|

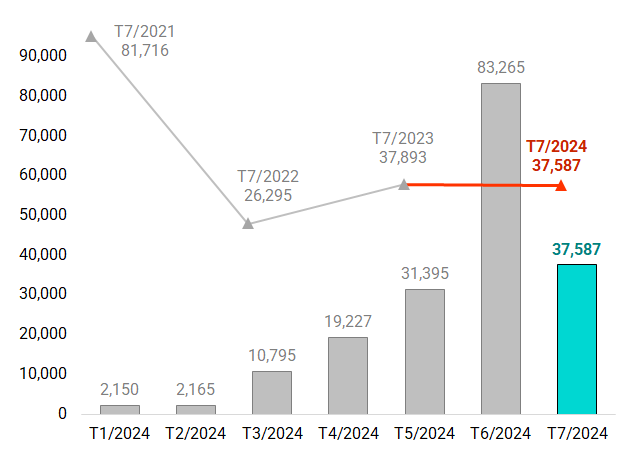

Monthly Development of TPDN Value Since the Beginning of 2024 (Unit: Billion VND)

Source: Author’s Compilation

|

In July 2024, enterprises offered 38 lots of bonds, raising over 37.5 trillion VND (face value), equivalent to the same period last year. The peak was in July 2021 when the amount reached 81.7 trillion VND. Although the value has halved compared to June, the issuance scale is generally on an upward trend, increasing by 19% compared to May.

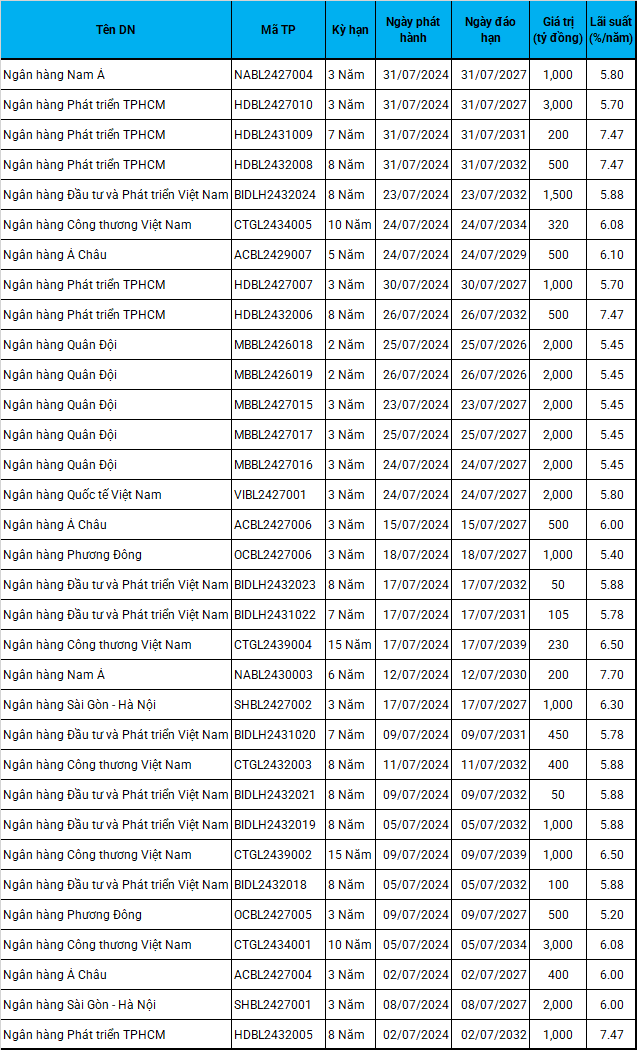

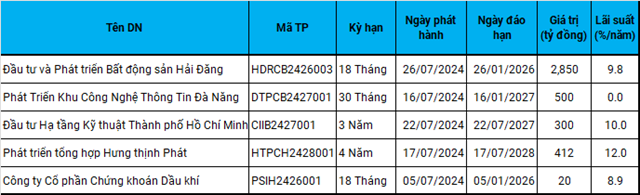

Banks accounted for 33.5 trillion VND, or 90% of the total; the largest being MBB with 10 trillion VND, followed by HDB with 6.2 trillion VND. CTG had its first mobilization for the year. The most notable real estate group was Investment and Development of Hai Dang Real Estate with a lot of 2.85 trillion VND in bonds.

Vietinbank Enters the Market

After remaining inactive in the first half of the year, Vietinbank (HOSE: CTG) consecutively offered 5 lots of privately placed bonds with maturities ranging from 8 to 15 years and interest rates from 5.88%/year (for an 8-year term) to 6.5%/year (for a 15-year term). The bank raised nearly 5 trillion VND, half of last year’s amount; of which, the largest lot was worth 3 trillion VND, with a 10-year term and an interest rate of 6.08%/year.

8, 10, and 15 years are the preferred terms for CTG. Statistics from the Hanoi Stock Exchange (HNX) show that this state-owned bank has 56 lots of bonds worth more than 31.5 trillion VND in circulation, all with terms ranging from 8 to 15 years and maturing after 2030.

