Oil prices fell more than 1% on Wednesday.

Oil Down 1%

Oil prices fell more than 1% on Wednesday after U.S. crude inventories unexpectedly rose and as concerns over an escalation of conflict in the Middle East, a major oil-producing region, eased.

Brent crude futures settled down 93 cents, or 1.15%, at $79.76 a barrel. U.S. West Texas Intermediate (WTI) crude fell $1.37, or 1.8%, to $76.98 per barrel.

The U.S. Energy Information Administration said crude inventories rose by 1.4 million barrels in the week to Aug. 9, compared with expectations for a decrease of 2.2 million barrels. It was the first weekly increase in crude stocks in six weeks. Gasoline and distillate inventories fell more than expected.

On Tuesday, the American Petroleum Institute had reported a draw in crude inventories of 5.21 million barrels for the week ended Aug. 9.

Brent had risen more than 3% on Monday, ending a five-day rally at $82.3 per barrel, after hitting a seven-month low of $76.3 earlier last week.

Capping oil price gains, the International Energy Agency (IEA) lowered its 2025 demand growth outlook, citing the impact of a weakening Chinese economy. This came after OPEC cut its 2024 demand forecast for similar reasons.

A string of downbeat data has dampened expectations for China’s economic performance in July, a worrying sign for the rest of 2024 for the world’s second-largest economy.

Global jet fuel demand also tends to decline as consumer spending slows and affects travel budgets, a shift that could impact oil prices in the coming months.

Gold Down 1%

Gold prices fell 1% on Wednesday as data showed U.S. consumer prices rebounded as expected in July, reducing expectations for a significant interest rate cut by the Federal Reserve next month.

Spot gold fell 1% to $2,440.47 per ounce, while U.S. gold futures for December delivery settled down 1.1% at $2,479.70.

The U.S. consumer price index rose 0.2% last month after a 0.1% drop in June. In the 12 months through July, the CPI increased 2.9% after advancing 3.0% in June.

Markets now see a 36% chance of a 50-basis-point rate cut in September, compared with 50% before the CPI data.

Copper Up on Rate Cut Hopes

Copper prices rose on hopes for a U.S. interest rate cut and after a strike occurred at the world’s largest copper mine. However, persistent worries about economic woes in top metals consumer China limited gains.

Three-month copper on the London Metal Exchange rose 0.2% to $8,872.50 per tonne, while the September contract on the Shanghai Futures Exchange fell 0.7% to 72,010 yuan ($10,073.33) per tonne.

Recent data, including weaker-than-expected U.S. producer prices, has fueled predictions that easing inflation will allow the Fed to cut rates sooner.

U.S. inflation data released on Wednesday showed a modest increase in July, further bolstering the case for a rate cut.

The U.S. dollar index hovered near a one-week low after falling in the previous session, making commodities priced in the greenback more appealing to buyers using other currencies.

Also supporting copper prices was a strike at the Escondida mine in Chile, raising the possibility of a production halt at the world’s largest copper mine.

Iron Ore at Over One-Year Low

Iron ore fell to its lowest in over a year as disappointing credit data from China added to already weak market sentiment driven by declining demand and high supply.

The September iron ore contract on the Dalian Commodity Exchange closed down 3.32% at 713 yuan ($99.74) per tonne. The contract fell to its lowest since June 1, 2023, at 706 yuan earlier in the session.

In Singapore, the September iron ore contract stayed below the psychologically important $100 mark for the fifth straight session, falling 2.74% to $95.75 per tonne. Prices touched their lowest since May 31 at $95.20 earlier in the day.

China’s iron ore demand in 2024 will fall by 33.4 million tonnes, according to Jia Yanlin, director of research at the China Metallurgical Research Group. Jia forecast iron ore imports into China to rise by 71 million tonnes this year compared with 2023, and the country’s steel exports to reach nearly 90 million tonnes, similar to last year’s level.

In Shanghai, rebar, hot-rolled coil and wire rod all fell more than 3%, while stainless steel dropped 0.91%.

