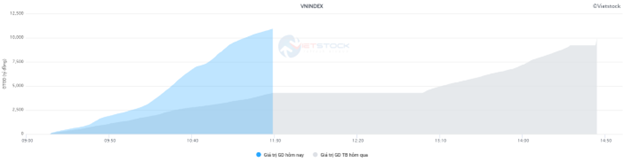

Market liquidity increased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 917 million shares, equivalent to a value of more than 21.5 trillion VND. The HNX-Index reached over 87 million shares, equivalent to a value of more than 1,720 billion VND.

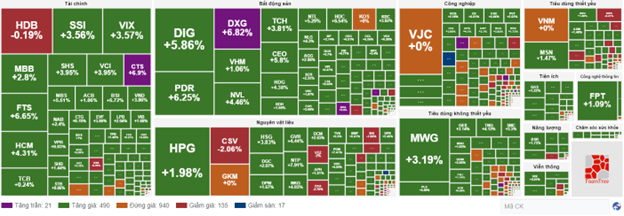

Continuing the positive momentum from the morning session, the market in the afternoon opened with continuous buying pressure, helping the index to surge until the end of the session. In terms of impact, GVR, BID, MWG, and MBB were the codes with the most positive impact on the VN-Index, with an increase of more than 5.2 points. On the other hand, VSH, TMS, TBC, and SRC were the codes with the most negative impact, but the impact was insignificant.

| Top 10 stocks with the strongest impact on the VN-Index on 16/08/2024 |

The HNX-Index also had a positive performance, with the index being positively impacted by the codes MBS (+8.27%), NTP (+9.92%), SHS (+6.58%), and CEO (+9.42%), among others.

|

Source: VietstockFinance

|

The telecommunications services sector was the group with the strongest increase, with a 4.65% gain mainly driven by the codes VGI (+4.79%), CTR (+6.94%), ELC (+5.41%), and FOX (+4.21%). This was followed by the energy and materials sectors, with increases of 3.96% and 3.29%, respectively.

In terms of foreign trading, foreigners continued to net buy more than 126 billion VND on the HOSE exchange, focusing on the codes MWG (99.97 billion), DIG (66.08 billion), MSN (55.8 billion), and CTG (53.65 billion). On the HNX exchange, foreigners net bought more than 700 million VND, focusing on PVS (4.57 billion), NTP (4.13 billion), VCS (3.45 billion), and MBS (3.28 billion).

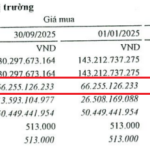

| Foreign trading buy – sell net off |

Morning session: Positive sentiment returns, market trades actively

Strong buying power in the morning session helped to quickly expand the upward momentum and spread it across the market. At the mid-session break, the VN-Index stood at 1,243.98 points, up 20.42 points, or 1.67%. The HNX-Index also broke through, increasing by 1.93% to 232.93 points. The buying side temporarily won overwhelmingly, with 592 stocks rising (including 34 stocks hitting the ceiling) and 163 falling.

After consecutive sessions of declining liquidity, money flow this morning exploded again, with the trading volume of the VN-Index reaching over 481 million units, equivalent to a value of nearly 11 trillion VND, more than 2.5 times the previous session. The HNX-Index recorded a trading volume of over 46 million units, with a value of about 1.06 trillion VND.

Source: VietstockFinance

|

In terms of impact, GVR, VCB, GAS, and MBB were the stocks that contributed most positively to the VN-Index, helping the index increase by more than 4.3 points. As most large-cap stocks recorded positive performance, SSB, TMS, and SGT had a negative impact on the index, but the impact was insignificant.

Green covered all industry groups. The securities group was the highlight, with the strongest increase in the market of more than 4%. Many stocks hit the ceiling or were close to it, notably CTS (+6.9%), FTS (+6.77%), BSI (+6.62%), and BVS (+6.72%).

The telecommunications services group traded positively, increasing by 3.48%, mainly contributed by VGI (+4.02%), FOX (+2.88%), CTR (+3.26%), and VNZ (+0.49%). This was followed by the energy, materials, and essential consumer industries, which also broke through with increases of 2-3%.