At the end of July, Military Bank (HOSE: MBB) issued 5 lots of privately placed bonds with terms ranging from 2 to 3 years. Each lot consisted of 20,000 bonds with a par value of 100 million VND/bond and an interest rate of 5.45%/year; the total value was 10 trillion VND, bringing the total amount mobilized in 2024 to 18.5 trillion VND, the highest in the last 4 years despite only half a year passing.

The previous plan of MBB‘s leaders was to privately offer a maximum of 20 trillion VND of non-convertible bonds, without warrants, without asset collateral, and not being subordinate debt of the bank.

Ho Chi Minh City Development Bank (HOSE: HDB) has just borrowed an additional 6 lots of bonds worth 6.2 trillion VND, nearly double the amount of the previous two months combined. This time, HDB‘s bond lots are all of the “3-no” type, with terms ranging from 3 to 8 years and interest rates from 5.7 to 7.47%/year. The largest lot was worth 3 trillion VND with an interest rate of 5.7%/year for a 3-year term.

Similar to MBB, HDB plans to borrow 20 trillion VND in bonds in 2024, divided into two phases: 8 trillion VND and 12 trillion VND. The amount raised so far is 9.7 trillion VND, almost equal to the 11 trillion VND raised in 2023, but only about half of the amount raised in 2021.

Bank for Investment and Development of Vietnam (HOSE: BID) issued 3.2 trillion VND worth of bonds with interest rates ranging from 5.78 to 5.88%/year for terms of 7 to 8 years. BID has borrowed nearly 14 trillion VND through this channel since the beginning of the year, equivalent to the amount raised in 2023 but only half of the amount raised in 2022.

In just two short months, Asia Commercial Joint Stock Bank (HOSE: ACB) raised 23.6 trillion VND from bond issuances; in July alone, the amount was 1.4 trillion VND, on par with 2021. The 3 lots this time were all of the “3-no” type, with interest rates of 6 to 6.1%/year for terms of 3 and 5 years.

Saigon-Hanoi Commercial Joint Stock Bank (HOSE: SHB) and Vietnam International Commercial Joint Stock Bank (HOSE: VIB) have also returned to the market after more than half a year of absence. SHB borrowed 2 lots of bonds worth 3 trillion VND for a 3-year term with interest rates of 6 to 6.3%/year. Meanwhile, VIB only mobilized 2 trillion VND but offered a lower interest rate of 5.8% for a 3-year term.

|

Bond Portfolio Issued by Banks

Source: Author’s Compilation

|

Bond Issuance with 0% Interest Rate

Apart from banks, a notable mention in July is the lot of 500 billion VND bonds issued by Danang IT Park with a 0% interest rate and a term of 30 months. Instead of receiving periodic interest, the bondholders will buy at a discounted price (compared to the par value) and will be repaid the full amount (at par value) upon maturity.

According to HNX, this is the company’s only loan through the bond channel, guaranteed by a series of assets related to the ecosystem of Trungnam Group.

Specifically, the collateral includes 100 million ordinary shares issued by Trung Nam Renewable Energy Joint Stock Company (TNRE). Of these, nearly 79.6 million TNRE shares are owned by Trung Nam Energy Investment and Development Joint Stock Company, and more than 20.4 million TNRE shares are owned by Mr. Nguyen Tam Tien.

Investment and Development of Hai Dang Real Estate has just completed the mobilization of more than 2.8 trillion VND from the lot of HDRCB2426003 bonds. The company borrowed for 18 months, expected to mature in January 2026, with a fixed interest rate of 9.8%/year for the first 4 interest calculation periods. The bonds are guaranteed by a credit institution.

Since the beginning of the year, the company headquartered in Dream City, Hung Yen province, has raised more than 5.3 trillion VND from 3 bond issuances.

Another real estate company, Hung Thinh Phat Comprehensive Development, also offered a lot of 412 billion VND with a term of up to July 2028. The company offered an interest rate of 12%/year for the first 2 interest calculation periods. The bonds are guaranteed by HDB. The registrar and depository is HD Securities (HDBS).

Hung Thinh Phat also has a lot of more than 2.8 trillion VND newly mobilized in December 2023, with a term of 48 months and maturing in December 2027. The interest rate, collateral, registrar, and depository of this lot are similar to the previous one.

On July 22, Technical Infrastructure Investment of Ho Chi Minh City (HOSE: CII) successfully issued a lot of 300 billion VND bonds. CII borrowed for 3 years at an interest rate of 9.95%/year. The collateral for the bonds is 10 million shares of Nam Bay Bay Investment (HOSE: NBB) (equivalent to nearly 10% of capital) and nearly 5.3 million shares of CII Bridge Investment (HOSE: LGC) (equivalent to 2.7% of capital).

PetroVietnam Securities (HNX: PSI) is the only securities company participating in this round. The company raised 20 billion VND from privately placed non-convertible bonds without collateral to restructure its debt. The buyer was identified as VinaCapital Fund Management. The bondholders will enjoy a fixed interest rate of 8.9%/year for 18 months, until January 2026.

|

Bond Portfolio Excluding Banks

Source: Author’s Compilation

|

An additional lot of bonds flows to Hai Dang Real Estate, raising the total to 5,350 billion VND

A company of Trungnam Group raises 500 billion VND in bonds with a 0% interest rate

CII uses NBB and LGC shares as collateral for the newly issued 300 billion VND bond lot

Another lot of bank-guaranteed bonds flows to Hung Thinh Phat

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.