Retail businesses in the Vietnamese market are facing significant challenges due to a decrease in consumer spending, as the overall economy is in a slump. However, it is surprising to see Japanese retail giants thriving in this environment, with AEON being a notable example.

For the fiscal quarter from March 1, 2024, to May 31, 2024, AEON recorded an operating revenue of 109.43 billion yen. Notably, their operations in Vietnam contributed over 4 billion yen, or approximately 640 billion VND, marking a 13.8% increase compared to the same period last year. On average, AEON generates about 7 billion VND in revenue per day in Vietnam.

Similarly, operating profit in the Vietnamese market increased by 21.9% year-over-year, reaching 1.3 billion yen, or 210 billion VND. AEON’s operating revenue in Vietnam accounts for approximately 48% of their total operating revenue in Southeast Asia, while their operating profit contributes a significant 92%.

Since entering the Vietnamese market in 2014, AEON has established six shopping centers, focusing on the two economic hubs of Hanoi and Ho Chi Minh City. They are also set to open a new shopping center in Thua Thien Hue province in 2024.

During a meeting with Prime Minister Pham Minh Chinh in May 2023, Mr. Akio Yoshida, Executive Chairman of AEON Group, revealed that the company has invested 1.18 billion USD in Vietnam so far. He further shared their plans to develop around 20 shopping centers in the country, focusing on supermarkets and entertainment.

AEON’s expansion is driven by the need to keep up with the growing demand for store openings from their fellow Japanese brands, such as UNIQLO and MUJI.

UNIQLO and MUJI: A Dynamic Duo

According to Cushman & Wakefield, in the past six months, numerous retail chains across all segments have expanded their presence in Ho Chi Minh City, particularly Japanese foreign direct investment (FDI) enterprises.

AEON opened a new branch following the Super Supermarket model at Crescent Mall, while the home center brand Kohnan added a new store in Vincom Le Van Viet. Nitori, a Japanese furniture and home goods retailer, opened its first store in Ho Chi Minh City, located in Vincom Mega Mall (VMM) Grand Park.

UNIQLO, a well-known Japanese clothing brand, opened a new store in Giga Mall and is set to launch two more stores in Vincom Plaza Le Van Viet and VMM Grand Park. By the end of 2023, UNIQLO had 22 stores nationwide.

MUJI, another popular Japanese brand known for its minimalist and affordable lifestyle products, is also expanding its presence in Vietnam. They are soon to open new stores in Vincom Plaza Le Van Viet, Thiso Mall Truong Chinh – Phan Huy Ich, and Thiso Mall Sala.

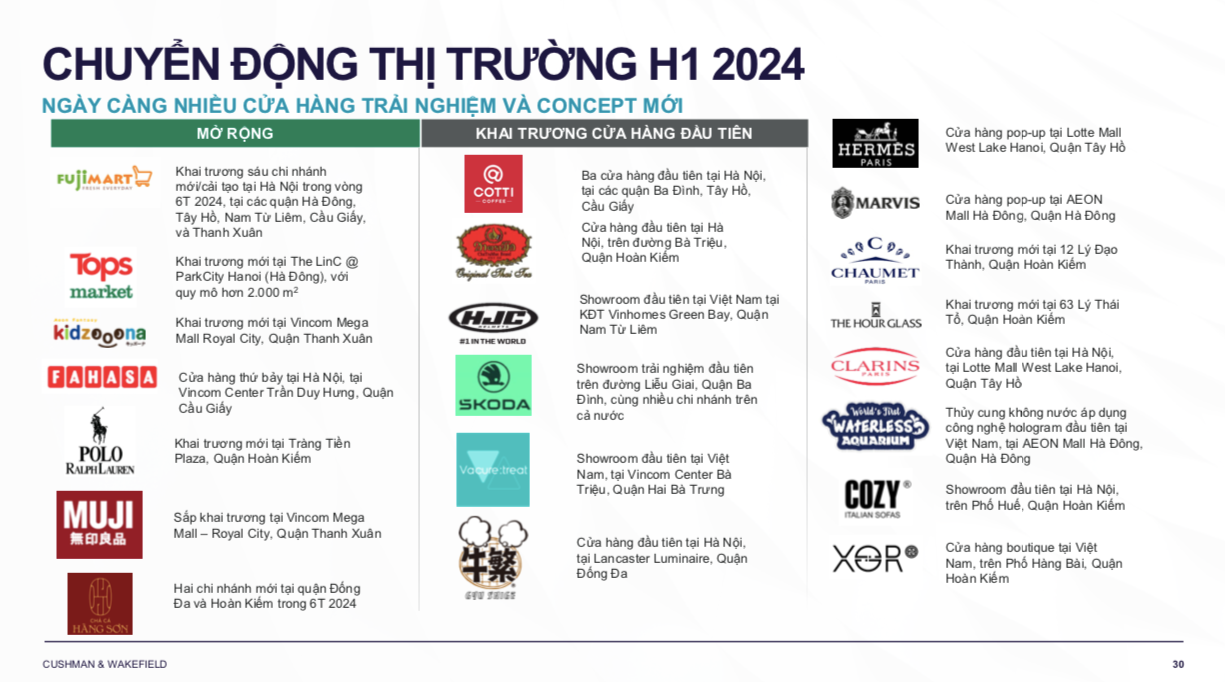

In the northern market, there has been an increase in experience stores and new concepts within shopping centers. Fuji Mart, a joint venture between BRG and Sumitomo, opened or renovated six stores in the first half of 2024. MUJI is also set to open a new store in Vincom Mega Mall – Royal City in Hanoi. As of July 2024, MUJI operates nine stores in Vietnam, according to their website.

