The market closed with losses, as the VN-Index dropped by nearly 7 points to 1,223.56. The HNX-Index also fell by over 1 point to 228.54.

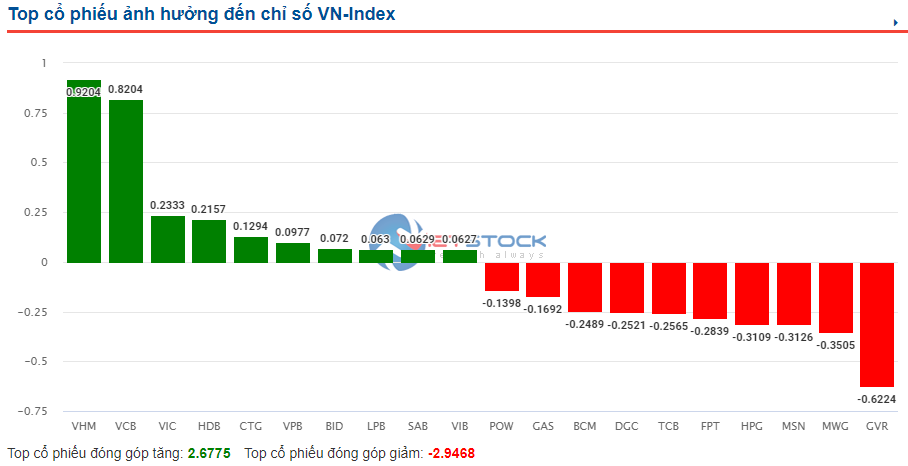

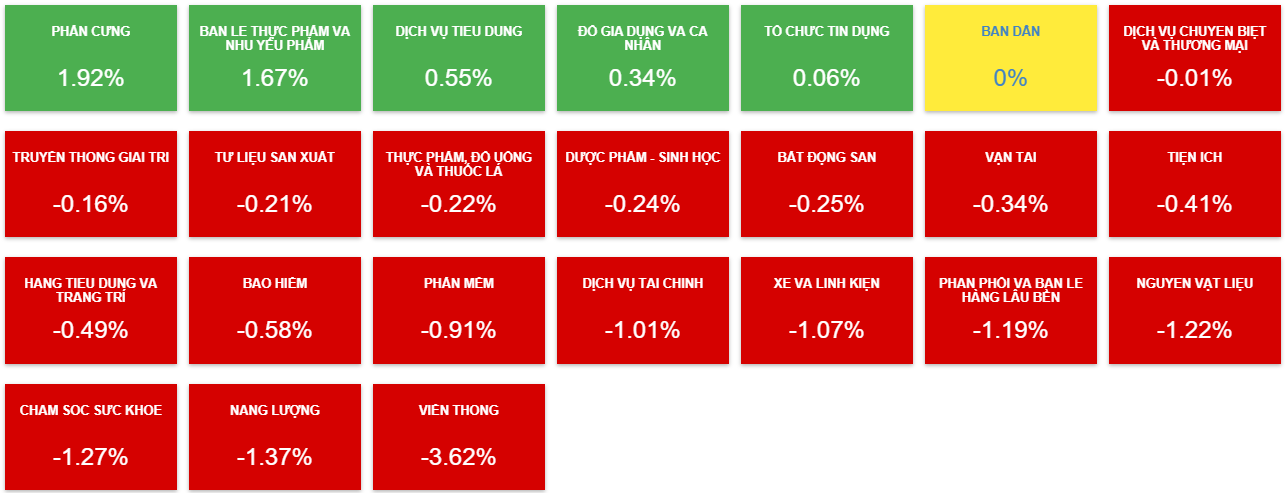

The session was dominated by red, with 17 out of 24 sectors finishing in negative territory. The telecommunications sector continued its decline, with VGI down 6%, FOX down 2.6%, CTR down 1.16%, and ELC down 3.5%.

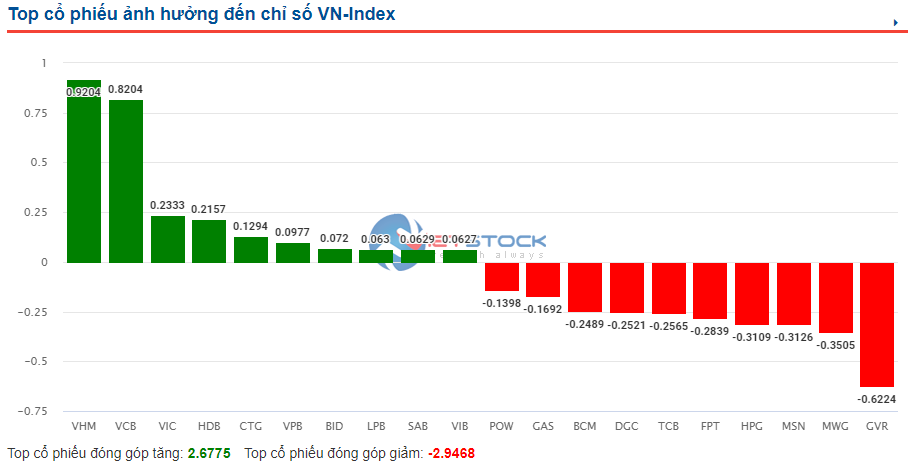

Large-cap stocks faced significant pressure today. GVR, BID, VCB, MSN, and GAS contributed the most to the VN-Index’s decline. Within sectors, leading stocks also witnessed notable drops. HPG, VNM, MWG, FPT, and others closed in the red.

