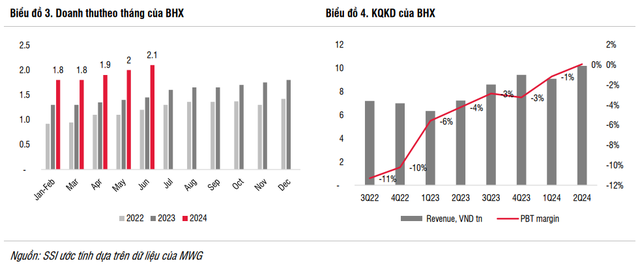

In a recent update on MWG – Mobile World Investment Corporation, SSI Research revealed that Bach Hoa Xanh’s revenue for Q2 2024 exceeded VND 10,200 billion, marking a 41% increase from the previous year.

The monthly revenue per store continued its upward trajectory, reaching VND 2 billion in the last quarter. This impressive growth can be attributed to an improved product mix, including more vegetables in urban stores, a wider range of imported fruits in rural stores, and a greater selection of branded meat and seafood.

Bach Hoa Xanh stores offer a more diverse range of products compared to their competitor, Winmart, which has proven effective in attracting new customers away from traditional markets. Notably, the chain reported a pre-tax profit of over VND 7 billion in the last quarter.

However, SSI Research believes that with the current store model of 150 sq. m, further revenue growth for Bach Hoa Xanh might be challenging. As revenue per store stabilizes between VND 2.1 and 2.2 billion, the focus will shift to cost optimization through operational automation to reduce labor and logistics expenses, ultimately improving the company’s gross profit margin.

To ensure long-term growth, SSI Research anticipates MWG will expand the Bach Hoa Xanh network. With a current low penetration rate of modern grocery stores (<14%), the number of Bach Hoa Xanh stores (approximately 1,700 as of Q2 2024) is expected to surpass that of phone and appliance stores (around 3,200) in the medium term.

SSI Research estimates that Bach Hoa Xanh could achieve VND 40,000 billion in revenue in 2024, potentially rising to VND 45,000 billion in 2025. This translates to a monthly revenue per store of VND 1.95-2.1 billion during 2024-2025. The unit also maintains its profit estimates at VND 228 billion and VND 668 billion for 2024 and 2025, respectively, a significant improvement from the VND 1,200 billion loss incurred in 2023.

MOBILE WORLD AND GREEN ELECTRICAL APPLIANCES EXPERIENCE GROWTH DURING EURO 2024

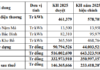

Turning to Mobile World and Green Electrical Appliances, these two chains recorded a combined revenue of VND 22,800 billion in Q2 2024, representing a 6% increase from the previous year. Despite closing 116 stores during the quarter, revenue grew by 7% compared to the previous quarter, as the closures mainly affected areas with a high density of stores, allowing customers to continue shopping at nearby MWG stores.

The record-breaking heatwave drove demand for air conditioners, while the EURO 2024 football tournament boosted TV sales, contributing to MWG’s revenue growth. SSI Research noted a continued recovery in gross profit margin for these two chains in Q2 2024, with an increase of 60 basis points from the previous quarter.

Apple’s efforts to maintain pricing power played a crucial role in the margin recovery for Mobile World and Green Electrical Appliances. In June, Apple requested that authorized retailers in Vietnam remove Apple products from livestream channels. SSI Research believes this could reduce competition between offline and online sales points, supporting the profit margins of offline retailers.

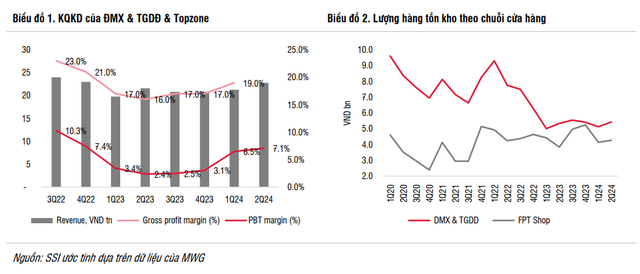

Apple’s premium phones are typically purchased at full price from offline stores. However, with increasing competition from online channels and inventory pressure in 2023, customers could acquire iPhones at significant discounts of up to 25%.

While inventory pressure has eased as the inventory levels of the two major companies, MWG and FRT, have decreased, competition from online channels remains a concern for offline retailers. Deep discounts on Apple products during livestreams not only erode the profit margins of offline retailers but also diminish Apple’s brand image, pricing power, and exclusivity.

By requesting the removal of Apple products from livestream channels, Apple has supported the recovery of offline retailers’ profit margins. Among phone and appliance retailers, MWG is the least affected by livestream sales in terms of revenue. As a result, the company stands to benefit from the margin recovery without sacrificing significant livestream revenue.

SSI Research maintains its revenue estimates for the two chains at VND 89,000 billion and VND 96,000 billion for 2024 and 2025, respectively, representing a 7% year-over-year increase for each year. While the 2024 revenue growth is driven by high air conditioner sales due to extreme weather and increased TV sales during EURO 2024, the 2025 growth will be propelled by replacement demand for phones, which typically occurs every 3-4 years from the peak of mobile phone spending in 2021-2022.

Given the faster-than-expected gross profit margin recovery in Q2 2024, SSI Research has upwardly revised its gross profit margin estimates for 2024 and 2025 to 5.3% and 6.2%, respectively. In the long term, we anticipate the gross profit margin to return to the level seen in Q4 2022 (7.4%, when non-essential consumption started to decline along with the economic downturn), although reclaiming the peak level of Q3 2022 may prove challenging due to intense competition from e-commerce.

ANKHANG PHARMACY CHAIN MAY CONTINUE TO INCUR LOSSES FOR THE NEXT TWO YEARS

Since mid-2022, MWG has halted the opening of new An Khang drugstores to refine its business model before embarking on network expansion. However, the pharmacy chain’s profitability has remained stagnant. According to SSI Research estimates, the gross profit margin declined by 15% in 2023 and a further 10% in the first half of 2024 due to an inappropriate product mix.

Consequently, MWG decided to close 45 An Khang drugstores in June and continued to accelerate the closure of additional stores in July. Year-to-date, MWG has shut down 139 drugstores, equivalent to approximately 25% of the total number of pharmacies.

SSI Research now forecasts that the AnKhang pharmacy chain will incur losses of VND 339 billion and VND 243 billion in 2024 and 2025, respectively. Thus, the closure of the An Khang drugstores is not expected to significantly impact MWG’s overall net profit.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.