Japanese Rubber Flat

Japanese rubber futures were little changed as investors weighed supply disruptions against falling spot rubber prices and disappointing Chinese economic data.

The Osaka Exchange rubber contract for January 2025 closed up 3.6 yen, or 0.09%, at 323.6 yen ($2.20) per kg.

Shanghai’s January 2025 rubber contract fell 210 yuan, or 1.31%, to 15,805 yuan ($2,211.23) per tonne.

Thai smoked rubber sheet prices fell 0.81% to 84.64 baht ($2.42).

Sugar Down

Raw sugar for October delivery closed down 0.42 cents, or 2.3%, at 17.97 cents per lb.

Data from industry group Unica showed sugar production in Brazil’s key Centre-South region in line with expectations, although cane yields are declining. Lower production in the coming weeks could limit price drops.

White sugar for October fell $7.70, or 1.5%, to $515.40 per tonne.

Coffee Up

Arabica coffee for December delivery closed up 5.6 cents, or 2.4%, at $2.3465 per lb, regaining some ground after falling 4% in the previous session.

There has been only light and localized frost in Brazil over the past few days, and the cold air mass is starting to weaken.

Robusta coffee for November delivery rose $105, or 2.5%, to $4,292 per tonne.

Soybeans, Wheat, and Corn Up

Chicago soybeans fell to a session low before the most-active contract recovered. A U.S. Department of Agriculture report on Monday forecast a record soybean crop, continuing to pressure futures.

CBOT November soybeans settled up 6 cents at $9.68-1/2 per bushel after falling to $9.55-1/4, the contract’s lowest since July 14.

Wheat firmed on gains in corn and soybeans, shrugging off pressure from plentiful supplies of grain from the Black Sea region.

CBOT September soft red winter wheat ended up 6 cents at $5.34-3/4 per bushel.

CBOT September corn rose 3-1/4 cents to $3.81 per bushel.

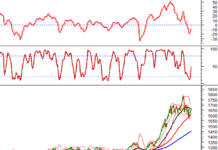

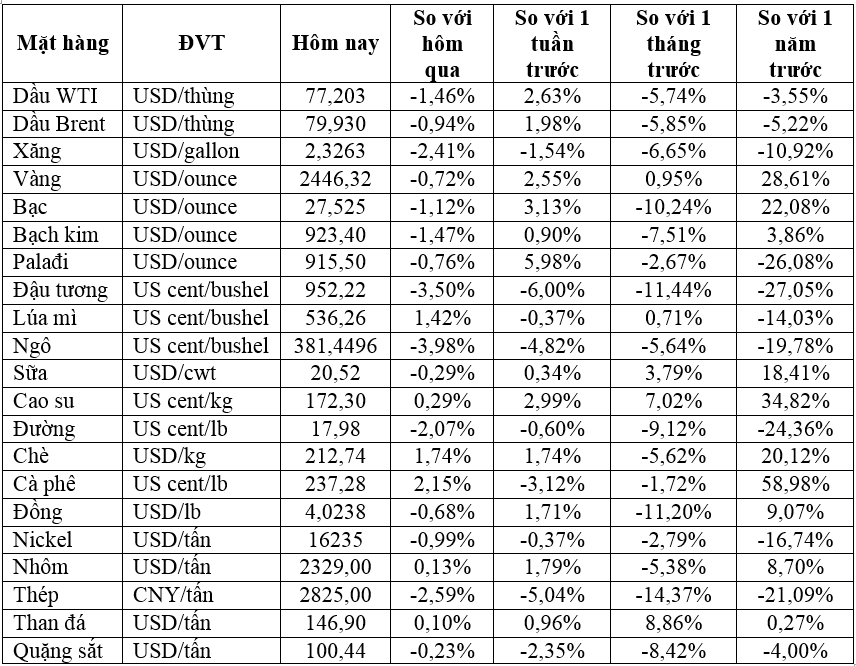

Key Commodity Prices on Aug 15

Key commodity prices

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.