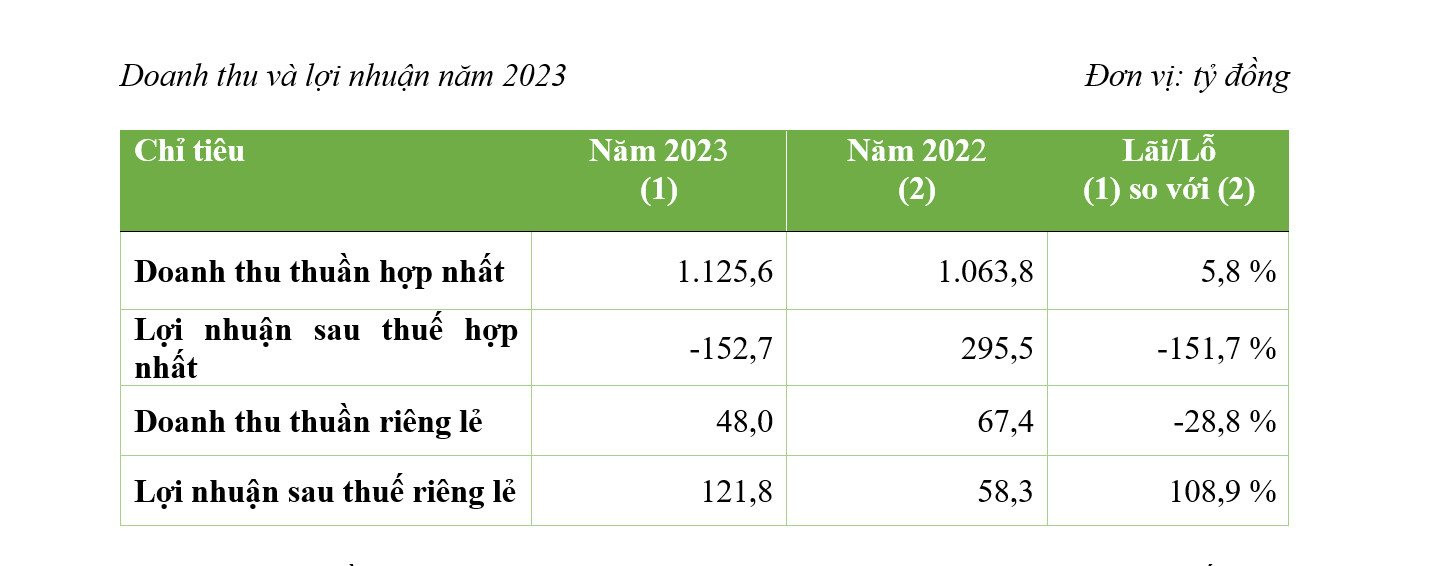

According to the 2023 report published, BCG Energy Joint Stock Company – a renewable energy company under Bamboo Capital Group (BCG Stock Exchange: BCG) recorded net revenue of VND 1,125.6 billion (an increase of 5.8% compared to the same period in 2022), the growth was due to the solar power plants operating with a performance of more than 100% compared to the forecast.

Net loss in 2023 was VND 152.7 billion mainly due to two reasons: the exchange rate difference for USD-denominated loans with a total debt of about USD 140 million, which is an unrealized loss; and one-time financial expenses related to international financial support packages such as capital arranging costs and appraisal costs. However, the accumulated undistributed post-tax profit of BCG Energy as of December 31, 2023 was VND 186.6 billion.

The growth in revenue from the renewable energy sector in 2023 compared to 2022 was mainly due to the high-performance solar power plants that were put into operation with minimal disruption, some plants even exceeded 100% of the forecast capacity in the final months of the year. In addition, the rooftop solar power portfolio also expanded, contributing to the revenue of 2023.

For the separate financial statement report, although in 2023 BCG Energy recorded net revenue of VND 48 billion, a decrease of 28.78% compared to the same period in 2022, its post-tax profit was VND 121.8 billion, an increase of 108.9% compared to the same period last year due to the Company recording financial income.

The Company’s total assets as of December 31, 2023 reached VND 8,540.6 billion, equivalent to a slight decrease of 5.3% compared to the beginning of the year, but the payable debt decreased significantly by 74.2% to VND 1,180 billion.

