While the stock market faced pressure at the 1,230-point resistance level, CNN shares of Construction Equipment and Inspection Joint Stock Company (Coninco) reversed the trend and surged. The share price rose to the ceiling price, with a gain of nearly 15%, thereby reaching 46,500 VND/share before the upward momentum narrowed towards the end of the session.

At the close of the August 14 session, CNN shares stood at 41,200 VND/share, a remarkable 17% increase after just two trading sessions. However, the trading volume was quite modest, with only 500 units matched, while the previous ceiling-hitting session saw a mere 100 shares traded.

Looking at a broader perspective, CNN shares have been trading sideways compared to the price at the beginning of the year, but they have declined by 39% from their all-time high set 13 months ago.

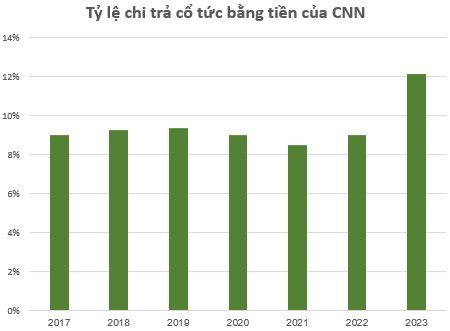

This rapid surge in the share price of this construction company occurred just before the record date for shareholders eligible for the 2023 dividend payment. In a recent announcement, Coninco stated that August 19 would be the ex-dividend date for shareholders entitled to receive cash dividends for 2023, at a rate of 12.15%/share (each share will receive 1,215 VND). The payment is expected to be made on September 16.

With 8.8 million shares currently in circulation, Coninco plans to distribute approximately 11 billion VND in dividends for this period.

Notably, this dividend payout also marks the highest cash dividend in the company’s history. Prior to this, the company had consistently paid cash dividends to its shareholders since its listing, with rates ranging from 8.5% to over 10%.

According to our research, the Construction Equipment and Inspection Joint-Stock Company – Coninco was established on April 16, 1979, originating from a research institute specializing in construction technology and organization. Coninco is a construction investment consulting company, operating in multiple fields and sectors within Vietnam and internationally. Currently, Coninco has nine subsidiary companies in various fields, including mechanical and electrical engineering, construction machinery and industrial projects, environment, and project management…

As mentioned on their website, the company has also participated in several key projects, including Phu Bai International Airport, Noi Bai International Airport, the National Assembly House in Ba Dinh, the National Convention Center, and Can Tho Cancer Hospital…

Additionally, the company owns a prime location, the CONINCO Tower, situated on a land area of 1,814 square meters at 4 Ton That Tung, Dong Da, Hanoi.

In terms of shareholder structure, the Chairman of Coninco’s Board of Directors, Mr. Nguyen Van Cong, is also the largest shareholder, holding over 2 million CNN shares, equivalent to 23.17% of the capital. Alongside Mr. Cong, Vietnam Construction Consulting Corporation (VNCC) owns 19.7% of the capital.

It is worth mentioning that, last July, Coninco, in a joint venture with the foreign contractor Japan Airport Consultants, Inc., won Package 5.12 – consulting supervision and design review for the construction of the passenger terminal, component project 3, under the Long Thanh International Airport project phase 1. This package is valued at over 630 billion VND, with an implementation period of 33 months.

Turning to the company’s financial performance, Coninco’s profit after tax has been fluctuating around 11-13 billion VND annually in the 2016-2022 period. In 2023, the company recorded its highest-ever revenue and profit. Specifically, CNN’s net revenue reached nearly 496 billion VND, a 13% increase compared to 2022. Profit after tax amounted to nearly 18 billion VND, a growth of nearly 40% over the same period.

As of the end of 2023, Coninco’s total assets stood at 896 billion VND, with equity reaching 142 billion VND, including after-tax profit yet to be distributed of 17 billion VND.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.