Recently, Refrigeration Electrical Engineering Corporation (REE) announced that it had received an amended filing from Platinum Victory Pte. Ltd. regarding their tender offer for REE shares.

Platinum Victory Pte. Ltd. has registered to publicly offer to purchase 4 million REE shares, representing 0.85% of the capital, at a proposed price of 80,000 VND per share, totaling over 320 billion VND.

Currently, REE shares are trading at 68,000 VND per share. Therefore, the price offered by this foreign fund is nearly 18% higher than the market price.

According to the amended document, Platinum Victory will cancel the public offering at any time if the public offering results in a violation of foreign ownership ratio regulations at REE. Ho Chi Minh City Securities Corporation (HSC) will act as the agent for this public offering.

Currently, Platinum Victory is REE’s largest shareholder, holding over 164 million shares, representing 34.85% of the capital. If the tender offer for 4 million REE shares is successful, Platinum Victory will increase its holdings to over 168 million shares, or 35.7% of the charter capital.

Previously, Platinum Victory Pte. Ltd. had registered to purchase REE shares several times, most recently in early June 2024, when the organization registered to buy nearly 300,000 REE shares from June 12 to July 3. However, due to unfavorable market conditions, the foreign fund was unable to purchase any shares during the trading period.

It is known that the Platinum Victory fund has continuously registered to increase its ownership in REE over the years but has mostly been unable to do so due to “unfavorable market conditions.” However, it is highly likely that REE has already reached its foreign ownership limit of 49%. For Platinum Victory to successfully purchase REE shares, they would need to acquire them from other foreign organizations or investment funds.

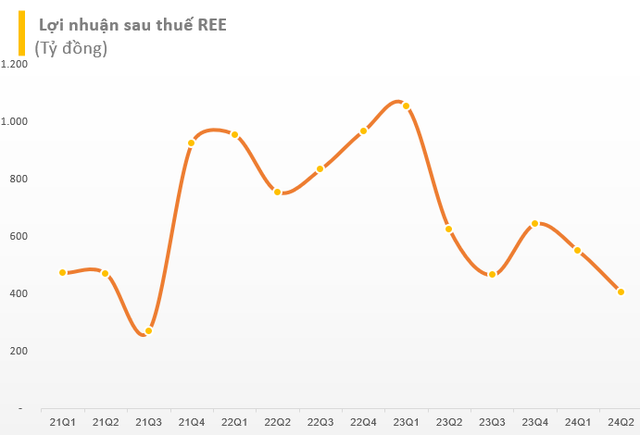

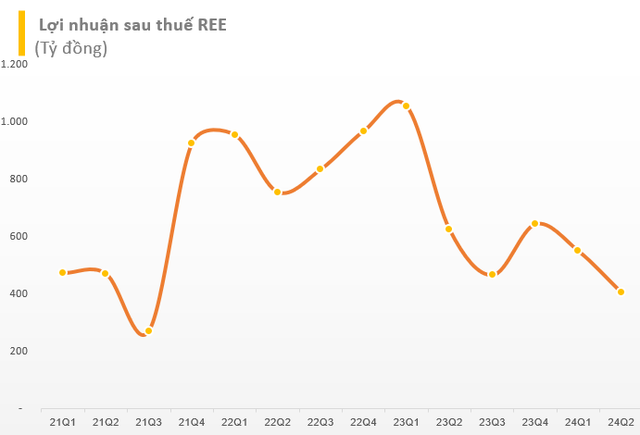

Regarding the company’s business results for Q2 2024, REE recorded consolidated net revenue of over 2,181 billion VND, almost unchanged from the same period last year. However, a 16% increase in cost of goods sold led to a 23% decline in gross profit to nearly 680 billion VND. After deducting other expenses, REE reported a post-tax profit of nearly 404 billion VND, a 35% decrease compared to the previous year and the lowest in 11 quarters since Q3 2021.

REE attributed the 27% decline in consolidated after-tax profit attributable to shareholders of the parent company in Q2 2024 compared to the same period last year to a 134 billion VND decrease in the electricity segment. This was mainly due to reduced profits from member companies and associates in the hydropower group, including Vinh Son Song Hinh Hydropower Joint Stock Company, Thac Mo Hydropower Joint Stock Company, Thac Ba Hydropower Joint Stock Company, and Central Hydropower Joint Stock Company.

In the first six months of the year, REE recorded net revenue of 4,019 billion VND and after-tax profit of 952 billion VND, a decrease of 12% and 43%, respectively, compared to the same period last year. For 2024, REE’s Board of Directors set a revenue target of 10,588 billion VND and a profit after tax of 2,409 billion VND. With the results achieved in the first half, REE has completed 38% of the revenue target and 40% of the profit target.

The Largest Shareholder Proposes a Public Offer for REE at VND 320 Billion, 20% Higher than Market Price

After numerous filings of transaction registrations with no execution, foreign fund Platinum Victory Pte. has now registered to publicly purchase REE shares (Refrigeration Electrical Engineering Corporation) and has disclosed the intended purchase price.