The trading market was sluggish ahead of the derivatives expiration, with the Vn-Index fluctuating throughout the session but with little change, closing slightly down 0.06 points and trading sideways compared to yesterday’s session at the 1,230-point level.

The breadth was negative, with 243 declining stocks against 163 advancing ones. Banks reversed course, falling 0.32%, and securities stocks dropped 0.85%, weighing on the index. Meanwhile, most other sectors posted gains, with real estate climbing 0.59%, steel gaining 0.19% despite news of price cuts and anti-dumping investigations in the EU, telecommunications rising 0.4%, and food and beverage increasing 0.74%.

Stocks that contributed positively today were mainly from the Vin family, with VHM, VRE, and MSN lifting 0.89%, 0.30%, and 0.62%, respectively. They were joined by BID, SAB, TCB, and GAS. On the flip side, VCB exerted the most pressure on the market, blowing off 2.03 points, followed by VPB, MBB, and DGC.

Liquidity continued to decline as tomorrow marks the derivatives expiration, and stronger fluctuations are expected. The total matched orders on the three exchanges decreased to VND 14,700 billion, with foreign investors surprisingly net buying VND 676.1 billion. However, for matched orders only, they were net sellers at VND 86.6 billion.

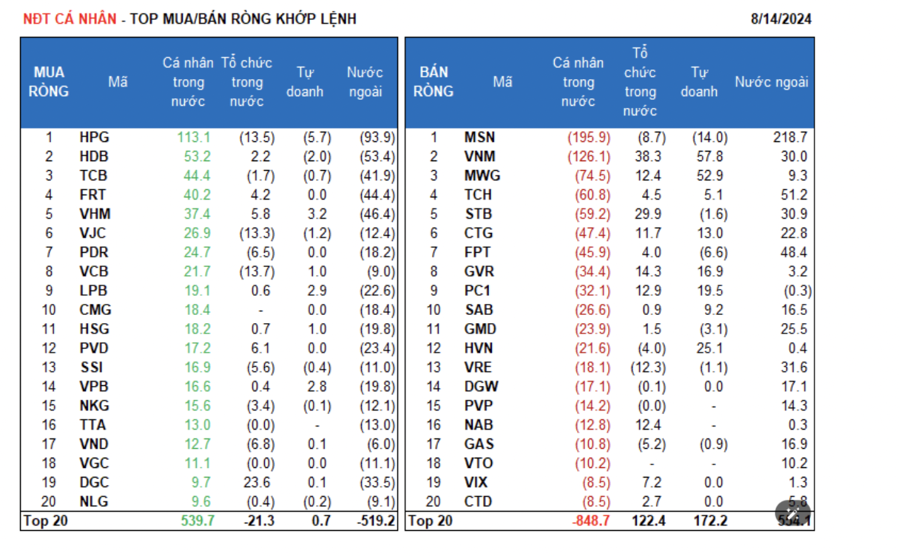

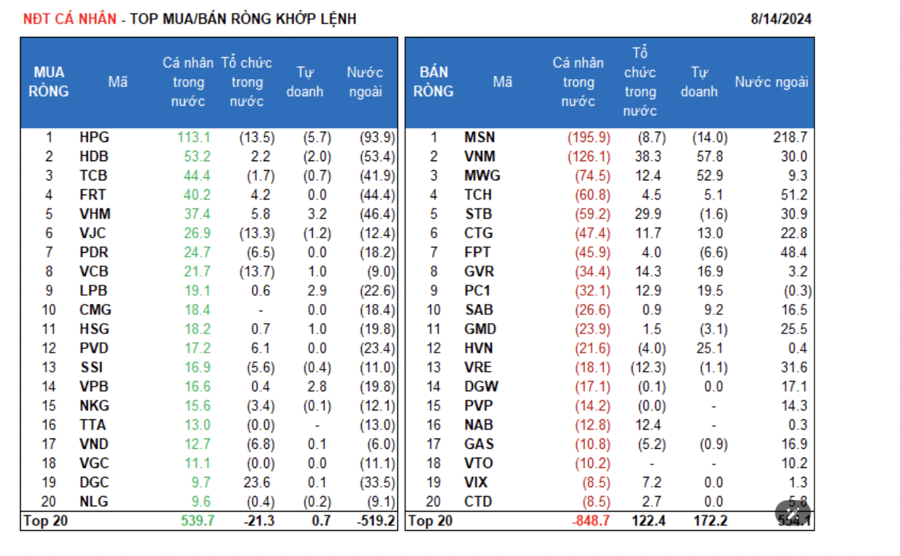

Foreign investors’ net buying on the matched orders side was focused on the food and beverage and industrial goods and services sectors. The top stocks they net bought were MSN, TCH, FPT, VRE, STB, VNM, GMD, CTG, PLX, and DGW.

On the net selling side, they offloaded basic resources stocks. The top stocks they net sold were HPG, HDB, VHM, FRT, TCB, PVD, LPB, FUEVFVND, and HSG.

Individual investors net sold VND 775.6 billion, including VND 209.2 billion in net selling for matched orders.

For matched orders only, they bought a net on 11 out of 18 sectors, mainly basic resources. The top stocks they net bought were HPG, HDB, TCB, FRT, VHM, VJC, PDR, VCB, LPB, and CMG.

On the net selling side for matched orders, they offloaded stocks in 7 out of 18 sectors, primarily food and beverage and retail. The top stocks they net sold were MSN, VNM, MWG, TCH, STB, CTG, GVR, PC1, and SAB.

Proprietary trading bought a net VND 134.9 billion, including VND 167.0 billion in net buying for matched orders.

For matched orders only, proprietary trading bought a net on 9 out of 18 sectors, with the strongest net buying in food and beverage and retail. The top stocks they net bought were VNM, MWG, HVN, PC1, GVR, CTG, SAB, MBB, TCH, and FTS.

The top net selling sector was information technology. The top stocks they net sold were MSN, ACB, FPT, HPG, VIB, REE, GMD, PNJ, AAA, and NTL.

Domestic institutional investors net sold VND 45.6 billion, but for matched orders only, they net bought VND 128.8 billion.

For matched orders only, domestic institutions net sold 7 out of 18 sectors, with the largest net selling in tourism and entertainment. The top stocks they net sold were VCB, HPG, VJC, VRE, PLX, MSN, VND, PDR, SSB, and DIG.

The sector with the highest net buying value was banking. The top net bought stocks were VNM, STB, DGC, FUEVFVND, GVR, PC1, NAB, MWG, CTG, and VIB.

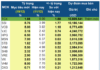

Today’s matched orders contributed about VND 2,430 billion in trading value, a significant increase of 54% compared to yesterday, accounting for 16.5% of the total trading value.

Notable matched orders today included a transaction in KDC, where over 8.62 million units (equivalent to VND 500 billion) changed hands between an individual seller and a foreign institutional buyer. The matched order price was VND 58,000 per share, 6.2% higher than the average trading price during the session. In addition, individuals continued to trade matched orders in VHM, TCB, and VJC.

The money flow allocation decreased in banking, securities, construction, steel, information technology, and retail but increased in real estate, chemicals, agricultural and marine products, food, building materials, and beer.

For matched orders only, the money flow allocation increased in the large-cap VN30 and small-cap VNSML groups but decreased in the mid-cap VNMID group.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.