Non-performing loans increase by 21%, spread across debt groups

According to the Credit Department for Economic Sectors at the State Bank of Vietnam (SBV), as of the end of June, credit to the economy reached nearly VND 14.4 quadrillion, up 6% compared to the end of last year. After two months of negative growth at the beginning of the year, credit rebounded at the end of the first quarter with a growth rate of 1.34%. Thus, it can be seen that credit grew strongly in June.

Data from VietstockFinance shows that as of June 30, 2024, the total outstanding debt of 29 banks in the system was over VND 12.45 quadrillion, up nearly 7.2% compared to the beginning of the year.

ABBank (ABB) was the only bank with negative credit growth compared to the beginning of the year (-7%). The remaining banks achieved positive growth with an average rate of 7.8%. Among them, NCB (NVB) had the strongest credit growth (+16%), followed by LPBank (LPB, +15%), Techcombank (TCB, +13%), HDBank (HDB, +12.5%), and ACB (+12.3%)…

The growth in credit has led to a further increase in non-performing loans compared to the beginning of the year. Data from SBV shows that as of the end of the second quarter, the internal bad debt of the entire credit institution system increased by 5.77% compared to the end of 2023. The bad debt ratio stood at 4.56%, higher than the 4.55% at the end of 2023 and 2.03% at the end of 2022.

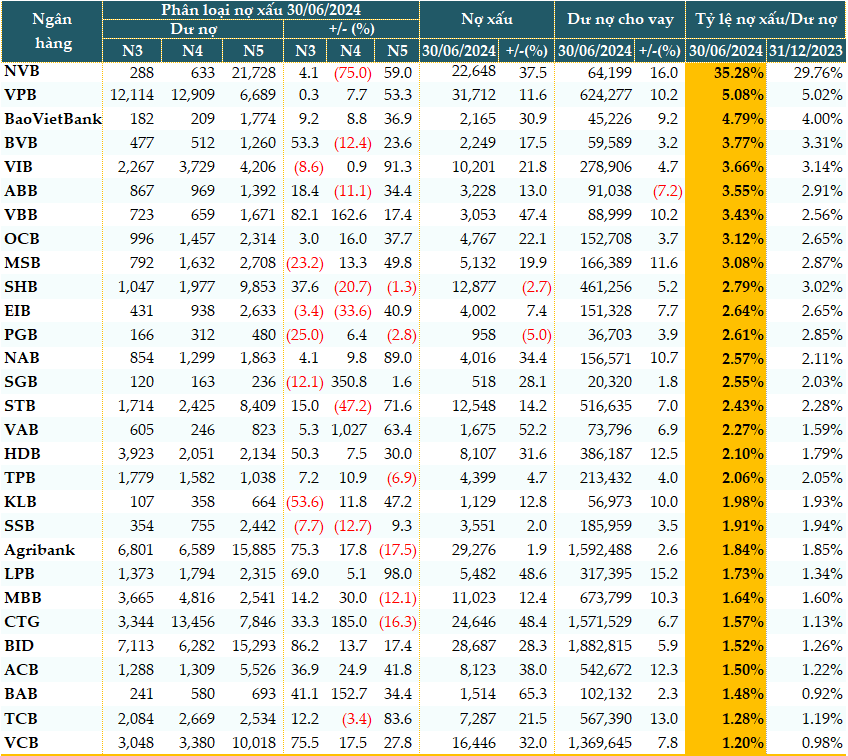

The total bad debt as of the end of the second quarter of the 29 banks was VND 271,421 billion, up nearly 21%. Two banks that improved their loan quality were SHB (-3%) and PGBank (PGB, -5%).

The remaining banks in the system reported an increase in bad debt compared to the beginning of the year, with an average growth rate of 26%. The highest increase in bad debt was reported by Bac A Bank (BAB, +65%), followed by VietABank (VAB, +52%), and LPB (+48%)…

At the same time, the structure of bad debt also witnessed a negative development. Substandard debt (Group 3) increased the most, at nearly 26%, followed by debt with potential losses (Group 5), which rose by over 22%, and doubtful debt (Group 4), which increased by more than 15%. Many doubtful debts were reclassified as debt with potential losses.

