Hundreds of billions set aside in provisions following audit

On August 2, the Ho Chi Minh City Stock Exchange (HOSE) issued a warning to Dong A Plastic Joint Stock Company (HOSE: DAG) for delayed disclosure of information regarding significant events that impacted its production and business operations.

Specifically, the audited financial statements for 2023 revealed a net loss of 606 billion VND, a further 349 billion VND decline compared to the previously self-prepared report. This was primarily due to a sudden surge in the provision for inventory obsolescence, skyrocketing from 34 billion VND to 404 billion VND, which resulted in a gross loss of 372 billion VND, a decrease of an additional 307 billion VND.

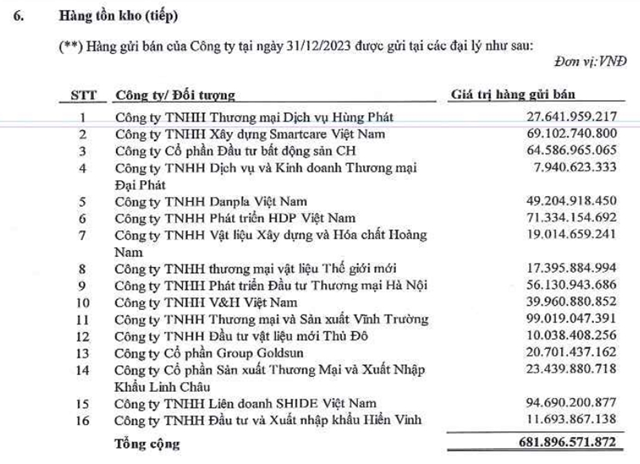

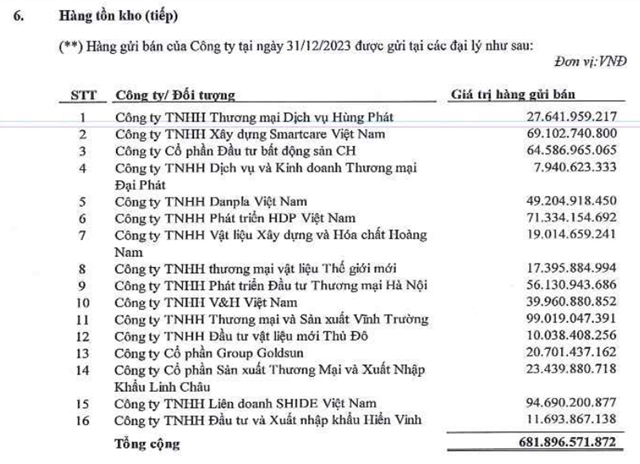

A notable difference from previous years is the appearance of goods sent for sale worth 682 billion VND, for which a provision for obsolescence of 307 billion VND was made. The highest amounts were recorded at Vinh Truong Trading and Manufacturing Co., Ltd., at 99 billion VND, and Shide Vietnam Joint Venture Co., Ltd., at 95 billion VND.

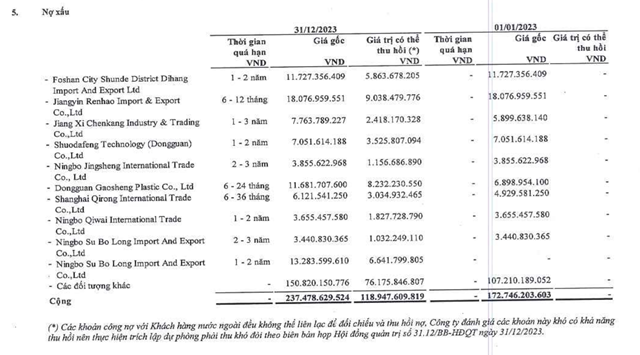

Additionally, management expenses increased by 30%, reaching 148 billion VND, as the company set aside additional provisions for short-term receivables deemed difficult to recover, rising from 87 billion VND to 118 billion VND. According to DAG, these receivables were mostly from foreign customers with whom the company was unable to establish contact to reconcile the debts.

|

Source: DAG

|

Following the audit, DAG’s total assets diminished by 732 billion VND, leaving just over 1,400 billion VND. Aside from inventory, the most significant loss was in short-term receivables, which halved to 230 billion VND. Meanwhile, prepayments to short-term suppliers and other short-term receivables stood at over 50 billion VND, in contrast to the 331 billion VND figure in the self-prepared report.

