In their recent report, Dragon Capital noted that the economy has shown significant signs of recovery. The growth momentum from the supply side of the economy continues to improve positively. Agricultural production and services maintained a good growth rate with an 11% increase year-on-year in July. For the first seven months, the growth rate reached 8.5%.

Additionally, manufacturing and processing industries increased by 9.5%. The PMI index for July reached 54.7 points, marking the fourth consecutive month above the 50-point threshold, indicating continued improvement in manufacturing activities. Moreover, the growth momentum on the demand side also witnessed a positive recovery. Total registered FDI for the first seven months surpassed the $18 billion mark, while FDI disbursement reached approximately $12.6 billion. Total retail sales of goods and consumer services revenues increased by 9% year-on-year in July and rose by nearly 9% cumulatively for the first seven months.

The CPI index for July increased by 0.5% compared to the previous month, corresponding to a 4.4% increase year-on-year. This was attributed to low base effects from the previous year, an increase in the basic salary, and adjustments in the prices of certain goods and services, particularly health insurance costs. For the first seven months, the CPI index rose by 4.12% year-on-year, remaining within the target range set by the National Assembly. In the remaining months of 2024, inflation is expected to ease slightly due to the absence of low base effects from the previous year, with average inflation for the whole year projected to be around 4.0% and still within the controlled range.

Expectations of maintaining a loose monetary policy, and international impacts on Vietnam’s stock market will only be temporary

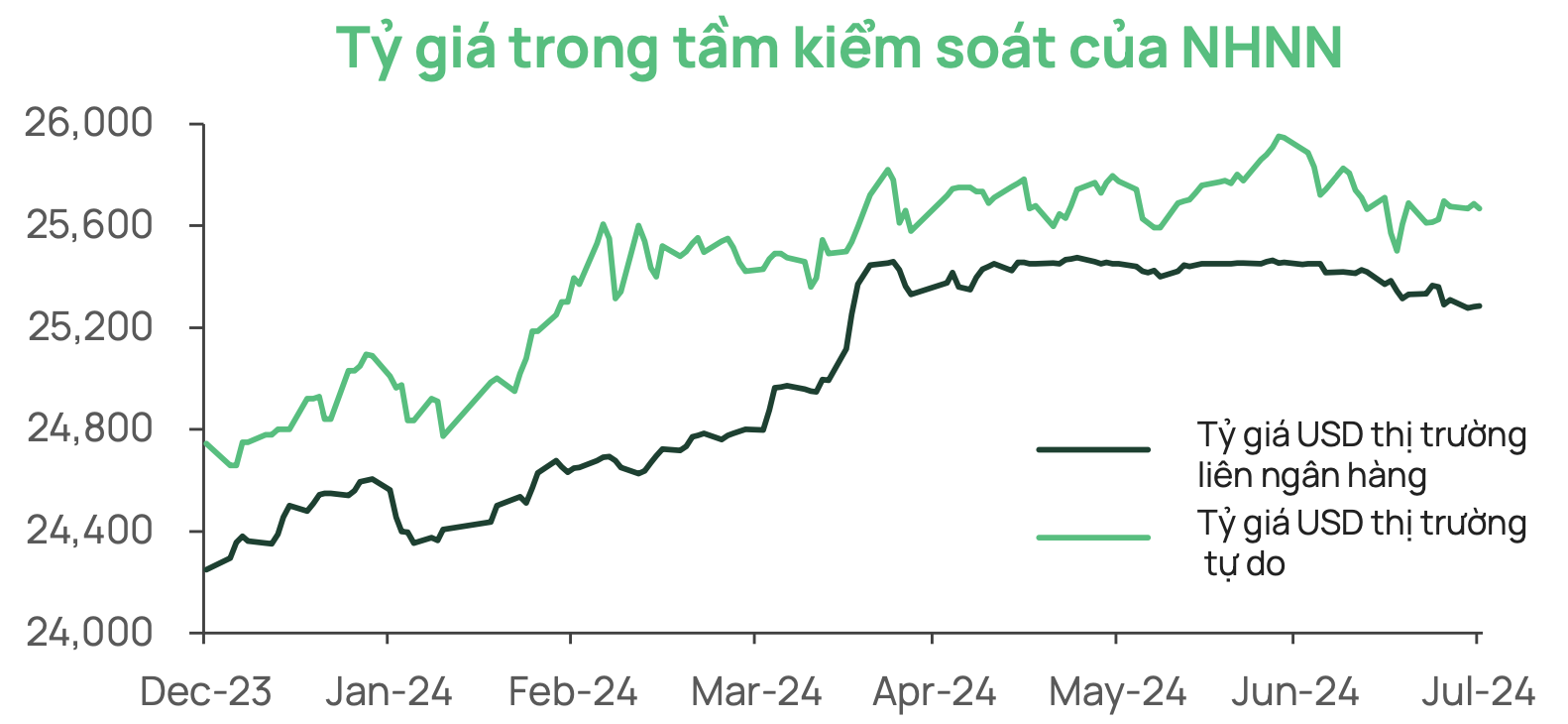

Since the beginning of 2023, Vietnam has maintained a loose monetary policy to support and promote economic recovery. There have also been some mid-cycle interest rate adjustments to ease pressure on exchange rates and inflation. Amid a cooling US dollar, reflecting market expectations of Fed rate cuts in upcoming meetings, and with domestic inflation under control, the State Bank of Vietnam is expected to continue its loose monetary policy in the coming period if exchange rate and inflation pressures ease. According to Dragon Capital, the SBV’s reduction in OMO interest rates and bill interest rates clearly demonstrates its commitment to stabilizing interest rates to support the economy.

Regarding the stock market, despite recent volatility in global financial markets, Dragon Capital believes that the impacts on Vietnam will not be significant and will only be temporary. The projected P/E and P/B ratios of the VN-Index are lower than one standard deviation below the five-year average, indicating attractive valuations.

With the global trend of cutting interest rates, Vietnam has many opportunities to maintain supportive policies and focus on growth. The analysis team maintains their projection of a 16-18% growth in post-tax profits for the full year 2024.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.