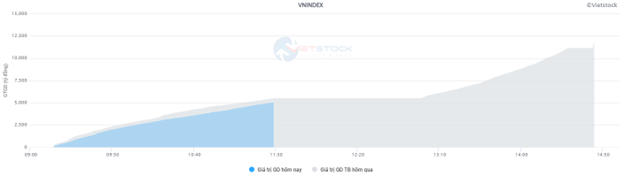

Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 448 million shares, equivalent to a value of more than 10.8 trillion VND; HNX-Index reached over 38.2 million shares, equivalent to a value of more than 784 billion VND.

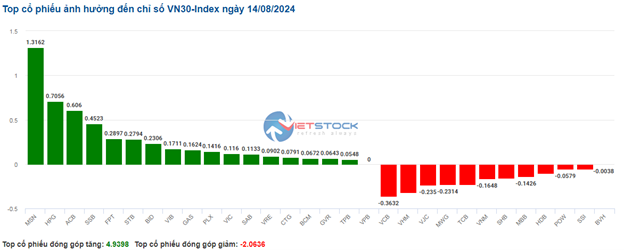

VN-Index opened the afternoon session on a less favorable note, with strong fluctuations around the reference level, but by the end of the session, sellers had gained the upper hand, pulling the index into negative territory. In terms of impact, VCB, VPB, MBB, and DGC were the most negative influences, taking away more than 2.6 points from the index. On the other hand, VHM, MSN, BID, and SAB were the most positive influences on the VN-Index, contributing over 2.4 points to the overall index.

| Top 10 stocks with the most significant impact on the VN-Index |

HNX-Index followed a similar trajectory, with negative influences from IDC (-1%), MBS (-1.52%), PVS (-0.76%), and PTI (-5.28%)…

|

Source: VietstockFinance

|

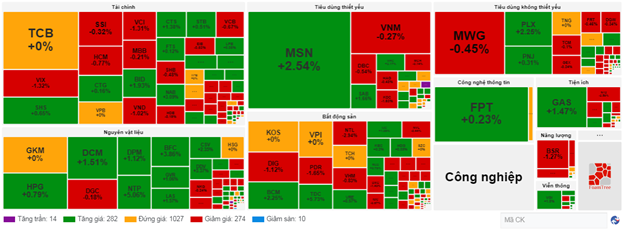

The energy sector witnessed the sharpest decline in the market, falling by -1.55%, mainly due to BSR (-2.12%), PVD (-0.19%), PVS (-0.76%), and PVC (-0.75%). This was followed by the financial sector and the healthcare sector, which decreased by 0.36% and 0.24%, respectively. On the contrary, the consumer staples sector witnessed the strongest growth in the market, increasing by 0.76%, driven primarily by MSN (+2.27%), KDC (+0.18%), and VNM (+0.27%).

In terms of foreign trading activities, foreign investors continued to be net buyers on the HOSE exchange, focusing on stocks such as KDC (461.43 billion VND), MSN (215.68 billion VND), HDB (199.32 billion VND), and TCH (51.17 billion VND). On the HNX exchange, foreign investors were net sellers, offloading stocks such as TNG (7.78 billion VND), MBS (6.76 billion VND), IDC (4.16 billion VND), and BVS (2.98 billion VND).

| Foreign Investors’ Net Buying and Selling Activities |

Morning Session: Subdued Trading

Investors adopted a cautious approach despite the prevalence of green on the screen, as trading volume remained lackluster. At the end of the morning session, the VN-Index stood at 1,233.06 points (+0.21%), while the HNX-Index edged slightly lower by 0.02% to 230.14 points. Despite the index’s gain, the market breadth tilted towards sellers, with 346 declining stocks versus 287 advancing stocks.

The trading volume of the VN-Index continued its downward trend, reaching nearly 200 million units, equivalent to a value of over 5 trillion VND in the morning session. The HNX-Index recorded a trading volume of over 18 million units, with a value of nearly 375 billion VND.

