In Mirae Asset’s August update on the stock market outlook, they noted that the trading activities in the first few sessions of August reflected investors’ risk aversion, especially among domestic individual investors.

However, the downside risks remain as the broader negative sentiment across major global stock markets will likely impact Vietnam’s market as well.

In the worst-case scenario, the market is expected to find support at attractive valuation levels for the VN-Index, such as between -1 and -2 standard deviations from the 10-year average P/E, ranging from 1,050 to 1,150 points. This support expectation is based on the assessment of Vietnam’s improved macroeconomic performance in the first seven months and the trend of corporate earnings recovery in the first half of the year.

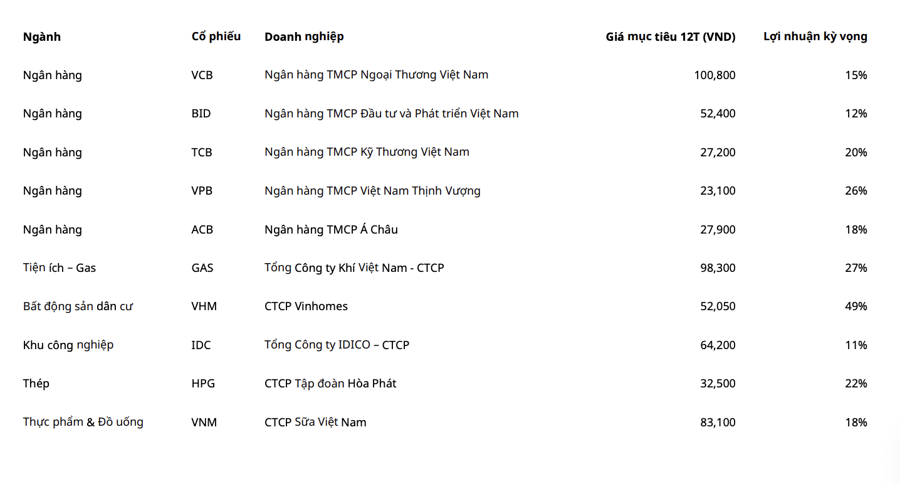

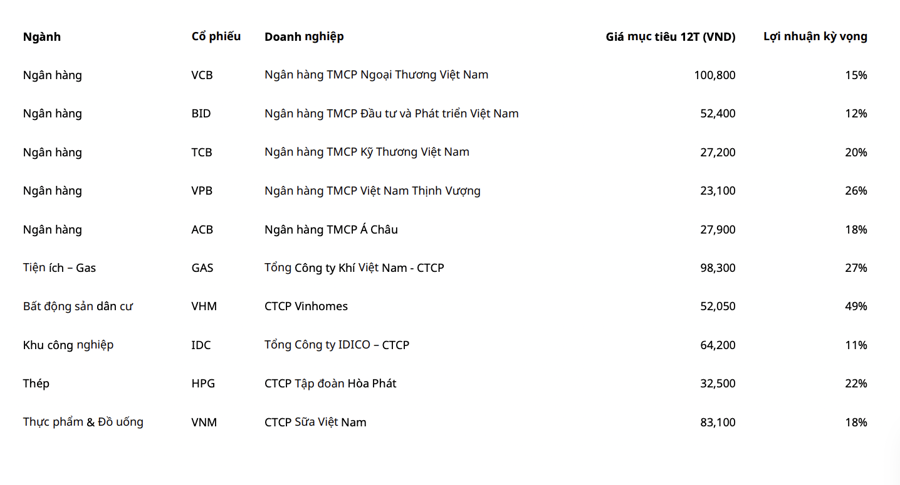

Based on this assessment, Mirae Asset provided a list of 10 stock recommendations for August, with a focus on the banking sector, offering potential price gains of up to 26%.

The first stock on the list is VCB, with a potential profit of 15% and a target price of 100,800 VND per share. As the market’s primary concern is the quality of bank assets, VCB maintained relative stability in Q2. The NPL ratio decreased slightly by 2 bps from Q1 to 1.2%, while the gross NPL ratio improved more significantly, falling by 22 bps to 1.56%. The NPL coverage ratio showed a modest improvement, increasing by 12.3% from the previous quarter to 212.1%. Although most asset quality indicators showed a relative decline in the first half of 2024, they remain superior when compared to the industry average, indicating a stable outlook.

