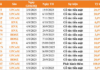

Although the VN30 index employs a different calculation method for capitalization weighting compared to the VN Index (by using capitalization weighting adjusted for free float), FPT and MWG remain the new leading stocks, with FPT climbing to the top position in the VN30 basket.

In terms of liquidity, Vietcombank Securities Company (VCBS) anticipates that with interest rates remaining relatively stable, investing in the stock market will continue to be a preferred choice for investors.

However, with fluctuations in exchange rates and more attractive profits from foreign stock markets, liquidity from foreign investors is unlikely to recover soon, but it is expected to cool down in the second half of the year.

MARKET VOLATILITY PRESENTS OPPORTUNITIES FOR INVESTORS

Firstly, according to VCBS’s 2H/2024 outlook report, there are still bright spots in the investment landscape towards the end of 2024. The interest rate environment has positively impacted the valuation of most stocks in the market. Additionally, supportive policies and reduced capital costs have positively affected various stock groups, including banks. However, the differentiation witnessed in the first half of the year will become more pronounced in the remaining months of 2024.

VCBS expects this trend to continue in the coming quarters, implying that investors should focus on a select few banks that maintain good asset quality and promote credit growth.

Regarding information technology stocks, Vietnam’s participation in the global semiconductor supply chain is still in its early stages, offering long-term growth prospects for businesses that find related opportunities and successfully integrate into this value chain. Nevertheless, this is a lengthy process that requires time, while stock price movements may have already “anticipated” and reflected this positive development.

VCBS believes that stocks in this category face significant short-term adjustment pressures, especially those that have attracted speculative capital. Still, they will remain the focus of long-term investment flows. In other words, a corrective phase, if it occurs, is necessary to “cool down overheated money” and ensure a more stable upward trajectory afterward.

Additionally, export stocks, public investment stocks, and stocks from other sectors also present investment opportunities for investors seeking to hold stocks for an extended period with an asset accumulation investment goal. These investors can explore industries with more “defensive” characteristics during this phase, where business performance is less dependent on economic cycles.

Secondly, according to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by nearly 330,000 in July 2024, triple the number from the previous month and the third-highest in history. This indicates a strong interest in the stock market and provides a potential opportunity for investors to continue their trust and develop appropriate investment strategies to increase profits in the future.

VCBS HELPS INVESTORS SEIZE MARKET OPPORTUNITIES

Currently, VCBS offers a range of attractive fee promotions catering to different customer segments, from new customers to those within the Vietcombank ecosystem, including existing Vietcombank customers and Vietcombank Priority customers.

Notable fee promotions include: waiving base fee transactions for six months, preferential fees for derivative transactions during specific periods, a supportive financing rate of 8.9%/year, and especially for the Margin T5 product (5-day interest waiver) with flexibility, the actual number of interest-free days can be up to 7 days (including weekends within the interest-free period).

By regularly updating and offering diverse and flexible fee promotions, VCBS helps investors make informed trading decisions and feel confident when using their products and services.

While fee promotions always support customers in their trading decisions, investors should refrain from overly risky trading practices, such as “full margin” – using the maximum allowable margin to purchase stocks. This can negatively impact an investor’s asset value if the market experiences a significant downturn, leading to a high risk of “call margin” (request for additional margin) or “force sell” (forced sale of stocks) situations.

With over 20 years of experience, VCBS is not only a reputable securities company in the market but also the only securities company within the Vietcombank financial ecosystem. This affiliation brings stability and safety to our clients’ assets.

Leveraging our extensive experience, high-quality human resources, and modern technology, VCBS is committed to delivering quality products and services with a customer-centric approach to meet the diverse needs of investors on their journey towards prosperity.

Discover the detailed fee promotions at VCBS here: https://vcbs.com.vn/

Start trading with VCBS today: https://vcbs.com.vn/ekyc

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.