Foxconn’s expansion into Southeast Asia involves investing hundreds of millions of dollars, according to the New York Times (NYT). The company plans to manufacture electric vehicle batteries and other auto parts in Thailand and Vietnam, as well as microchips for cars in Malaysia.

The group is also planning to open a battery factory worth billions of dollars in Indonesia and is in talks with two Japanese carmakers to collaborate on electric vehicles.

These moves by Foxconn have raised eyebrows as it prompts the question of who they will sell electric vehicles to, now that their biggest client, Apple, has abandoned the project.

Reducing Dependence on Apple

In February 2024, Apple officially scrapped its electric vehicle project after years of development and over $10 billion in investment.

Despite this, Foxconn still intends to build an electric vehicle factory in Zhengzhou, known as the “iPhone City.” This city houses most of Foxconn’s infrastructure, factories, supply chains, and 250,000 employees dedicated to manufacturing iPhones for Apple.

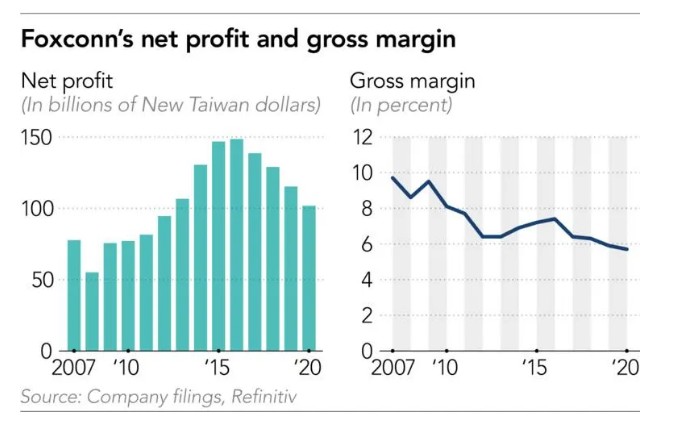

Foxconn is facing a decline in gross profit margins as the iPhone’s popularity wanes.

Even though Apple is out of the electric vehicle race, the Chinese market remains vibrant, and Foxconn doesn’t want to miss out. While Apple has withdrawn, numerous other clients are eager to join the electric vehicle race. Many businesses still want access to China’s cheap electric vehicle contract manufacturing capabilities, which Foxconn is keen to provide.

However, an even more critical reason for Foxconn’s moves is the desire to reduce its dependence on Apple.

Apple’s iPhone sales in China have declined amid the rise of domestic phone brands. Geopolitical tensions have also forced Apple, an American company, to gradually shift its manufacturing to other countries, exposing Foxconn to risks from this strategy.