VHM was the main pillar in today’s session, posting a gain of nearly 2% and adding almost 0.7 points to the VN-Index. However, foreign investors net sold this stock the most, with a net sell value of VND 105 billion.

On the bright side, food and essential goods retailers witnessed the strongest gains, climbing by 3.3%.

Liquidity continued to weaken, with today’s trading value reaching nearly VND 13 trillion. Foreign investors net sold, but the value was modest at VND 75 billion. VNM, FPT, CTG, GMD, and DGW were among the most net bought stocks.

| Top 10 stocks net bought and net sold by foreign investors on August 15, 2024 |

14:00: The market struggled to recover, with VHM and VCB providing support

In the first half of the afternoon session, the VN-Index continued to fluctuate, attempting to recover from a nearly 6.5-point loss to a drop of less than 3 points at times, but then quickly reversing course. As of 14:00, the VN-Index was down over 5.5 points at 1,224.77.

In fact, the VN-Index could have fallen deeper if it weren’t for the strong support provided by two pillar stocks, VHM and VCB. Specifically, these two stocks together contributed the most to the market’s performance, with VHM adding 0.92 points and VCB adding over 0.82 points, totaling 1.74 points, while the top 10 stocks positively impacting the index only contributed 2.68 points.

In addition to VCB, the top 10 list also included several other banking stocks, namely HDB, CTG, VPB, BID, LPB, and VIB.

Source: VietstockFinance

|

Morning Session: Red Dominates Across Most Sectors

The VN-Index fluctuated throughout the morning session, with multiple declines and recoveries, amid weak liquidity. At the end of the morning session, the VN-Index fell 4.46 points to 1,225.90, the HNX lost 1.32 points to 228.36, and the UPCoM dropped 0.39 points to 92.26.

Only five sectors managed to stay in positive territory at the close of the morning session, with two sectors posting gains of over 1%: hardware up 1.92% and food and essential goods retail up 1.67%.

On the other hand, 18 sectors declined, led by telecommunications, which fell 3.62% due to pressure from VGI’s 4.28% drop and FOX’s 1.83% loss. Several other sectors fell by over 1%, including energy, healthcare, and materials.

Source: VietstockFinance

|

Foreign investors also traded sparingly in the morning session, with a buy value of just over VND 448 billion and a sell value of nearly VND 427 billion, resulting in a net buy position of nearly VND 22 billion. If they continue to net buy today, it will mark the fifth consecutive net buying session, which hasn’t happened in a long time.

A closer look at today’s foreign trading activities reveals that VNM, FPT, and HDB stood out with net buys of VND 46 billion, 39 billion, and 21 billion, respectively. Conversely, VHM, TCB, and MWG were the most net sold stocks, with net sell values of VND 42 billion, 33 billion, and 24 billion, respectively.

10:35: Market Struggles, Liquidity Weakens

The market continued to face challenges as red dominated all three exchanges, with the VN-Index falling by more than 4 points at one point. Liquidity showed a significant decline.

As of 10:30, the VN-Index dropped 3.46 points to 1,226.90, the HNX fell 0.79 points to 228.89, and the UPCoM slipped 0.08 points to 92.57.

Red dominated the market, with 369 stocks in negative territory, 6 floor prices, 168 gainers, and 22 ceiling prices. Sector-wise, most sectors were also in the red, led by telecommunications, which fell 2.84% due to pressure from VGI, FOX, and others, and energy, which declined 1.06% amid losses in PVS, PVD, BSR, and others.

In the top 10 stocks negatively impacting the VN-Index, GVR took the lead, erasing 0.5 points, followed by a series of large-caps such as MWG, FPT, TCB, and MSN. On the positive side, HDB stood alone in its effort to “rescue” the index.

The trading value on all three exchanges stood at just over VND 3,498 billion, noticeably lower than the previous session and the 5-session average. However, this cautious sentiment is understandable, given today’s futures expiration, which often brings unpredictable fluctuations.

Opening: Diverging from Global Markets

Contrary to expectations of positive momentum in line with global stock markets, the VN-Index started the day with a slight decline. It’s worth noting that today is the futures expiration, which could bring about unexpected developments.

As of 9:30, the VN-Index fell 2.08 points to 1,228.28, the HNX slipped 0.18 points to 229.50, while the UPCoM rose 0.2 points to 92.85. Liquidity was recorded lower than the previous session and the 5-session average, indicating a certain level of caution.

HDB attracted notable buying interest in the early morning session and was up over 2%.

The performance of Vietnam’s stock market diverged from the predictions of many investors, who anticipated a positive correlation with the upbeat sentiment in global markets. Notably, major indices in the US, such as the Dow Jones, S&P 500, and Nasdaq Composite, closed in positive territory, buoyed by positive inflation data.

The US Labor Department’s Bureau of Labor Statistics reported that the consumer price index (CPI) rose 2.9% year-over-year in July, down from 3% in June and marking the lowest level since March 2021. On a monthly basis, CPI increased by 0.2%. Economists surveyed by Dow Jones had expected CPI to rise 0.2% from the previous month and 3% from a year ago.

Core inflation, which excludes food and energy prices, rose 0.2% in July, in line with forecasts.

This report came a day after wholesale inflation data showed a slower-than-expected rise, boosting stock markets.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.