Short-term and long-term financial borrowings and finance lease liabilities amounted to 721 billion VND and 489 billion VND, respectively, reflecting decreases of 300 billion VND and 234 billion VND.

The recognition of substantial losses led to a plunge in DAG’s equity, falling to 80 billion VND from a peak of 687 billion VND in 2022. This equity had been accumulated over the company’s two decades of operation.

Another point to note is that UHY, the auditing firm for DAG in 2022 and 2023, issued an unqualified opinion for the 2022 financial statements, indicating no apparent issues related to inventory, receivables, or bad debts. However, in the recent financial statements, significant adjustments were made to these areas.

In its recent explanation, DAG attributed the delay in submitting the 2023 audited financial statements (exceeding the 45-day deadline) partly to UHY being a new auditing firm, requiring more time to understand and review the company’s records.

| Change in DAG’s equity and undistributed post-tax profits since 2007 |

Auditor’s opinion spans 3 A4 pages, and the company is facing lawsuits from banks

Along with adjustments to various items in the financial statements, UHY provided a 3-page basis for its qualified opinion and matters of emphasis. Regarding bad debts, the auditor sent independent confirmation letters to these partners but received no response. Additionally, they were unable to obtain reconciliation statements of the company’s debts with these entities. DAG acknowledged the low confirmation rate and attributed it to the challenging circumstances, which have made it difficult for their partners to settle their debts.

In terms of inventory obsolescence, the auditor applied alternative procedures to determine the quantity and value of raw materials and goods but still lacked a sufficient basis to assess the existence and value of finished goods. DAG also failed to consistently apply the same method for calculating the cost of different types of finished goods in 2023.

For goods sent for sale, amounting to nearly 682 billion VND, UHY was unable to physically observe the inventory and did not receive responses to independent confirmation letters sent to related parties regarding the value and quantity of the goods.

In its statement, DAG acknowledged the need to learn from this experience and strengthen its accounting software and personnel to better manage and control inventory.

Furthermore, UHY expressed concern about DAG’s ability to continue as a going concern, as its short-term assets were approximately 72 billion VND lower than its short-term liabilities.

The company also had nearly 348 billion VND in bank loans that were past due and had not been granted additional extensions as of the financial statement issuance date at the end of July. DAG has not yet reached alternative financial arrangements for these debts.

Additionally, DAG is facing lawsuits from Woori Bank Vietnam, VPBank, Eximbank, HDBank, and Chailease Finance Company regarding the repayment of principal and interest on loans and finance leases.

In September of last year, DAG was subject to enforcement measures by the Hanoi Tax Department, which invalidated its tax invoices. The Tax Department of Ha Nam province took similar action against Dong A Plastic Company, a subsidiary of DAG.

Issuing shares to convert debt

In the first half of 2024, DAG incurred a net loss of 67 billion VND, with equity standing at over 27 billion VND. The company generated only 55 billion VND in revenue, equivalent to 6% of the figure from the same period last year. Despite setting a target of 9.5 billion VND in post-tax profits and 642 billion VND in revenue, DAG has achieved less than 10% of its revenue plan so far.

