On August 15, 2023, VinFast Auto Ltd.’s VFS shares and VFSWW warrants officially began trading on the Nasdaq Global Select Market (“Nasdaq”). This marks a historic milestone for a Vietnamese company to successfully list and create a significant impact on the US stock market.

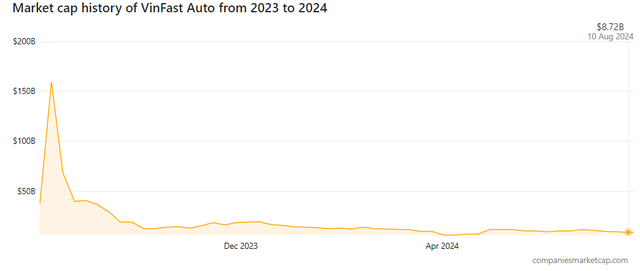

After the ringing of the bell by VinFast Global CEO Le Thi Thu Thuỷ, VFS opened its first trading session on Nasdaq at $22 per share. VFS traded explosively and closed its first session at $37.06 per share (up 68.45% from the opening price), corresponding to a market capitalization of over $85 billion.

This number propelled VinFast past a slew of big names such as Li Auto, NiO, and Rivian to become the world’s second-largest electric vehicle manufacturer. This is also the highest market capitalization ever achieved by a Vietnamese company. To put this figure into perspective, VinFast’s market cap at that time was equivalent to the combined market cap of the top 10 most valuable companies on the Vietnamese stock exchange, including major banks.

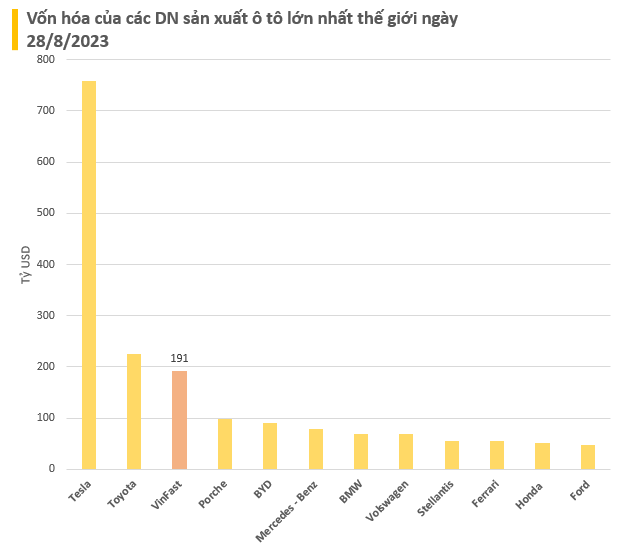

However, just a few days later, on August 28, VinFast’s market capitalization briefly touched $191 billion, even climbing to the third position among the most valuable automakers globally. The market cap of this electric vehicle maker also made it into the global top 100.

At the time of the listing, Ms. Le Thi Thu Thuy, Chairwoman of VinFast, shared: “The market capitalization is quite surprising, but we know that the company’s value is much more. The initial results achieved by VinFast are also encouraging as we continue our journey to conquer the world.”

Currently, VFS shares are trading at $4 per share, with a market capitalization of $8.6 billion, lower than many domestic companies.

Although VinFast listed on the US stock exchange with the aim of raising capital, Ms. Le Thi Thu Thuy, the current Chairwoman of VinFast, has stated to the media that the company does not face significant pressure in fundraising as it continues to receive financial support from its parent company, Vingroup, and especially from billionaire Pham Nhat Vuong – Chairman of Vingroup and founder of VinFast.

Billionaire Pham Nhat Vuong, Chairman of Vingroup and CEO of VinFast.

In an interview in June 2024, the billionaire stated that all of Vingroup’s resources are now dedicated to VinFast.

“I will invest in VinFast until I run out of money.”

Mr. Pham Nhat Vuong, Chairman of Vingroup and CEO of VinFast

To realize his vision, in January 2024, billionaire Pham Nhat Vuong officially transitioned from his role as Chairman of the Board to become the General Director of VinFast, replacing Ms. Le Thi Thu Thuy. From then on, he directly oversaw the company’s operations, including global production, sales, and market strategy.