The real estate industry also had a notable recovery session, increasing by more than 2% after a continuous downward trend. From the beginning of the year to now, this group has been the only one “left behind,” with a decrease of 3.58%, while other industries have recorded good increases. Green is present in most stocks in the industry, notably KDH (+4.23%), KBC (+4.22%), VRE (+2.25%), NVL (+4.91%), NLG (+5.91%), PDR, and DXG hitting the ceiling.

10:35 am: Money flow chooses real estate and financial stocks, VN-Index rebounds strongly

As investor sentiment gradually turned positive, the main indices leaned towards strong greens. Real estate and financial stocks led the market’s upward momentum.

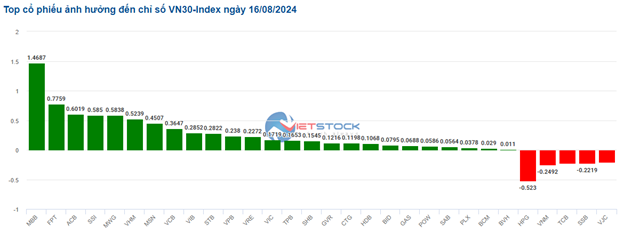

Most of the stocks in the VN30-Index basket were in the green. On the upside, MBB, FPT, ACB, and SSI stood out, contributing 1.47 points, 0.77 points, 0.6 points, and 0.58 points to the overall index, respectively. Meanwhile, HPG, VNM, TCB, SSB, and VJC were still under selling pressure, but the decline was not significant.

Source: VietstockFinance

|

Leading the current upward trend is the real estate sector, with a strong recovery of 1.42% and green covering most of the stocks in the industry. Specifically, DIG rose 4.1%, VHM increased by 1%, PDR climbed 4.83%, and NVL went up by 4.02%… Notably, DXG hit the ceiling from the opening bell.

From a technical perspective, the stock’s price in the session of 16/08/2024 surged strongly and formed a White Marubozu candlestick pattern, accompanied by rising volume above the 20-session average, indicating that investors were actively trading again. Moreover, the DXG price successfully broke through the medium-term downward trendline and crossed above the Middle line of the Bollinger Bands, while MACD and Stochastic Oscillator continued to trend upward after giving buy signals, further reinforcing the recovery scenario in the coming time.

Source: https://stockchart.vietstock.vn/

|

Following the real estate sector was the financial sector, which also showed positive greens. This included banking stocks such as HDB, MBB, TCB, and ACB, which rose between 0.19-1.06%. In addition, securities stocks such as SSI, VIX, FTS, and HCM also increased by at least 3%.

The market breadth inclined towards the buying side, with more than 490 stocks rising, outnumbering the approximately 130 declining ones. VN-Index rose over 18 points at 10:30 am, reaching 1,241 points; HNX-Index gained 1.51%, hovering around 231 points, and UPCoM-Index climbed 0.75%.

Source: VietstockFinance

|

The total trading volume on the three exchanges exceeded 329 million units, corresponding to a value of over 7.4 trillion VND. However, foreigners turned to net sell by more than 130 billion VND, focusing on HPG, TCB, and VHM.

| Foreign trading buy – sell net off |

| Top 10 stocks with the strongest foreign trading buy – sell net off in the morning session of 16/08/2024 (10:40 am) |

Opening: Greens dominate

At the beginning of the session on 16/08, by 9:30 am, the VN-Index surged nearly 5 points to around 1,228 points. The HNX-Index also edged up 0.79 points, trading around 229 points.

The energy group continued to be among the top recovering sectors in the early session, with BSR rising 0.44%, PVD climbing 0.38%, and PVB increasing by 1.11%…

The real estate sector also contributed to the greens, with most of the stocks in the industry trading higher. Specifically, stocks such as VHM rose 0.66%, DIG climbed 0.9%, VRE increased by 0.84%, CEO went up by 1.45%, DXG advanced 1.14%, and NVL gained 0.89%…

In addition to the two aforementioned groups, many Large Caps also had positive performances. FPT, MBB, VCB, and HDB also supported the indices.