Source: VietstockFinance

|

In terms of impact, BID, MSN, and GAS were the three pillars with the most positive influence on the VN-Index, contributing over 2.3 points to the index’s gain. Conversely, VCB was the most significant drag on the index, taking away more than 1 point. This was followed by MWG, VJC, HAG, TCB, and others, which also traded on a negative note.

Green dominated most industry groups, but the performance of stocks within each group varied significantly. The telecommunications services group led the market with a 0.87% increase, mainly attributed to the performance of VGI (+1.05%), FOX (+0.98%), and a few stocks that hit the ceiling price, including CAB, DST, and TPH.

Following closely was the consumer staples group, which rose by 0.65% in the morning session. Several stocks witnessed strong gains, notably MSN (+2.54%), SAB (+2.03%), VHC (+2.17%), and IDP (+6%). However, VNM, MCH, QNS, KDC, DBC, and others failed to join the upward momentum of this group.

The materials sector exhibited a similar trend. While many large-cap stocks in the industry traded in positive territory, such as HPG (0.79%), GVR (+1.06%), DCM (+0.82%), DPM (+0.98%), and NTP (+5.38%) …, there were also a significant number of stocks that succumbed to selling pressure, including DGC, BMP, HSG, NKG, TVN, HT1, PTB, and others.

On the flip side, the energy group faced substantial selling pressure, declining by more than 1%. This was mainly driven by BSR (-1.27%), PVD (-1.12%), and PVS (-0.76%). Sellers also temporarily gained the upper hand in the industrials and financials groups during the morning session.

10:40 am: A tug-of-war ensues

The market continued to witness a divergence in performance as buying and selling forces remained evenly matched, preventing the major indices from making significant breakthroughs. As of 10:40 am, the VN-Index gained over 2 points, hovering around 1,233 points. Meanwhile, the HNX-Index edged slightly higher, trading around the 230-point level.

The breadth of the VN30 basket index was predominantly green. Specifically, MSN, HPG, ACB, and SSB contributed 1.32 points, 0.71 points, 0.61 points, and 0.45 points to the VN30-Index, respectively. Conversely, VCB, VJC, VHM, and VNM faced selling pressure, collectively dragging down the overall index by more than 1 point.

Source: VietstockFinance

|

Leading the gains was the telecommunications services group, with notable performers such as VGI, which climbed 1.8%, CTR, up 0.66%, FOX, advancing 1.09%, and MFS, rising 3.53%… The remaining stocks in this group either stood pat or witnessed marginal increases.

Additionally, the materials sector posted a solid performance, accompanied by a positive market breadth. Standout performers included DCM, which rose 1.65%, DPM, up 1.12%, NTP, surging 5.55%, GVR, climbing 1.21%, HPG, advancing 0.79%, and CSV, which gained 3.06%…

In contrast, the energy group faced a wave of selling pressure, painting a predominantly red picture. The decline was largely driven by three stocks: BSR, which fell 0.85%, PVD, down 0.56%, and PVS, slipping 0.51%.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, resulting in over 1,027 stocks standing pat, with buyers slightly gaining the upper hand. There were 274 declining stocks (including 10 at the lower limit) versus 282 advancing stocks (including 14 at the upper limit).

Source: VietstockFinance

|

Opening: Positive sentiment prevails

At the start of the August 14 session, as of 9:30 am, the VN-Index climbed over 3 points to reach 1,234.24 points. Meanwhile, the HNX-Index also edged slightly higher to 231.22 points.

On August 13, the Dow Jones index rose 408 points (or 1.04%) to 39,765.64 points. The Nasdaq Composite added 2.43% to reach 17,187.61 points, while the S&P 500 index advanced 1.68% to 5,434.43 points. The latter is currently about 5% below its all-time high recorded in July 2024.

The Producer Price Index (PPI) for July – a measure of wholesale prices – inched up 0.1% from the previous month, falling short of economists’ forecast of a 0.2% increase and matching the previous month’s figure.

As of 9:30 am, large-cap stocks such as BID, FPT, and MSN spearheaded the index’s advance, collectively contributing nearly 1.5 points to the gain. Conversely, stocks such as VCB, VHM, and VJC weighed on the market, dragging down the index by a combined total of over 1.5 points.