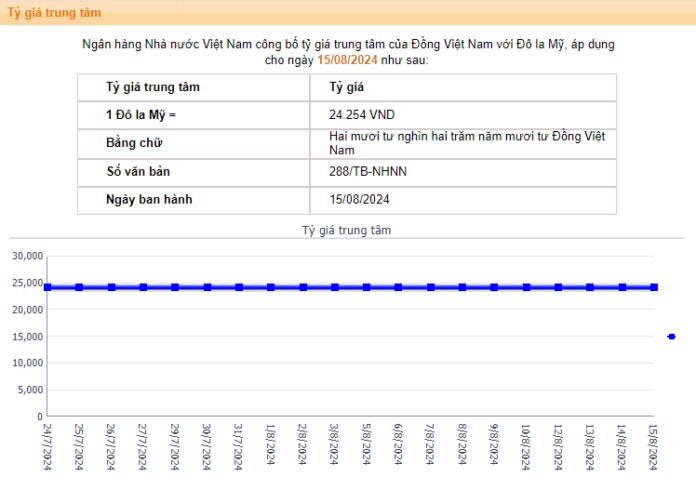

Source: SBV

With a +/- 5% fluctuation band, today’s ceiling rate is 25,467 VND/USD and the floor rate is 23,041 VND/USD.

The reference exchange rate at the State Bank of Vietnam remains stable at 23,400 – 25,450 VND/USD (buying – selling).

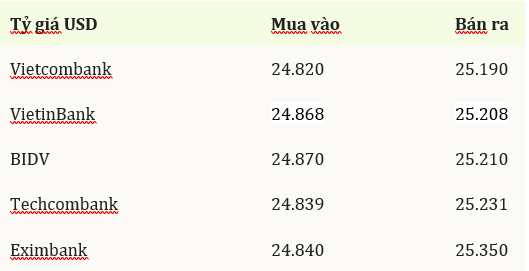

Meanwhile, many commercial banks have lowered their buying and selling prices for the greenback. Specifically, at 9:30 am this morning, Vietcombank set the buying and selling prices at 24,820 – 25,190 VND/USD, a decrease of 70 VND in both directions compared to yesterday.

BIDV listed the dollar price at 24,870 – 25,210 VND/USD (buying – selling), down 56 VND in both buying and selling directions compared to the same period yesterday.

Techcombank listed the exchange rate at 24,839 – 25,231 VND/USD (buying – selling), down 61 VND in buying and 60 VND in selling compared to yesterday.

At Eximbank, the USD/VND exchange rate was listed at 24,840 – 25,350 VND/USD (buying – selling), down 50 VND in buying and 58 VND in selling compared to yesterday.

Compared to the beginning of August, banks have lowered the USD price by more than 200 VND, equivalent to a decrease of 0.78%. The selling price is approaching 25,000 VND/USD.

At the same time, the USD/VND exchange rate in the self-traded market in Hanoi was traded at 25,495 – 25,575 VND/USD (buying – selling), down 25 VND in buying and 5 VND in selling compared to the previous session.

In the global market, the US Dollar Index (DXY) – which measures the strength of the US dollar against a basket of major currencies, stood at 102.63 points, up 0.06% from the previous session.

Source: MarketWatch

According to analysts, the majority of market participants are leaning towards the scenario that the Fed’s first rate cut could come at the September meeting, with a 50-basis-point reduction instead of the previously expected 25 basis points. The FedWatch tool of CME Group also indicated that ahead of the producer price data and increased bets on a 50-basis-point cut from 53% a day earlier to 56% after the inflation data was released.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…