The National Bank for Foreign Trade (NCB) officially adjusts the savings interest rates for business customers from 29 February 2024.

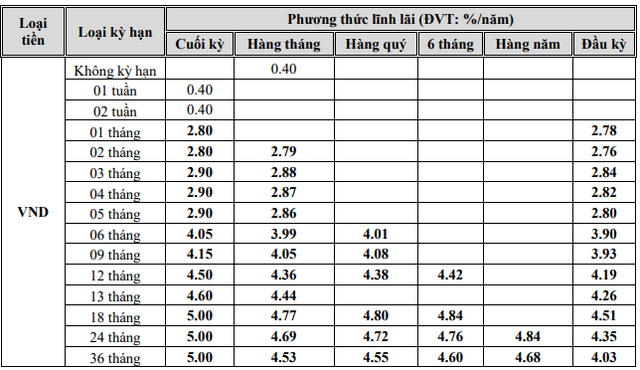

According to the latest savings interest rates of NCB bank, the highest interest rate applicable to business customers is 5% per year for a term of 18-36 months with the last compound interest, a decrease of 0.2 percentage points.

For the term of 6-13 months, the bank applies interest rates ranging from 4.05-4.6% per year, also decreasing by an average of 0.2-0.4 percentage points.

Interest rate table applied to business customers.

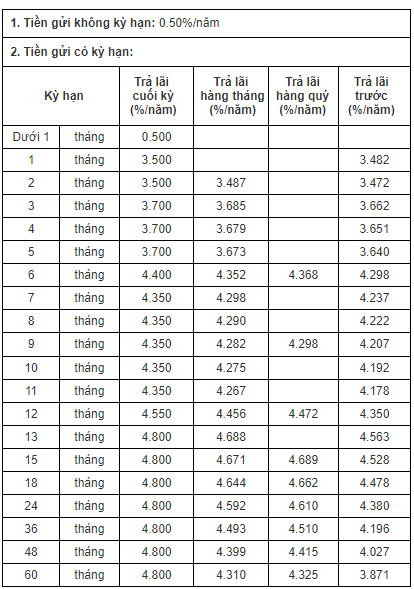

For individual customers, the highest interest rate is 5.5% per year, applicable for a term of 18-60 months, a decrease of 0.15 percentage points compared to the previous adjustment in early March.

NCB applies deposit interest rates for terms of 1-5 months from 3.3-3.5% per year, a decrease of 0.6 percentage points. This is the deepest decline. The deposit interest rates for the terms of 6-8 months are kept at 4.55% per year, and for the terms of 9-11 months, it is 4.65% per year, a decrease of an average of 0.15 percentage points.

The latest savings interest rates applied to individual customers by NCB bank.

Previously, on February 28, Vietnam Construction Joint Stock Commercial Bank (CBBank) also adjusted the savings interest rates.

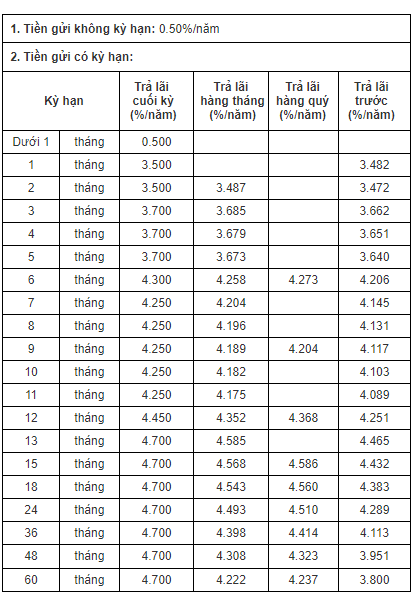

According to the current savings interest rates of CBBank, the highest interest rate is 4.8% per year for terms of 15 months and above, a decrease of 0.4 percentage points compared to the previous adjustment.

The lowest interest rate is 3.5% per year for the term of 1-2 months, remaining the same as the most recent change. For the terms of 3-5 months, the interest rate remains at 3.7% per year. However, for the terms of 6 months-12 months, the interest rate decreases by an average of 0.4 percentage points.

Savings interest rates applied to individual customers.

For business customers, the highest interest rate is 4.7% per year for terms of 13-60 months. The lowest interest rate is also 3.5% per year for the 1-month term. The average interest rate reduction for terms from 5 months to 60 months is 0.4 percentage points.

On the same day, HDBank adjusted the savings interest rates for certain terms.

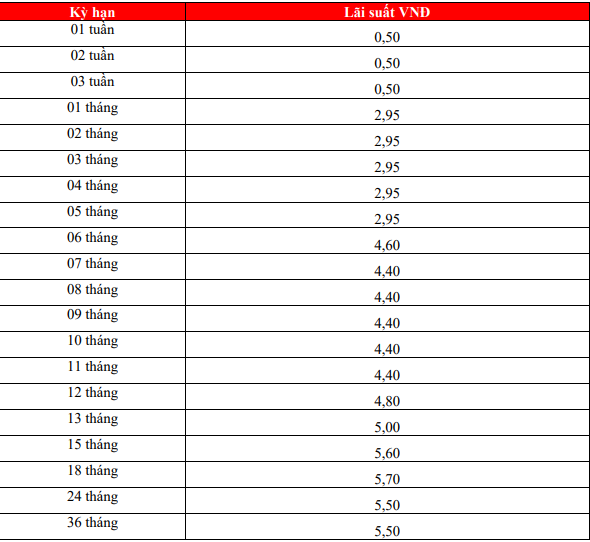

According to HDBank’s latest savings interest rates, the current highest interest rate is 5.7% per year, applicable for the 18-month term, an increase of 0.1 percentage points compared to the previous adjustment. Meanwhile, for the 24-36 month terms, the interest rate also increases by 0.1 percentage points to 5.5% per year.

For the 15-month term, the applicable interest rate is 5.6% per year, an increase of 0.1 percentage points.

From the terms of 1-5 months, 6 months, 7-11 months, and 12 months, the interest rates remain the same as the previous term. The corresponding interest rates are 2.95%, 4.6%, and 4.8% per year.

It’s worth noting that for deposits of 500 billion VND or more, HDBank applies an interest rate of 7.7% per year for the term of 12 months and 8.1% per year for the term of 13 months. To enjoy these interest rates, HDBank requires an additional deposit of 200 billion VND compared to the most recent adjustment.

The latest savings interest rate table of HDBank.

Previously, several banks simultaneously announced interest rate adjustments for all terms, including major ones such as MB, Techcombank, VPBank, and others like SeABank, Sacombank, BVBank,…