|

Loan quality of banks as of June 30, 2024 (Unit: Billion VND)

|

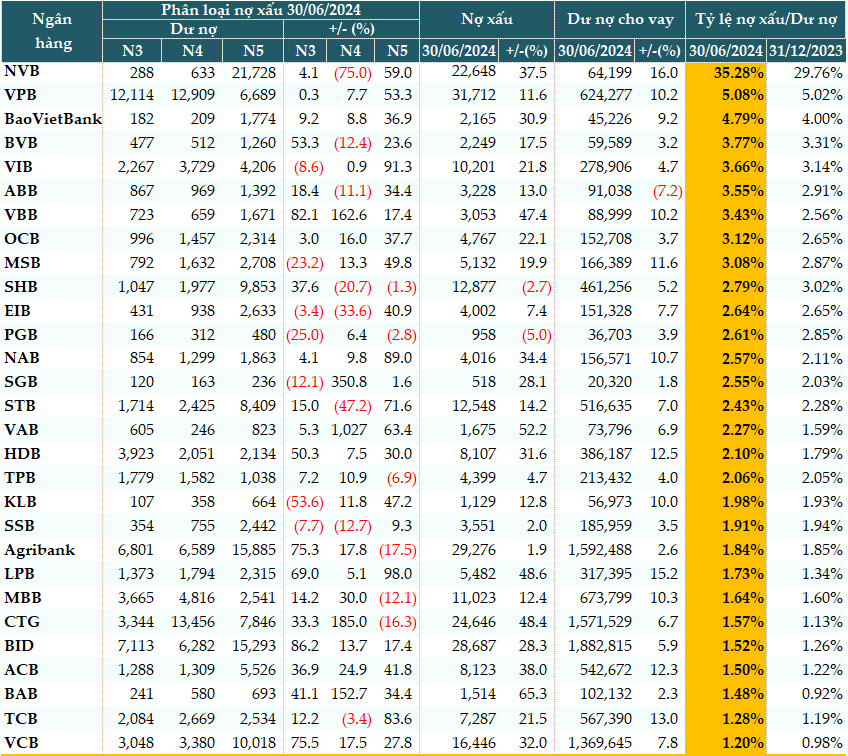

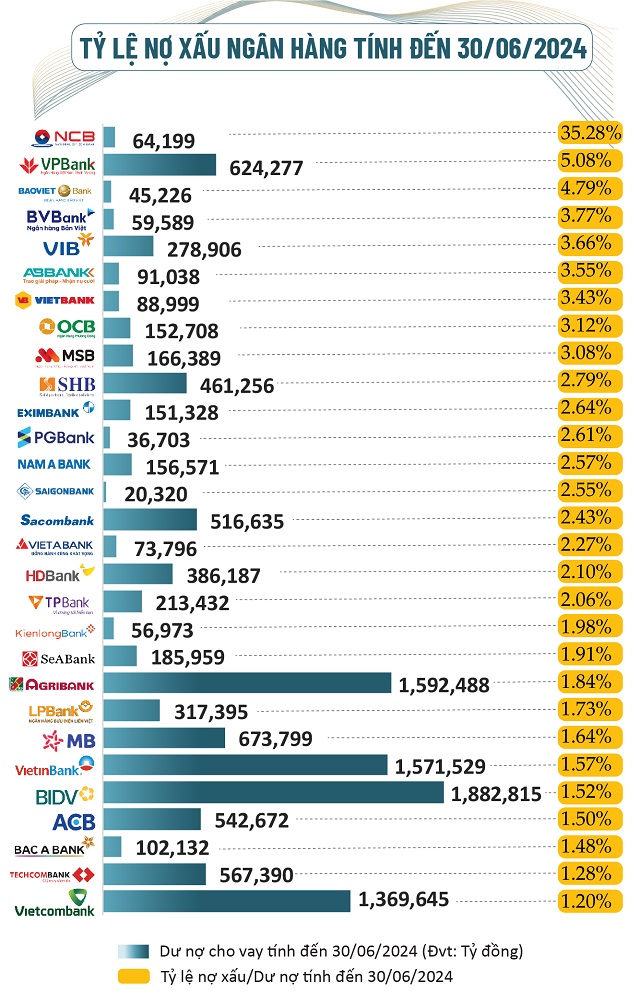

25 banks reported an increase in the bad debt ratio

As of June 30, 2024, 25 out of 29 banks reported an increase in the bad debt ratio compared to the beginning of the year. On a positive note, the number of banks with a ratio above 3% remained the same as at the end of the first quarter, at nine, while there were only five such banks at the beginning of the year.

However, four banks that managed to improve their bad debt ratios were Eximbank (EIB), SeABank (SSB), Agribank, SHB, and PGB.

Source: VietstockFinance

|

Debt is expected to rise further after Circular 02 expires

Although the SBV allowed for an extension of Circular 02/2023/TT-NHNN until the end of 2024, which includes provisions for credit institutions and foreign bank branches to restructure repayment periods and maintain debt groups to support customers facing difficulties, it is clear that the bad debt situation as of June 30, 2024, continues to increase compared to the beginning of the year, serving as an early warning of risks for the banking system. All relevant parties need to take decisive and synchronized action to address this issue.

Associate Professor Dr. Nguyen Huu Huan, lecturer at the University of Economics Ho Chi Minh City, stated that while it is challenging to accurately calculate the actual level of bad debt in banks, it is certain that the true figure is much higher than what has been reported. Furthermore, when Circular 02 expires, bad debt will likely increase further.