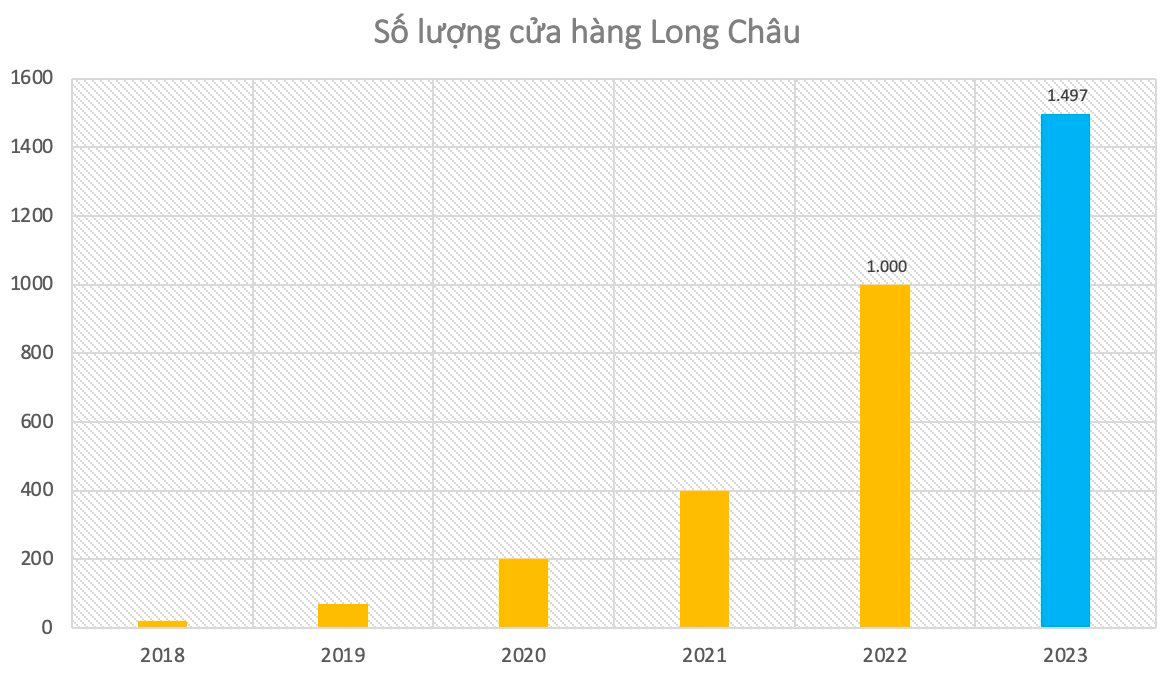

Prior to this, the company had consistently grown its revenue since 2007, reaching a peak of over 2,200 billion VND in 2022, only to see it nearly halved in 2023. During this period, the gross profit margin gradually declined from 25% in 2009 to just under 5% in 2022.

The company’s profit took a significant hit in 2020, coinciding with the onset of the COVID-19 pandemic, despite continued revenue growth. The highest net profit of 59 billion VND was recorded in 2017.

| Change in DAG’s revenue and net profit from 2007 to 2023 |

At the 2023 Annual General Meeting of Shareholders, General Director Duong Ngoc Dieu attributed the company’s setbacks to two main reasons: the pandemic and the shortening life cycle of certain products, such as profile bars and ceiling panels. She noted that during the 2015-2019 period, revenue was high due to the popularity of profile bars, but in 2022, competition from aluminum products in the market led to lower revenue.

The challenges faced in recent years can also be partly attributed to the increasing burden of interest expenses, which have eroded profits. In 2020, interest expenses amounted to 56 billion VND, accounting for half of the gross profit. This figure rose to 90 billion VND in 2023.

As of the second quarter of 2024, DAG’s cash balance stood at a mere 843 million VND. The company also has long-term borrowings from key management personnel, including a 100 billion VND loan from Board member Pham Ngoc Hinh, a 40 billion VND loan from former Chairman Tran Viet Thang, and an 184 billion VND loan from Board member Nguyen Ba Hung.

To restructure its debts, DAG plans to issue over 28.3 million shares to creditors through a private placement to convert 283 billion VND of debt into equity (at a ratio of 10,000:1, with every 10,000 VND of debt exchanged for one newly issued share). As a result, Mr. Pham Ngoc Hinh will receive 10 million shares, and Mr. Nguyen Ba Hung will receive 18.3 million shares. Currently, Mr. Hung holds a 5.99% stake.