Almost immediately, the billionaire introduced numerous strategies to support VinFast. In late 2023, the Chairman of Vingroup gifted 99.8% of the capital of VinES Energy Solutions JSC to VinFast. Following the merger, VinFast would gain self-sufficiency in battery technology – a critical component of electric vehicles, while also gaining control over the production chain, enhancing its competitive advantage in the market, and reducing costs.

Moreover, in March 2024, Mr. Vuong established V-GREEN Global Charging Station Development JSC, aiming to support VinFast’s global expansion. This enterprise was spun off from VinFast’s charging station development department and operates independently as a partner in developing the company’s global charging network. This move also allows VinFast to focus on vehicle production without having to invest in charging infrastructure.

In addition, the entrepreneur also established the green taxi technology company, Xanh SM.

However, above all, the financial support provided by Mr. Pham Nhat Vuong is the most noteworthy aspect. Specifically, the billionaire has contributed $1 billion from his personal funds to VinFast, and Vingroup has also committed to providing an additional $500 million to the automotive company. But the wealthiest individual in Vietnam didn’t stop there. In April 2024, Mr. Vuong caused a stir by announcing an additional $1 billion in funding.

“I will rearrange my personal assets and contribute an additional $1 billion to VinFast.”

Mr. Pham Nhat Vuong, Chairman of Vingroup and CEO of VinFast

According to DeelStreetAsia, from 2017 to 2023, VinFast received a total of $11.4 billion in capital injections from its parent company, Vingroup, affiliated companies, credit institutions, and billionaire Pham Nhat Vuong.

Reuters reported in February 2024 that VinFast plans to increase the free-float ratio on the Nasdaq to 10-20% by the end of this year, up from the current 2%, to attract more investors.

Not only did VinFast create a buzz after its listing in the US, but it has also made significant strides in its production and business operations over the past year. Firstly, the electric vehicle maker continues to view Vietnam as its primary market and focuses its attention on this market.

In the domestic market, VinFast introduced an unprecedented policy. Accordingly, from July 1, 2024, to July 1, 2025, VinFast electric vehicles will be charged for free at V-Green charging stations and parking lots located within the Vingroup ecosystem.

Specifically, for Vinhomes residents who own VinFast electric vehicles, the company will offer free parking and charging for two years. In cases where VinFast owners have private homes in Vinhomes and wish to install charging stations, the company will provide on-site installation support with a subsidy of up to VND 10 million.

This can be considered a “bold” move by VinFast. Currently, VinFast’s charging stations are nationwide and do not allow other electric vehicle brands to share the infrastructure. As a result, VinFast owners can save tens of millions of VND in the coming year thanks to this policy.

“I will invest an additional VND 10,000 billion to triple the number of charging stations in Vietnam,” affirmed billionaire Pham Nhat Vuong at Vingroup’s 2024 Annual General Meeting of Shareholders. He also stated that increasing the number of charging stations would reassure people considering purchasing electric vehicles. Citing a report, the billionaire noted that over 90% of people travel less than 100 km per day, while VinFast electric vehicles can travel 400-500 km, depending on the model. Therefore, home charging can sufficiently meet their daily needs.

A V-Green charging station.

Furthermore, after its listing on the stock exchange, VinFast also attracted media attention with the launch of its electric mini car, the VF3. What captivated consumers about this model was not just its compact design and aesthetic appeal, but also its incredibly affordable price for the Vietnamese market, starting at just VND 240 million.

VinFast announced receiving more than 28,000 orders during the first three days of sales. The launch of this model could help VinFast achieve its target of delivering 80,000 vehicles this year and significantly increase production compared to 2023.

The VinFast VF3 model.

VinFast has not only focused on the domestic market but has also actively promoted its export activities worldwide. In the past year, the company has reached agreements to export vehicles to the Middle East, India, Southeast Asia, Europe, and Africa. It has also continuously partnered with distributors to open dealerships abroad.

According to market research firm Counterpoint, VinFast currently ranks second in the Southeast Asian electric vehicle market as of the first half of 2024.

Notably, VinFast plans to invest over $3 billion to build factories in India and Indonesia. As of now, construction has commenced on both factories, while the US factory project has been delayed. This move enables VinFast to benefit from policies supporting electric vehicles in Indonesia and India, thereby reducing vehicle production costs.

