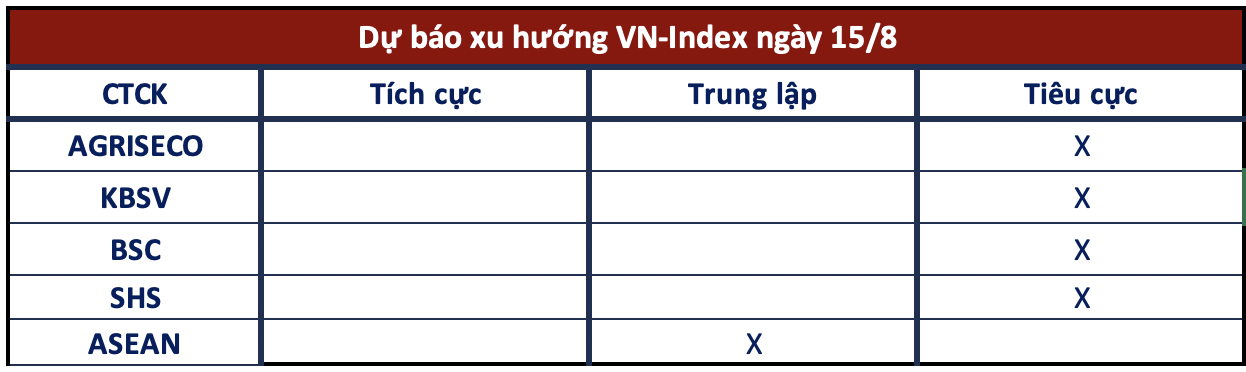

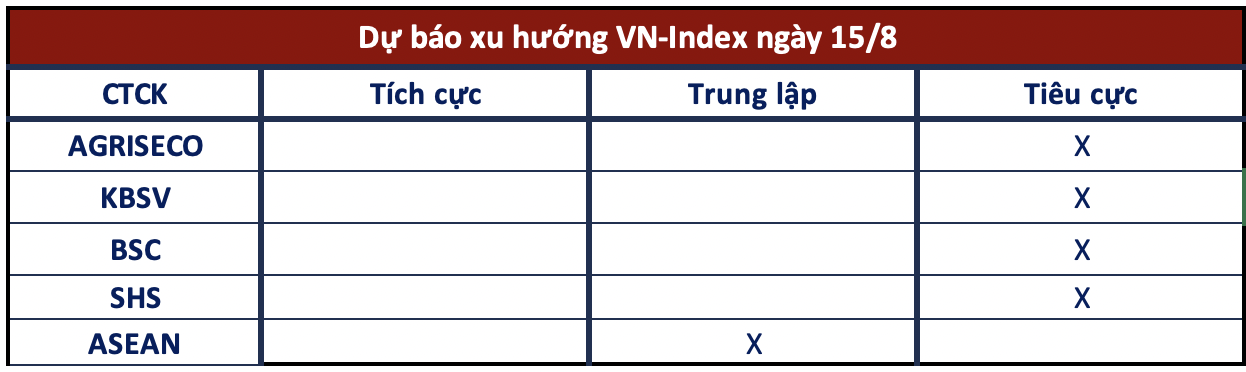

The VN-Index experienced a cautious trading session, resulting in a narrow trading range. The index closed slightly lower on August 14, dropping 0.06 points to 1,230. Turnover remained subdued, with the value of transactions on the HOSE reaching just over VND 13 trillion.

Looking ahead, several securities companies predict that the downward trend may not be over yet, especially with the upcoming futures expiration. Investors are advised to remain cautious as volatility could increase during this period.

Volatility Expected During Futures Expiration

Agriseco Securities

The recovery trend persists as the market continues to fluctuate within a narrow range with low turnover. It’s important to note that the following session is the August futures expiration, which may lead to significant changes in turnover and index levels. For the next session, Agriseco predicts that the VN-Index will retest the MA20 level with increased turnover. They recommend that investors restructure their portfolios, considering reducing stock proportions during early recovery periods towards the aforementioned MA20 resistance level. When it comes to increasing proportions, it’s advisable to wait for the market to establish a balance or confirm a clear upward trend. It’s important to maintain a low financial leverage to effectively manage portfolio risks.

KBSV Securities

Selling pressure has intensified as the index approached the 20-day MA. Additionally, the lack of aggressive buying interest has limited the upward momentum of some large-cap stocks, causing the VN-Index to struggle and barely avoid a sharp decline. As market sentiment remains cautious about this recovery, the potential for high-priced supply remains a risk for the index to reverse around the nearby resistance level.

Investors are Advised to Exercise Caution

BSC Securities

The market remains range-bound around the 1,230 level with low turnover. Prolonged consolidation at this level may impact market sentiment, and investors are advised to trade with caution in the upcoming sessions.

SHS Securities

The short-term trend of the VN-Index is still confined within a downward channel connecting short-term peaks. Currently, the index is facing resistance around 1,235 points, corresponding to the 20-session average price. The index continues to face downward pressure, likely testing the support zone of 1,220-1,225 points, which coincides with the lows of the sharp declines on July 24 and August 1, 2024.

ASEAN Securities

Turnover remained subdued, with trading volume barely surpassing 443 million shares, indicating investor caution. However, it also suggests that selling pressure is easing. Investors should closely monitor the support level of 1,220 points and consider increasing their stock allocations when more positive signals emerge from market liquidity.