Mr. Hung previously shared at the 2023 Annual General Meeting that, as a founding shareholder and major shareholder, he was willing to incur losses by lending to DAG at a 0% interest rate to support the company’s development over the years.

According to DAG’s leadership, this year will continue to be challenging due to the banks’ unanimous decision to downgrade the company’s credit rating to Group 5, making it difficult to access loans to sustain its business operations.

It is worth noting that in 2023, DAG proposed issuing private placement shares to professional securities investors. However, due to market fluctuations, the investors decided not to participate.

|

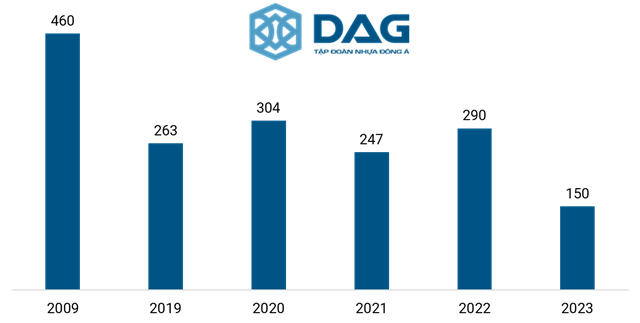

Change in DAG’s number of employees over time (in people)

Source: Author’s compilation

|

Founding shareholder’s influence waning?

DAG, formerly known as Dong A Plastic Trading and Manufacturing Limited Company, was established in 2001 with a charter capital of 2.5 billion VND, contributed by Hung Phat Trading and Service Company Limited and Dong A Plastic Joint Stock Company. The company operates in the field of manufacturing plastic products for the construction and interior-exterior decoration industries.

After a period of time, the entire capital contribution of Dong A Plastic Joint Stock Company was purchased by Mr. Nguyen Ba Hung. In 2006, DAG transitioned to a joint-stock company model.

Mr. Hung was one of DAG’s founding shareholders. In 2010, he and Hung Phat Company held 36.42% and 28.9% stakes, respectively. Additionally, Japan Vietnam Growth Fund LP held a 5% stake.

Mr. Nguyen Ba Hung – Source: DAG

|

Mr. Hung’s wife, Tran Le Thi Hai, served as Vice Chairwoman of the Board of Directors and General Director of DAG, as well as Chairwoman of the Members’ Council and legal representative of Hung Phat Company. Board member Nguyen Thi Tinh (Mr. Hung’s sister) was also a founding shareholder, holding a 0.15% stake.

In 2016, Mr. Hung reduced his ownership to 6.9% and sold his entire stake in 2017. Three years later, he repurchased a 5.99% stake. Currently, Hung Phat Company holds a 5% stake, and another major shareholder, NBH Investment and Development Company Limited, holds a 10% stake in DAG, with Mr. Hung serving as its Director and legal representative.

Mr. Hung (born in 1971) served as Chairman of the Board of Directors of DAG from 2006 to 2013, when he also took on the role of General Director from his wife. He held this position until the end of 2022, after which Mr. Duong Ngoc Dieu assumed the role and continues to do so today. In 2020, Mr. Hung relinquished the Chairmanship to Mr. Vuong Tri Dung. Meanwhile, Ms. Hai stepped down from the Board of Directors in 2018.

In 2024, DAG had to convene its Annual General Meeting of Shareholders three times before successfully holding it, and for the first time, Mr. Hung was not part of the Presidium.

During its peak in 2021-2022, DAG’s share price surpassed 18,000 VND per share, but it quickly fell below par value within a year. As of now, it stands at just over 1,400 VND per share, reflecting a loss of 90%. In 2024 alone, the share price has dropped by nearly 50%, but given the current situation, it is uncertain if this marks the bottom for the stock.

| Change in DAG’s share price since the beginning of 2024 |

Tu Kinh

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.