By the end of 2024, UNIQLO is expected to have at least 25 stores, while MUJI will have 13. It is worth noting that MUJI’s 13 stores in Vietnam, with an average retail space of 2,000 square meters each, could be equivalent to 26 stores in other markets.

Mr. Tetsuya Nagaiwa, General Director of MUJI Vietnam, shared in March 2023: “Compared to other Asian markets like Singapore, Malaysia, the Philippines, and Thailand, MUJI stores in Vietnam currently have the largest average retail space, at around 2,000 square meters.

This is almost double the global average, including Japan. As a result, we can display a diverse range of products from various product groups, providing customers with more choices and encouraging more frequent shopping.

Regarding future store openings, I cannot disclose the exact number, but I can assure you that we plan to open more than two stores. After facing challenges during the pandemic, we are happy to report that our business has stabilized, and we look forward to smooth expansion in the market.”

MUJI Vietnam seeks retail spaces of 2,000 square meters or more for their new stores within shopping centers, but this has proven challenging due to the limited space available in most Vietnamese malls. This is also why their expansion in Ho Chi Minh City has been faster than in Hanoi.

According to Cushman & Wakefield, there were no new supply additions in Hanoi during the second quarter of 2024. In the first six months of the year, the city welcomed only 10,200 square meters of new retail space from The LinC @ ParkCity Hanoi.

In contrast, Ho Chi Minh City saw new and renovated supply additions totaling 52,421 square meters in the same period. This included the reopening of Vincom 3/2 in June, the launch of VMM Grand Park in June and July, and the opening of additional floors at Thiso Mall Truong Chinh – Phan Huy Ich in August.

Ms. Tu Thi Hong An, Senior Director of Commercial Leasing Services, Savills Vietnam

Ms. Tu Thi Hong An, Senior Director of Commercial Leasing Services at Savills Vietnam, highlighted the trend of F&B tenants driving expansion demands in Ho Chi Minh City and neighboring markets like Bangkok and Singapore. She also noted that Japanese tenants were the most active.

As an example, she mentioned Nitori, a Japanese home furnishings and housewares retailer, which recently entered the market with five stores, demonstrating their ambitious growth plans similar to MUJI. MUJI itself has announced plans to open an additional 100 stores across Southeast Asia, with a particular focus on Vietnam.

Savills’ report showed that transactions in the first half of 2024 averaged 256 square meters of net leasable area (NLA), a 26% increase year-over-year, as large chain brands like MUJI, Poseidon, and UNIQLO expanded. The fashion industry accounted for 35% of leased space, followed by F&B with 30%, home furnishings & furniture with 15%, and entertainment with 11%.

From a broader market perspective, Ms. Cao Thi Thanh Huong, Senior Manager of Research at Savills Ho Chi Minh City, commented: “The domestic economy’s strong recovery has boosted the development of the retail industry, attracting new brands to enter the market and encouraging existing ones to expand.”

70% of Japanese Companies Plan to Expand Operations in Vietnam in the Next 1-2 Years

Japanese interest in Vietnam is not limited to the retail sector but extends to manufacturing and production as well.

Both Japanese and Vietnamese companies faced numerous challenges in 2023 and continue to be impacted by decreased consumer spending and a sluggish economy in 2024. However, there are signs of recovery in Vietnam’s economy, with notable improvements in import and export activities.

Mr. Matsumoto Nobuyuki, Chief Representative, Japan External Trade Organization (JETRO), Ho Chi Minh City Office

According to Mr. Matsumoto Nobuyuki, Chief Representative of JETRO’s Ho Chi Minh City Office, Japanese companies’ interest in Vietnam remains strong. He shared that 18 Japanese companies, 16 of which are new entrants, will participate in METALEX Vietnam 2024. This year’s event will feature 350 exhibiting companies.

“Vietnam continues to be an attractive investment destination for Japanese businesses. According to a survey, 56.7% of Japanese companies in Vietnam plan to expand their operations in the next 1-2 years, with the industrial production sector accounting for 47.1%.

As of June 2024, Japanese investment in Vietnam reached 1,225 million USD, a 2.1-fold increase compared to the same period last year, making Japan the third-largest investor in Vietnam (second if including capital contribution for purchasing shares). The localization rate of Japanese companies in Vietnam in 2023 expanded to 41.9% (this rate is much lower in Indonesia and Thailand), a 4.6-point increase from 2022, with a 10-year growth rate second only to India.

The procurement rate from local Vietnamese enterprises has gradually increased over the years, reaching 17.2% (a 2.2-point increase compared to the same period). Regarding future localization prospects, 43.2% of Japanese companies responded that they will ‘expand’ in Vietnam, much higher than the ASEAN average of 28.8%,” added Mr. Matsumoto Nobuyuki.

RX Tradex Vietnam, the organizer of “METALEX Vietnam 2024,” has signed a cooperation agreement with JETRO, the Investment and Trade Promotion Center (ITPC), and the Center for Supporting Industrial Development (CSID) to organize the “Supporting Industry Show 2024” for the 23rd time in Vietnam and the 12th time in Ho Chi Minh City.

“Supporting Industry Show 2024” is a joint initiative between Japan and Vietnam established in 2003. It aims to improve Vietnam’s investment environment and is related to the “Vietnam-Japan Economic Partnership Agreement (VJEPA)” in the supporting industry sector.