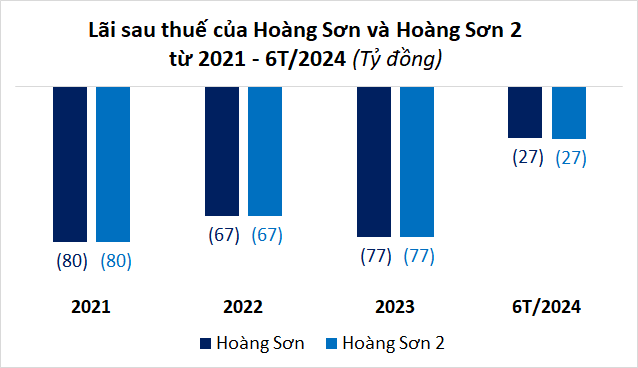

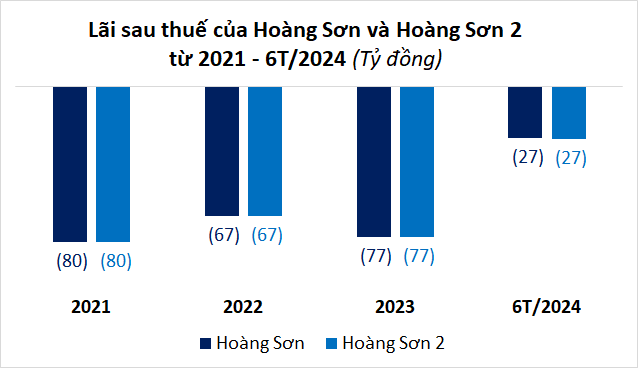

Hoang Son and Hoang Son 2 have announced their business results for the first six months of 2024, and both companies continue to incur losses. Hoang Son reported a loss of 27 billion VND, an improvement from the nearly 32 billion VND loss in the same period last year. Meanwhile, Hoang Son 2 posted a loss of over 27 billion VND, also an improvement from the nearly 37 billion VND loss in the previous year’s first six months.

Interestingly, these two energy companies have shown remarkably similar performance since their establishment in 2019.

Specifically, neither Hoang Son nor Hoang Son 2 recorded any profits in 2019 and 2020, and both have been in a continuous loss-making cycle since 2021 until the first half of 2024.

Source: Consolidated

|

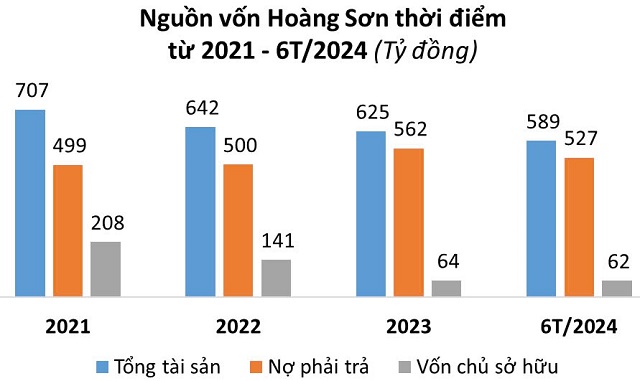

Hoang Son’s losses in the first six months of 2024 have led to a 30% decrease in owner’s equity compared to the previous year, now standing at over 62 billion VND. The company’s liabilities amount to more than 526 billion VND, including approximately 460 billion VND in bond debt.

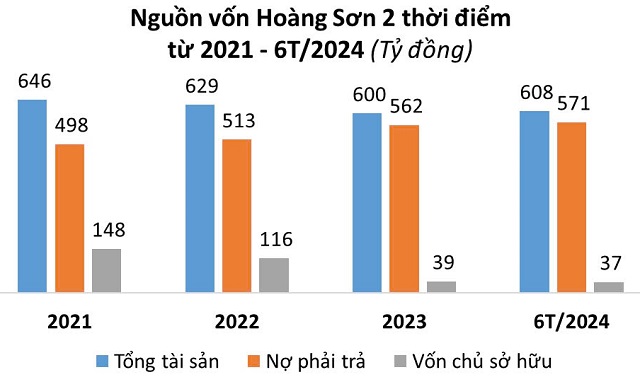

On the other hand, Hoang Son 2’s owner’s equity has more than halved from over 79 billion VND in the previous period to nearly 37 billion VND. Their liabilities exceed 570 billion VND, with 500 billion VND attributed to bond debt.

