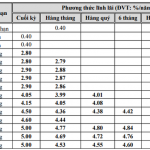

The Social Policy Bank (SPB) recently issued a document to its provincial and municipal branches regarding interest rate adjustments for preferential loans for social housing, according to Decree 100/2015/ND-CP. For loans with credit contracts signed before August 1, 2024, the SPB branch and the borrower will agree to adjust the interest rate to the interest rate for poor households as stipulated by the Prime Minister for each period (currently, the interest rate is 6.6%/year). The interest rate for overdue debt will be 130% of the lending rate.

This decision follows the government’s issuance of Decree 100/2024/ND-CP, which details several articles of the Housing Law on the development and management of social housing. The decree came into effect on August 1, 2024. While awaiting the issuance of sample documents by relevant ministries (Ministry of Construction, Ministry of Public Security, and Ministry of Defense) to prove the eligibility of beneficiaries for social housing support, the General Director of SPB has instructed its branches to adjust the interest rates for social housing loans in accordance with Decree 100/2015/ND-CP. This is based on Clause 14, Article 78 of Decree 100/2024/ND-CP, which states that “for loans with credit contracts signed with SPB to purchase, lease-purchase social housing, or construct or renovate houses for residence according to Decree 100/2015/ND-CP before this decree takes effect, the interest rate stipulated in Clause 4, Article 48 of this decree shall be applied to the actual principal debt and overdue principal debt (if any).”

In response to inquiries from the Banking Times, representatives from the SPB’s Ho Chi Minh City branch stated that they are in the process of disseminating the directive from the General Director of SPB to borrowing units in districts, counties, and Thu Duc City. Accordingly, savings and borrowing groups are coordinating with local political and social organizations to communicate the new interest rate for outstanding debts and new loans for social housing, construction, or renovation of houses for residence after August 1. The majority of borrowers have accepted the new interest rate.

Mr. Nguyen Duc Lenh, Deputy Director of the SBV’s Ho Chi Minh City branch, shared the city’s perspective on directing policy credit. He emphasized that the city always prioritizes implementing sustainable poverty reduction measures and allocates budget funds for this purpose. Additionally, it focuses on effectively carrying out Directive 40/CT/TW/2014 of the Secretariat on strengthening the Party’s leadership in social policy credit.

However, in reality, the outstanding balance of social housing loans is not significant. According to statistics from the SPB’s Ho Chi Minh City branch, as of early 2024, the social housing loan program implemented by the branch under Decree 100/2015 reached a total turnover of VND 157.2 billion, with 322 borrowers. The current outstanding balance is over VND 110 billion, accounting for 1.0% of the total outstanding balance, with approximately 290 borrowers. The borrowers of this program are mainly low-income individuals, civil servants, and armed forces personnel.

According to reports from SPB branches in various localities, the most significant challenge in social housing lending is the lack of supply. For example, in Ho Chi Minh City, Dong Nai, and Ba Ria – Vung Tau, which are key economic regions in the South with a large number of industrial park workers, there have been no additional social housing units available for SPB lending for many years.

Therefore, experts suggest that to integrate social housing policy credit into people’s lives and provide housing for the poor, the State needs to design policies that enable enterprises to develop this type of housing sustainably. This will encourage businesses to invest confidently, and SPB will be able to lend more of this policy credit.

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

Unlocking Opportunities: Easing Requirements for Better Access to Social Housing

The experts have weighed in, and the verdict is clear: Decree 100/CP is a game-changer. The new regulations, particularly the relaxed income requirements for social housing support, are set to revolutionize the landscape. This groundbreaking move is a much-needed breath of fresh air, offering a glimmer of hope to those seeking a helping hand in achieving their dream of homeownership.