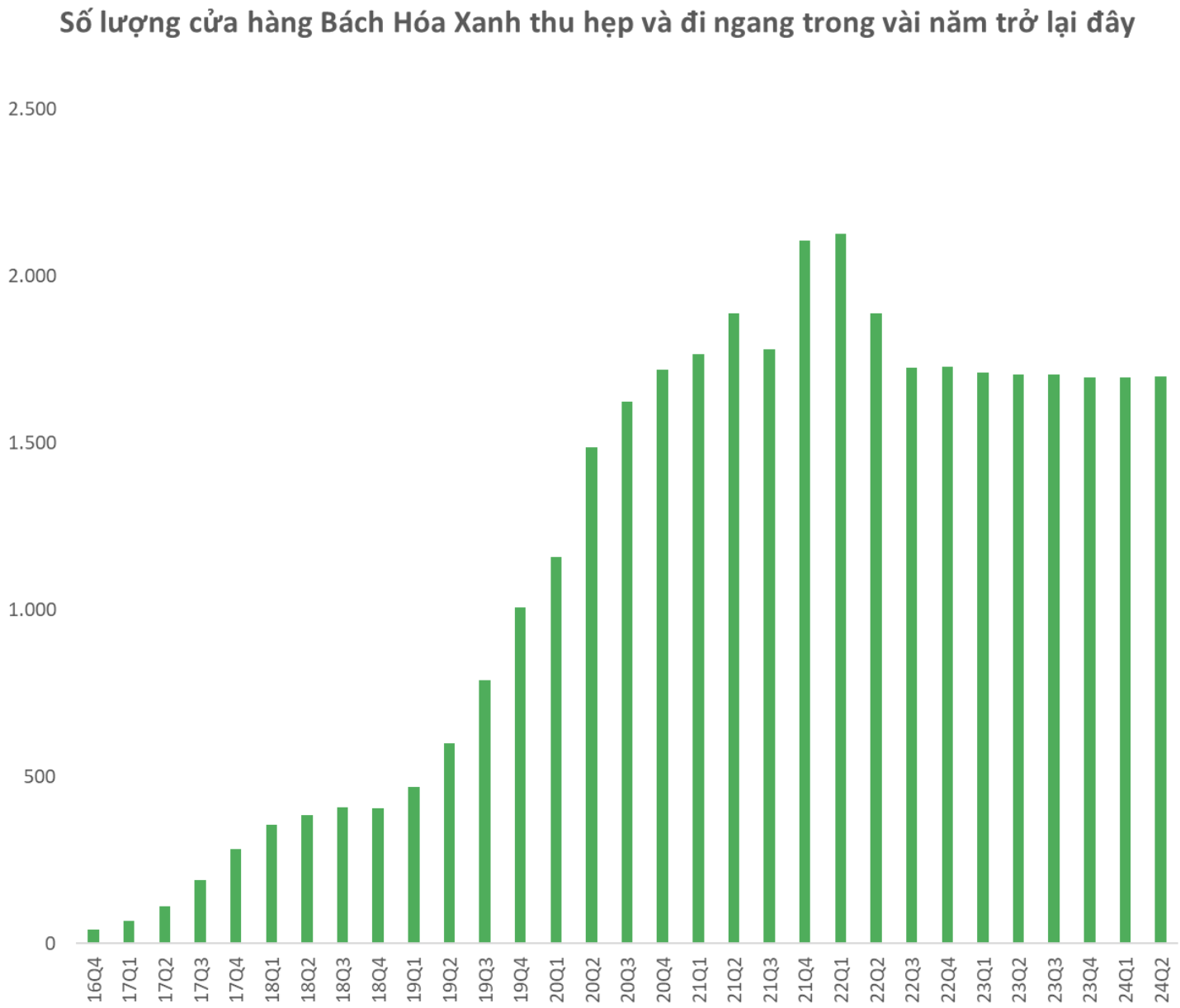

According to the Q2 2024 financial statements, Bách Hoá Xanh recorded a profit of nearly VND 7 billion, a significant improvement from the loss of VND 105 billion in the first quarter. Currently, the average revenue per Bách Hoá Xanh store has reached a peak of VND 2.1 billion per store per month, the highest ever, excluding the surge in revenue in July 2021 due to pandemic-related stockpiling by customers.

Bách Hoá Xanh has been a significant bet for MWG since 2008, with the company investing heavily in the expectation that this chain would become a future “launchpad,” similar to the explosive growth of its previous electronics and mobile phone chains. However, the journey with Bách Hoá Xanh has been more challenging, particularly due to a communications crisis in 2021 that led to a slowdown in expansion, leadership changes, and restructuring.

After a comprehensive restructuring and delivering on the promise of profitability, MWG is now poised to expand the chain again. In August 2024, the Bách Hoá Xanh recruitment fan page announced the inauguration of new stores. The supermarket chain plans to open seven new stores in four provinces and cities: Ho Chi Minh City (3 stores), Long An (1 store), Binh Duong (1 store), and Dong Nai (2 stores).

In addition to Bách Hoá Xanh, MWG is reportedly planning to go big with the EraBlue chain in Indonesia. Recently, MWG held an investor meeting, confidently sharing its plans to expand the chain and achieve profitability in 2024. Moreover, MWG also revealed its ambition to IPO EraBlue in Indonesia within the next two years.

Image: Scale of the Bách Hoá Xanh chain.

EraBlue represents MWG’s new experiment in the foreign market since 2022. It is worth noting that to focus on EraBlue, MWG decided to pause its plans for Bluetronics in Cambodia.

Currently, EraBlue stores are generating almost double the revenue compared to a similarly-sized Điện Máy Xanh store in Vietnam. Specifically, the monthly revenue for size M stores is VND 4 billion, while size S stores are generating VND 2.2 billion.

In terms of overall business performance, MWG demonstrated a strong recovery in Q2, with a net profit after tax of VND 1,172 billion, a remarkable 6,800% increase (69 times) compared to the same period in 2023. This is the highest profit recorded in the last nine quarters.