In its analysis report on Digiworld Corporation (stock code: DGW), DSC believes that the ICT segment will benefit from the electronics device replacement cycle in 2024, while other business segments will also experience positive growth.

As evidence, DSC points out that in the second quarter of 2024, revenue from the mobile phone and laptop and tablet segments increased by 1% and 17% YoY, respectively, even though the peak season has not yet arrived.

Thanks to the benefits of the laptop replacement cycle and the consumption momentum as the back-to-school season approaches, ICT items, especially computer products, recorded good growth in a sector that is considered saturated.

In addition, purchasing power in the last two quarters will improve significantly with the launch of new technology products and the early arrival of the Lunar New Year holiday, stimulating consumer spending.

Therefore, DSC forecasts that by the end of the year, with fairly clear growth drivers, revenue from the ICT segment of DGW this year will experience positive growth.

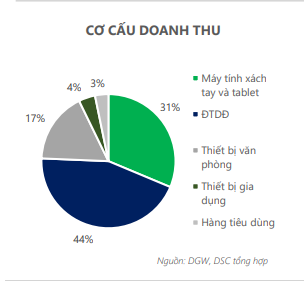

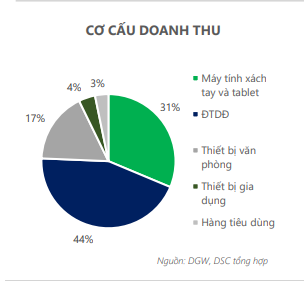

It can be seen that revenue from the mobile phone and laptop and tablet segments still accounts for a large proportion of Digiworld’s revenue structure, accounting for 44% and 31%, respectively.

According to DSC, in the second quarter of 2024, the contribution of revenue from DGW’s ICT segment improved significantly, reaching 75% thanks to the positive story of these items this year.

However, DSC also believes that ICT revenue will decline in the future as the growth potential of other segments, such as personal protective equipment, home appliances, and fast-moving consumer goods, increases.

DSC notes that the decline in the proportion of ICT is not due to a lack of growth potential, but because the growth rate of other segments is faster.

Digiworld’s business model (Source: DSC)

In the context of the ICT segment becoming saturated and unable to maintain good growth in the following years, DGW has carried out a series of M&A deals and diversified its product portfolio to diversify its profit sources.

At a recent investor meeting, Digiworld’s leaders updated information about the M&A situation. Specifically, a potential M&A deal in the office equipment segment fell through, but there is a high chance of closing a potential deal in the consumer segment in 2025.

In the past, Digiworld’s notable M&A deal was the acquisition of Achison to expand its business in meeting the demand for personal protective equipment.

In the first half of 2024, Achison’s sales were lower than expected due to weaker-than-expected production activities.

Mr. Doan Hong Viet, Chairman of Digiworld, said that Achison currently accounts for a 10% market share, which is not too high. According to Mr. Viet, Achison is planned to contribute VND 1,000 billion in revenue and VND 50 billion in after-tax profit, corresponding to a higher profit margin than DGW.

Mr. Doan Hong Viet

“Compared to much larger markets from Asian brands, Achison has not yet reached its full potential. Vietnam’s transformation into a production center for the region and the world will create long-term growth opportunities with high growth rates in this segment,” said Mr. Viet.

In addition, Digiworld aims to have 2-3 M&A deals per year, as the company believes that M&A will help DGW move faster, leveraging its strong understanding of the market and robust backend platform.