Ms. Bui Thi Thao Ly, Director of Analysis at Shinhan Securities Vietnam (SSV), assumed that with a slight increase in deposit interest rates and a slight decrease or stabilization of lending rates, bad debt could rise. At the end of 2023, bad debt stood at around 1.7-1.8%, and it is estimated that it could reach 1.9% by the end of 2024. Balancing this with macroeconomic factors, bank profits could increase by 15% in 2024.

Ms. Ly analyzed that with a sensitivity range of 1.6-2.1% for bad debt, the pre-tax profits of listed banks could increase by 10-20%. Despite concerns about interest rates, bad debt, and narrowing profit margins, the profit growth momentum is expected to be maintained in 2024.

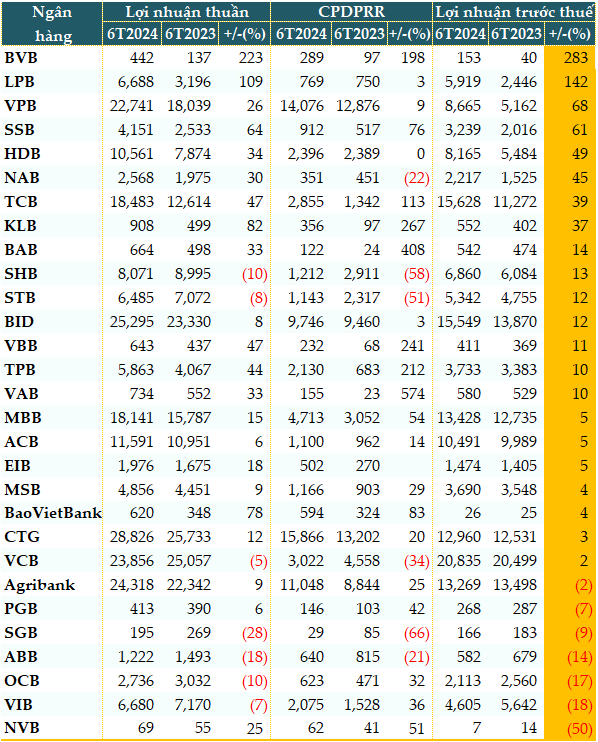

Data from VietstockFinance also showed that the total credit risk provision expenses of the 29 banks in the first six months of 2024 were VND 78,330 billion, up 13% over the same period last year. Twenty-three out of twenty-nine banks increased their provisions, affecting their profitability. As a result, seven banks reported a decrease in pre-tax profits during this period.

|

Pre-tax profits of banks in the first six months of 2024 (Unit: Billion VND)

|

Real estate laws come into effect, facilitating bad debt improvement

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, assessed that in the second half of the year, the absolute value of bad debt may continue to rise, but the bad debt ratio is expected to stabilize and show a downward trend.

There are several positive factors, including economic recovery, with second-quarter GDP growth exceeding expectations, export businesses continuously receiving orders for the third and fourth quarters of this year and even for the first quarter of next year, Vietnam remains an attractive destination for FDI in terms of both registered capital and disbursed capital, consistently achieving a trade surplus, and remittances continuing to increase strongly in the second half of the year. Vietnam is on track to achieve a growth rate of around 6.5% this year, which will facilitate the handling of bad debt.

Firstly, the Law on Credit Institutions 2024 allows for the handling of bad debt through the transfer of part of a real estate project, accelerating the resolution of real estate assets securing non-performing loans.

Secondly, the Law on Housing, the Law on Real Estate Trading, and the Law on Land, which took effect on August 1, 2024, will help resolve legal issues related to real estate projects, leading to increased supply and improved liquidity in the real estate market. This will enable investors to enhance the liquidity of their investment products, and the circulation of capital will facilitate the auction of collateralized real estate assets (as most non-performing loans are secured by real estate).

With the economic recovery, increased consumer confidence, and robust export orders, production will rebound sustainably and grow, allowing businesses to seize opportunities. As businesses receive orders and cash flow improves, they will be able to repay their debts to banks and gradually bring non-performing loans back to normal.

Credit growth in the last six months of the year is expected to be better, and it is hoped that this will lead to a decrease in the bad debt ratio for the entire system. This is a positive development that needs to be strongly promoted.

The legal documents related to the handling of bad debt provide specific regulations and clearly define the responsibilities of the parties involved, and they are constantly being improved. This will help accelerate the resolution of bad debt.

Credit institutions need to enhance their credit portfolio management, provide early warnings, and proactively restructure loans with potential risks. This will help both customers and prevent risky debt, ensuring the safety of the system. They should also proactively implement comprehensive solutions to recover bad debt, using established provisions at a reasonable pace, considering both short-term and long-term impacts. Overall, credit institutions should also prepare for the possibility that Circular 02/2023/TT-NHNN may not be extended next year and take proactive measures to work with customers to recover debts and support their recovery.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.