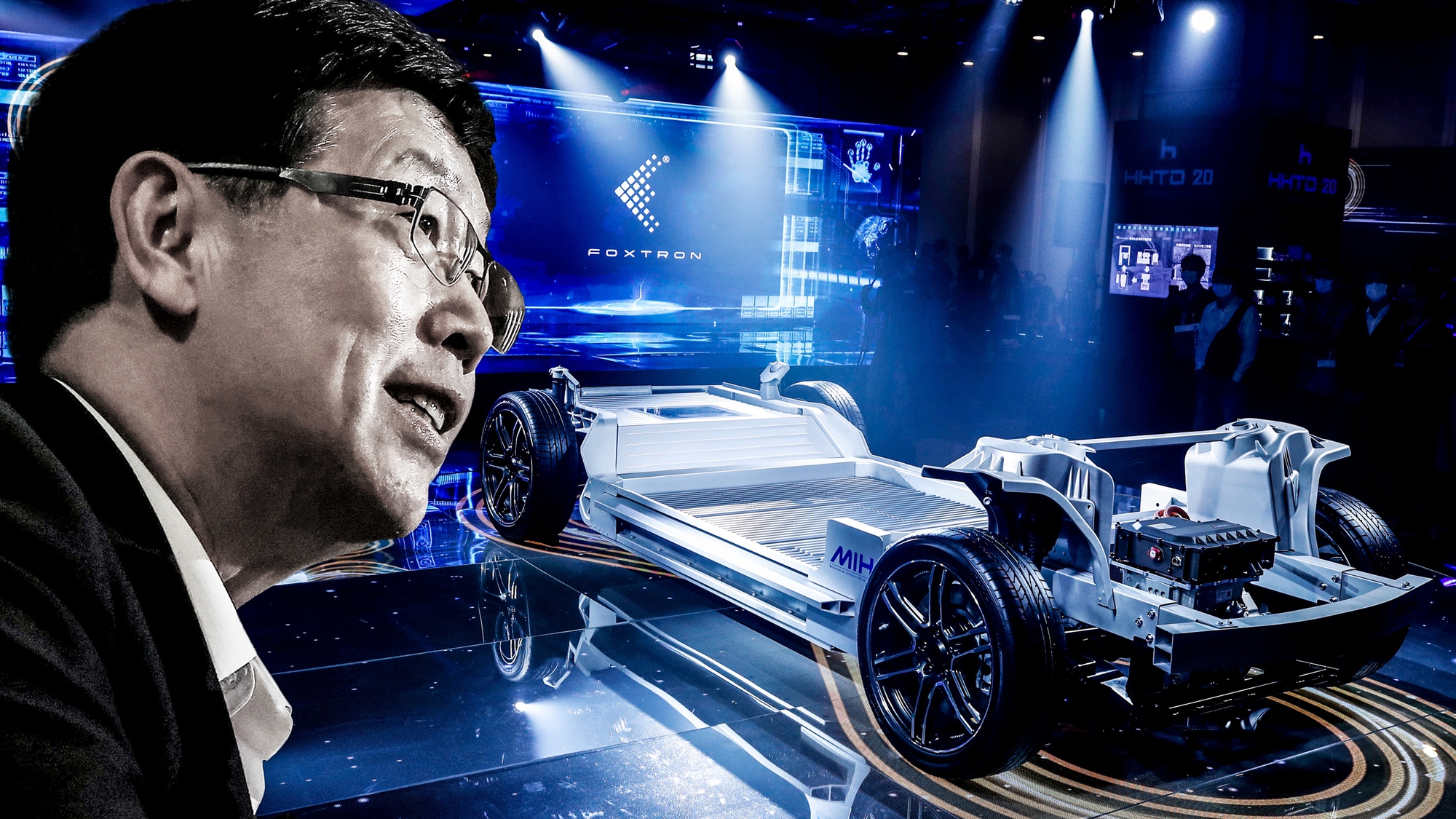

As a result, the NYT suggests that Foxconn aims to design, manufacture, and assemble contract electric vehicles for other automotive brands, much like it does with the iPhone for Apple.

So far, Foxconn has secured a contract to produce electric vehicles for Luxgen, a Taiwanese automotive brand. Additionally, the company has partnered with Yulon Motor to launch its own Foxtron line. According to Foxconn, they have delivered 5,400 vehicles to Yulon so far this year.

“They need to find a way to reduce their dependence on Apple, which means finding a major customer in this new electric vehicle sector,” said Kirk Yang, chairman of Kirkland Capital.

However, Foxconn’s strategy is not without challenges. The electric vehicle industry in China and globally is already crowded, and trade conflicts have made this sector even more sensitive.

Blurring Boundaries Between Phones and Electric Vehicles

According to Stephen Dyer, director of Asia Automotive at AlixPartners, China had over 130 electric vehicle businesses in 2023. However, he predicts that fewer than 20 of these companies will be profitable by the end of this decade.

The intense competition in the Chinese market has led to a price war, with numerous electric vehicle makers burning through cash. Even Tesla, led by Elon Musk, isn’t immune to this.

Internationally, both the US and the European Union (EU) are raising tariff barriers on Chinese electric vehicles to protect their domestic industries.

Nevertheless, Foxconn remains confident in its plans as the boundaries between electric vehicle and phone manufacturing are blurring.

Recently, two well-known Chinese phone brands, Huawei and Xiaomi, which have surpassed Apple in sales in China, decided to enter the electric vehicle market. This not only challenges Apple but also demonstrates Foxconn’s potential for success in contract manufacturing electric vehicles for other brands.

Just days after Foxconn announced its electric vehicle factory in Zhengzhou, Xiaomi broke ground on its second electric vehicle factory.

Foxconn’s management confidently asserts that the factors that make them faster and cheaper in iPhone contract manufacturing compared to their rivals will translate to the electric vehicle space.

This implies that the same factors, such as government support in infrastructure development, roads, power stations, and tax incentives, will come into play in the electric vehicle sector, just as they did in the smartphone industry.

Foxconn’s efforts in the electric vehicle space have raised some doubts due to the complexity of the industry, which involves both hardware and software.

However, some doubt Foxconn’s efforts due to the complexity of the electric vehicle industry, which involves not just hardware but also software.

“The factor that will make a Chinese electric vehicle company stand out in the market is not necessarily just hardware manufacturing but also the software technology they offer to serve their customers,” said Dyer, who previously served as Ford Motor’s director in Shanghai.

Additionally, there are concerns about quality, safety, and customer trust, along with the issue of affordability.

“If an electronic device breaks, it’s not a big deal, but if an electric vehicle gets into an accident, it can cause loss of life,” Dyer warned.

Source: NYT

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.

Chinese citizens flock to buy 280 tons of gold, realizing real estate and stocks are no longer a good investment channel

Regardless of the global decline in demand for gold, the purchasing power of Chinese citizens has propelled the price of gold to surpass the $2,000 per ounce threshold in 2023.