Profit growth in Q2 2024 turned positive again, increasing by 9%. For the first six months of 2024, VCB’s pre-tax profit reached 20,835 thousand billion VND, a 1.6% increase, completing 49.6% of the annual plan.

With a more positive macroeconomic outlook for the second half of 2024, international trade activities are expected to gradually recover, supporting VCB’s non-interest income growth. Additionally, VCB’s provisioning pressure is not significant, thanks to its solid asset quality, reasonable interest rates, low credit growth during challenging years, and manageable real estate-related exposures.

BID is also recommended, offering a potential price gain of 12%. BID’s assets, belonging to the largest joint-stock commercial bank in Vietnam, gained momentum in Q2 2024, increasing by 8.3% from Q1 and 9.6% year-on-year to reach 2,521.1 thousand billion VND. The NPL ratio increased slightly by 1 bp to 1.52%, which is relatively optimistic, as many banks reported an increase in on-balance-sheet NPLs.

Additionally, the expanded NPL ratio (including substandard loans) decreased by 45 bps from Q1 to 3.11%. The LLR ratio declined to 132.2%, a reduction of 20.5% from Q1 2024.

BID’s profit in Q2 2024 grew strongly by approximately 17.4%. For the first six months of 2024, BID’s pre-tax profit reached 15,500 billion VND, a 12.1% increase compared to the same period last year.

Regarding TCB, the asset quality indicators showed a slight decline in the quarter, with the NPL ratio increasing by 10 bps to 1.23% and the NPL coverage ratio decreasing by 5% to 101.1%. On a positive note, the substandard loan ratio decreased from 1.1% at the end of Q1 to 0.8% at the end of Q2 2024, reducing the potential pressure of increasing NPLs in the next period.

TCB’s profit continued to maintain high growth in Q2 2024, driven by strong performance in most main income sources. Pre-tax profit increased by 38.5% year-on-year in Q2 2024, similar to the 38.7% increase in the previous quarter. For the first six months, pre-tax profit increased by 38.6%, reaching over 15,600 billion VND and completing 57.6% of the annual plan.

Liquidity indicators remain robust, with CAR at 14.5% (+0.3% quarter-on-quarter, including the negative impact of cash dividend payment) and SFMLL at 24.2%, demonstrating the bank’s resilience in less favorable conditions. Based on these factors, TCB is recommended with a potential price gain of up to 20%.

VPB is the bank stock with the highest potential price gain, up to 26%. In the first half of 2024, VPB recorded credit growth of nearly 7% compared to 2023, reaching 647.7 thousand billion VND. While on-balance-sheet asset quality showed a quarterly decline, it improved overall. The NPL ratio increased to 5.08%, a 24 bp increase from Q1 but a 144 bp decrease year-on-year. The NPL coverage ratio ended the quarter at 48.1%, a 5.4% decrease from the previous quarter but a 5.1% improvement year-on-year.

The expanded NPL ratio decreased by 23 bps from Q1 and 181 bps year-on-year to 12.9%. A positive development in Q2 for VPB was the significant reduction in the ratio of below-standard bonds to 17.8% from 27.4% in Q1 2024 (a decrease of 53.8% in value).

Although profit growth slowed in Q2 2024, VPB’s performance was still higher than most of its peers in the first half of the year. In the first six months of 2024, consolidated operating income exceeded 29 thousand billion VND, a 17.5% increase, while pre-tax profit grew by nearly 68%, reaching over 8,600 billion VND. This achievement is attributed to improved operational efficiency across the ecosystem, particularly from reduced losses at subsidiaries (loss reduction from 3,725.7 billion VND in 1H 2023 to 707.6 billion VND in 1H 2024).

Lastly, ACB’s asset quality showed a declining trend in Q2 2024. Specifically, NPL increased by 10.5% in the quarter or 38% year-to-date, pushing the NPL ratio up by 3 bps to 1.48%. Meanwhile, the LLR ratio slightly decreased by 0.6% quarter-on-quarter to 76.4%. On a positive note, the expanded NPL ratio, including substandard loans, decreased by 22 bps to 2.01%.

For the first six months of 2024, ACB’s pre-tax profit reached 10.5 thousand billion VND, equivalent to 48% of the annual plan. ACB’s credit growth was relatively favorable, but the NIM outlook is not as advantageous, and it lacks the benefit of low base income. Therefore, ACB’s profit growth may not be as impressive as similar banks in 2024. Nevertheless, Mirae Asset still recommends ACB with a potential price gain of up to 18%.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.