Both of these “twin” energy companies have recently sent a letter to HNX requesting an adjustment to the term of their bonds. Hoang Son and Hoang Son 2 each have a bond issue with a face value of 500 billion VND, issued on December 25, 2020, with a three-year maturity date of December 25, 2023, and a coupon rate of 10.3% per annum. However, Hoang Son has repurchased bonds worth over 42 billion VND, leaving approximately 458 billion VND in circulation. Hoang Son 2 has a slightly higher amount in circulation, at about 463 billion VND.

The companies have proposed to extend the maturity date of their bonds to March 25, 2025, a 15-month extension. The coupon rate has also been adjusted to 8% per annum for the period from March 25, 2023, to March 25, 2025.

Source: Author’s Compilation

|

Background on the “twin” energy companies of Mr. Vu Quang Bao

Hoang Son is the investor of My Son 1 Solar Power Plant, and Hoang Son 2 is the investor of My Son 2 Solar Power Plant, both established in 2019 and sharing the same address at A203, The Manor Tower, Me Tri Road, My Dinh 1 Ward, Nam Tu Liem District, Hanoi.

According to the author’s research, both Hoang Son companies recently changed their legal representatives from Mr. Vu Quang Bao, Chairman of the Board of Directors, to Mr. Vu Quang Nam, CEO, on July 12, 2024.

Hoang Son was established in January 2019 with an initial charter capital of 48 billion VND. Energy Investment – Construction and Trading Hoang Son Joint Stock Company held 78.125%, Mr. Nguyen Nam Chung held 10.417%, and Mr. Nguyen Thanh Thanh (serving as General Director and legal representative) held 11.458%. In October 2020, the company increased its capital to 288 billion VND, and Mr. Dang Thanh Binh, as the Chairman of the Board of Directors, became the legal representative. In August 2023, all of Mr. Binh’s positions were replaced by Mr. Vu Quang Bao.

Hoang Son 2 was established in March 2019 with initial capital of 50 billion VND. Energy Investment – Construction and Trading Hoang Son Joint Stock Company held 80%, Mr. Nguyen Nam Chung held 10%, and Mr. Nguyen Thanh Thanh (serving as General Director and legal representative) held 10%. In November 2022, the company increased its capital to nearly 263 billion VND, and the positions were also changed similarly to Hoang Son.

Mr. Vu Quang Bao is also the legal representative of Phan Lam Energy Company, which has made significant profits in the first half of this year. Phan Lam is the investor of the Phan Lam 2 Solar Power Project in Binh Thuan province, with a land area of nearly 58.8 hectares and a capacity of 49 MWp. The total investment capital for the project is over 1,200 billion VND.

A company of energy tycoon Vu Quang Bao makes substantial profits in the first half of the year

In addition, Mr. Bao holds key positions in other companies, including Chairman of BB Group and General Director of Bitexco Group, alongside his brother, Mr. Vu Quang Hoi, who is the Chairman of Bitexco Group.

Chairman of BB Group and General Director of Bitexco, Vu Quang Bao – younger brother of Bitexco Chairman Vu Quang Hoi.

|

According to the BB Group website, the My Son 1 and My Son 2 solar power plants were constructed in My Son commune, Ninh Son district, Ninh Thuan province, and officially put into operation on June 30, 2020.

The My Son 1 solar power plant has a scale of 80 hectares, a total capacity of 61 MWP, and an average annual output of 94 million KWH. The total investment capital for this project is 1,363 billion VND.

The My Son 2 solar power plant spans 60 hectares, with a total capacity of 50 MWP and an average annual output of 77 million KWH. The total investment capital for this project is approximately 1,200 billion VND.

Source: BB Group

|

Mr. Nguyen Ho Nam’s energy company achieves revenue of over 1,100 billion VND

The main driver of revenue growth in the renewable energy sector is the high-performance, low cost solar power plants that have been operational. Additionally, the portfolio of rooftop solar installations has also expanded, contributing to the revenue.

“Unveiling Misconduct at the Saigon Real Estate Corporation: A Comprehensive Exposé”

The non-auction transfer of land by Resco has resulted in significant financial losses for the state, amounting to over VND 45 billion. This raises serious concerns about the management and transparency of land allocation practices, highlighting the need for stricter regulations and accountability measures to prevent such incidents in the future.