Illustration

Oil Falls

Brent and WTI crude oil prices fell as markets perceived a reduced risk of a wider Middle East war, with Iran yet to retaliate against Israel for the assassination of a Hamas official in Tehran.

On August 13th, Brent crude fell by $1.61 or 1.96% to $80.69 a barrel. WTI crude fell by $1.71 or 2.14% to $78.35 a barrel.

Brent crude had risen over 3% to close at $82.30 a barrel after hitting a seven-month low of $76.30 a week earlier.

The Organization of the Petroleum Exporting Countries (OPEC) lowered its 2024 demand forecast even as OPEC+ aims to increase output from October.

The International Energy Agency (IEA) kept its 2014 global oil demand growth forecast unchanged but cut its estimate for 2015 due to the impact of China’s lackluster consumption on economic growth.

The escalation of conflict in the Middle East could endanger oil supplies from the world’s key producing regions, but a broader war seems less likely as Iran believes that new ceasefire talks with Hamas could prevent retaliatory action.

Gold at Highs as USD, Treasury Yields Dip

Gold prices steadied near their highest level since July, as the USD and US Treasury yields dipped after US producer price data reinforced expectations of a Fed rate cut in September.

Spot gold fell 0.2% to $2,467.8 an ounce due to profit-taking. Gold prices had hit a record high of $2,483.6 on July 17th and have risen 20% so far this year.

US gold futures for December delivery settled up 0.2% at $2,507.8 an ounce.

The USD fell 0.4% against rival currencies, making gold more appealing to buyers using other currencies, while yields on 10-year US Treasury notes fell to a one-week low.

US producer prices rose less than expected in July, indicating that inflation continues to cool.

Copper Retreats on Rising Inventories, Tepid Demand

Copper prices fell after three sessions of gains, as inventories rose and demand was weak in top consumer China.

However, copper losses were curbed after workers at BHP’s Escondida mine in Chile went on strike, potentially impacting production at the world’s largest copper mine.

Three-month copper on the London Metal Exchange fell 1% to $8,940 a ton after rising 2.9% in the previous three sessions.

US COMEX copper fell 0.7% to $4.04 per lb.

LME copper has fallen 19% since hitting a record high of over $11,100 a ton in May.

LME inventories surged on August 13th to their highest in nearly five years, doubling in the past two months.

The latest data also raised concerns, showing that bank lending in China fell more than expected in July to its lowest in nearly 15 years, highlighting weak demand in the world’s second-largest economy.

Singapore Iron Ore Extends Losses

Singapore iron ore prices fell for a second straight session to their lowest in nearly two weeks, as demand eased amid cuts in steel production in China, outweighing support from some short-covering purchases.

September iron ore on the Singapore Exchange fell 0.36% to $98.95 a ton. During the session, prices fell to $98.25 a ton, the lowest since July 31st.

On the Dalian Commodity Exchange, the January 2025 iron ore contract closed flat at CNY 734.5 ($102.39) a ton after rising more than 1% in the morning session.

Analysts at consulting firm Mysteel said in a note that as of August 12th, 79 steelmakers had carried out equipment maintenance, an increase of 41 from the end of July.

In Shanghai, rebar fell 1.95%, hot-rolled coil fell 1.62%, wire rod fell 0.09%, and stainless steel fell 0.58%.

Japanese Rubber Extends Gains

Japanese rubber prices rose for a fifth straight session, tracking gains in synthetic rubber, while concerns about wet weather in Thailand, the world’s largest producer, also supported the market.

The January 2025 rubber contract on the Osaka Exchange closed up 1.3 JPY or 0.4% at 323.3 JPY ($2.19) per kg.

Rubber prices are rising due to increasing raw material costs and stable market demand amid slowing supply.

Robusta Coffee Falls Over 3%

November robusta coffee closed down $172 or 3.9% at $4,187 per ton.

Agents said robust export pace from Brazil had helped offset tight supplies from Vietnam.

Robusta coffee exports from Brazil in July jumped 82.2% from the same month last year to 900,000 60-kg bags.

December arabica coffee fell 4% to $2,290.5 per lb.

Sugar Climbs

October raw sugar closed up 0.1 US cent or 0.5% at 18.39 US cents per lb.

Data from Unica on sugar and ethanol production in Brazil’s key Center-South region was generally in line with expectations.

According to Unica, sugarcane crushing in the Center-South reached a total of 51.31 million tons in the second half of July, down 3.35% from the same period last year. Sugar production reached 3.61 million tons in the second half of July, down 2.16% from the same period last year.

October white sugar rose 0.7% to $532.10 a ton.

Soybeans, Corn Ease

Chicago soybeans extended losses after a US Department of Agriculture report the previous day.

August soybeans closed down 0.23 US cent at $9.89 a bushel.

Corn eased after the USDA reported 67% of the nation’s crop was in good-to-excellent condition.

September corn closed down 5-1/2 US cents at $3.77-3/4 a bushel.

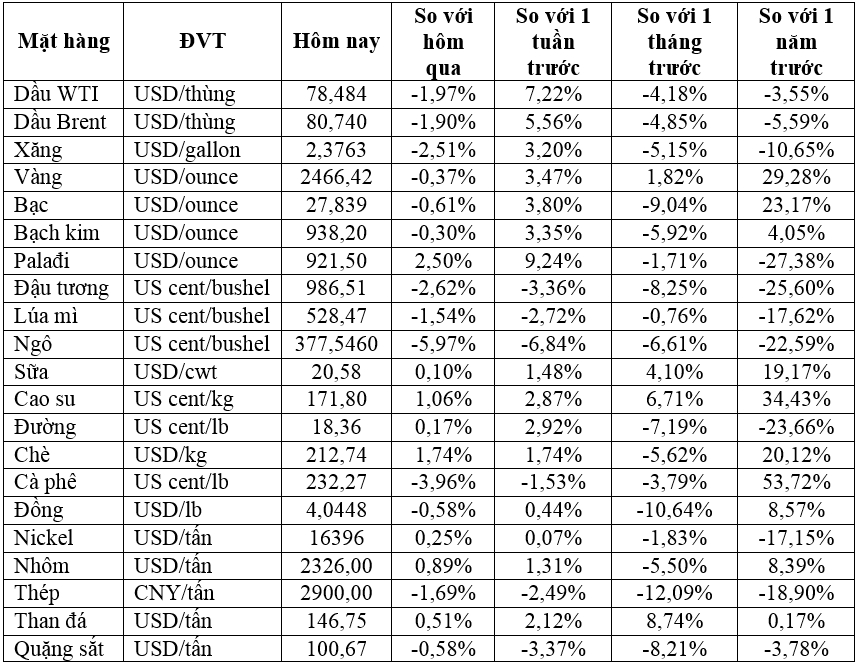

Prices of Key Commodities on August 14th Morning

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)