According to DeelStreetAsia, VinFast aims to expand its distribution network to 50 countries by the end of this year and may find more opportunities in the Asian market, where governments are actively encouraging the development of domestic electric vehicle supply chains.

According to Joshua Cobb, a senior automotive analyst at BMI, the delay in constructing the US factory will slow VinFast’s entry into the North American market but is the most prudent choice at present. This decision will give the electric vehicle maker more time to prepare and adapt to the dynamic electric vehicle market.

Inauguration ceremony of the VinFast factory in Indonesia in July 2024.

Above all, VinFast’s leadership aims to achieve EBITDA breakeven by 2026 and gradually move towards profitability. The company has already turned a profit in some markets, excluding depreciation, profit, and financial costs. This means that these funds are considered investments by the company, not included as expenses. Gradually, the company will incorporate these costs into the vehicle’s price. Positive cash flow is expected from 2026.

Despite significant progress, VinFast’s challenges are evident to all. VinFast was established in 2017 by billionaire Pham Nhat Vuong, Vietnam’s richest man. The automaker set a goal to become one of the leading automobile manufacturers in Southeast Asia, making a strong impression on experts and other businesses in the industry.

A significant turning point came for the company when, at the CES 2022 auto show in Las Vegas in early January 2022, Chairwoman Le Thi Thu Thuy announced that VinFast would officially transition to a 100% electric vehicle manufacturer by the end of 2022. According to Vingroup’s senior leadership, this information was pivotal and marked a strategic turning point in VinFast’s development.

VinFast’s electric vehicle lineup unveiled in 2021.

Billionaire Pham Nhat Vuong, Chairman of Vingroup and General Director of VinFast, has a grand vision for this electric vehicle maker.

“If we were just in it for the money, we wouldn’t have ventured into automobile manufacturing. If it were easy, it wouldn’t have been our turn. With VinFast, we want to demonstrate our social responsibility and patriotism; there are no ulterior motives.”

Mr. Pham Nhat Vuong, Chairman of Vingroup and General Director of VinFast

VinFast is still awaiting the day it turns a profit.

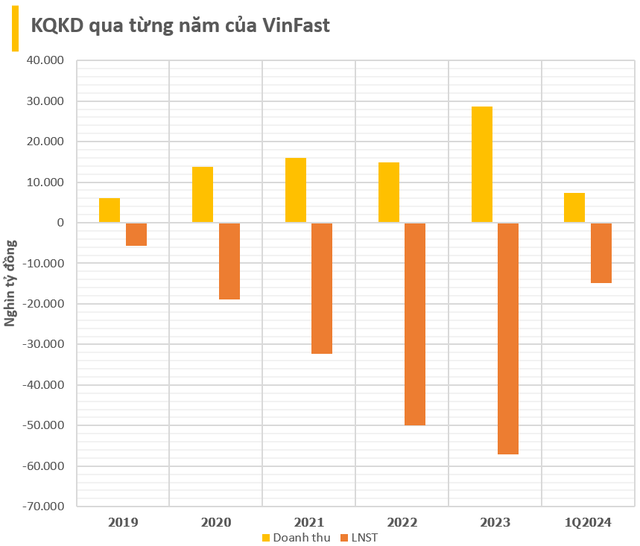

In 2023, the company witnessed a surge in sales compared to the previous year. In the first half of 2024, VinFast delivered nearly 22,000 electric vehicles, an increase of 92% over the same period last year.

For 2024, VinFast has set a target to deliver approximately 80,000 electric vehicles to customers.

Recently, VinFast made the decision to postpone the inauguration of its $4 billion North Carolina factory until 2028, instead of 2025 as initially planned. VinFast explained, “This decision will allow the company to optimize capital allocation and manage short-term spending more efficiently, focusing more resources on supporting short-term growth targets and consolidating existing operations.”

There have been a few partners who have taken action to purchase VFS shares.

Firstly, Yorkville spent $49 million to convert

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.

VinFast’s journey to realizing the dream of Vietnamese businesses conquering the international market

After a stunning victory in the “Event of the Year” category at the WeChoice Awards 2023, VinFast’s pioneering event listed on the US stock exchange has inspired many Vietnamese businesses and young people.