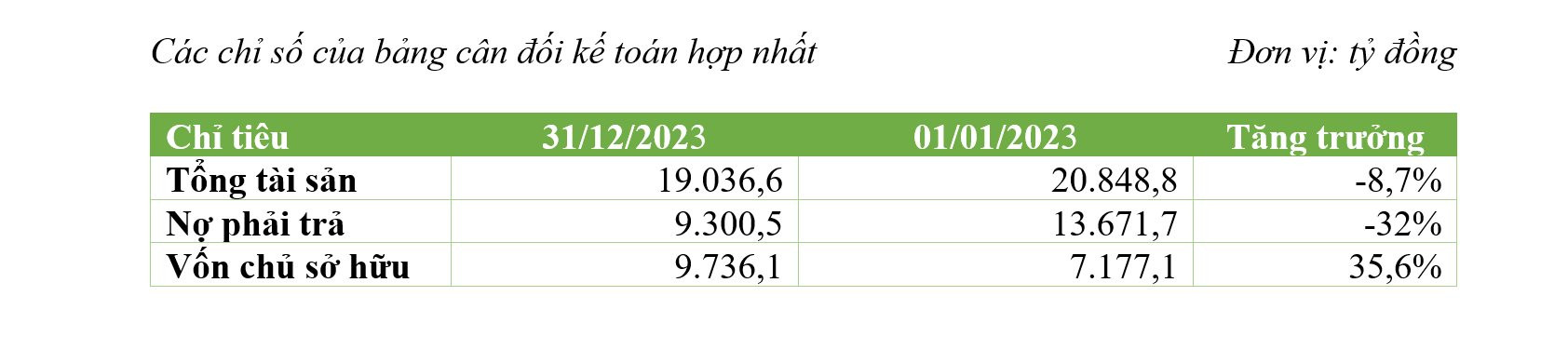

Similarly to the individual financial balance sheet, the consolidated total assets as of December 31, 2023 of BCG Energy reached VND 19,036.5 billion, a decrease of 8.7% compared to the beginning of the year due to the depreciation of fixed assets, liquidation and recovery of certain short-term and long-term investment cooperation, as well as a decrease in the outstanding tax refund due to two solar power projects of the Company.

Notably, the total payable debt decreased to VND 9,300.5 billion, a decrease of 31.97% thanks to BCG Energy actively repurchasing ahead of schedule the entire two bond lots worth VND 2,500 billion.

The debt-to-equity ratio of BCG Energy improved over the years: at the end of 2021, the debt-to-equity ratio was 2.77 times; at the end of 2022, this ratio decreased to 1.9 times and at the end of 2023, it was only 0.96 times. In addition, the debt-to-equity ratio also decreased to 0.66 times.

BCG Energy also recorded positive cash flow changes in 2023. The net cash flow from operating activities decreased from negative VND 130.9 billion in 2022 to negative VND 33.6 billion in 2023.

In the difficult period of 2023, when the market faced many difficulties and obstacles and the implementation plan of Power Development Planning VIII had not been issued, BCG Energy proactively reduced new investment activities, focused on internal restructuring, capital restructuring, improving corporate health and being ready to realize business opportunities in the coming time.

After the most challenging period, BCG Energy switched to a proactive defensive strategy, seizing potential opportunities in the renewable energy sector. In early 2024, BCG Energy expanded its activities into the waste-to-energy field by acquiring a waste treatment company in Ho Chi Minh City, known as Tam Sinh Nghia Investment Development Joint Stock Company.

In the 2024-2025 period, BCG Energy aims to build a waste-to-energy power plant with a total investment capital of over VND 5,000 billion in the Northwest Solid Waste Treatment Complex in Cu Chi district (Ho Chi Minh City). Phase 1 of the plant has a waste treatment capacity of 2,000 tons per day and night, equivalent to a power generation capacity of 40 MW. The entire plant will apply advanced waste treatment and incineration technology, without causing environmental pollution. In the later phase, the waste-to-energy power plant can increase its treatment capacity to 5,200 tons of waste per day and increase its power generation capacity to 130 MW.

After a continuous period of capital mobilization for project development, BCG Energy currently owns a portfolio of nearly 600 MW of power generation capacity. The Company has implemented financial restructuring, brought debt ratio to a safe level, and created room for the next expansion phase when specific action programs of Power Development Planning VIII are issued.