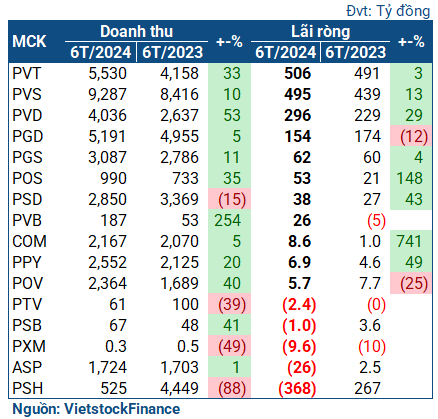

According to statistics from VietstockFinance, out of the 20 enterprises in the gasoline-oil-gas industry that published their second-quarter financial statements, 9 reported growing profits, 6 experienced declines, and 5 suffered losses.

The Giants: A Mixed Bag

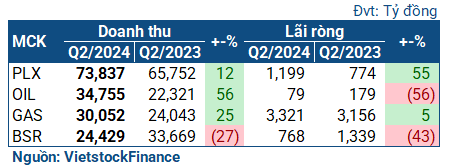

In the second quarter, the group of leading giants in the industry exhibited a balanced performance, with 2 companies posting profit growth and the other 2 witnessing declines.

|

Business results of the gasoline-oil-gas giants in Q2 2024

|

Petrolimex (HOSE: PLX) took the lead with a nearly 1,200 billion VND net profit, a 55% increase from the same period last year. The company attributed this growth to improved gasoline business performance compared to the previous year, increased sales volume due to stable global oil and gas prices and supply, and a steady domestic supply.

| Petrolimex achieved strong business growth in Q2 2024 |

PV GAS (HOSE: GAS) also recorded growing profits, with a net profit of 3,300 billion VND, a 5% increase from the previous year. This improvement was likely due to increased dry gas consumption and a recovery in selling prices.

On the other hand, PV Oil (UPCoM: OIL) and BSR faced challenges, with PV Oil’s profit declining by 56% to 79 billion VND and BSR’s profit plunging by 43% to 768 billion VND.

| BSR experienced a significant profit decline due to the comprehensive maintenance of the Dung Quat Refinery |

BSR’s performance was negatively impacted by the fifth comprehensive maintenance (TA5) at the Dung Quat Refinery, along with lower crude oil prices and cracking spread compared to the previous year. Meanwhile, PV Oil attributed its decline to the shorter period for adjusting the base price of gasoline and oil from 10 days to 7 days. Despite lower gasoline and oil prices, the faster decline in selling prices led to a narrower gross profit. Additionally, foreign exchange losses also contributed to PV Oil’s reduced profit.

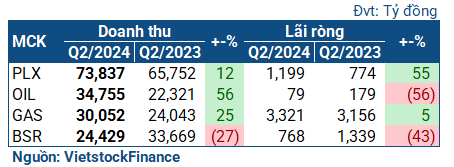

While the giants showed a balanced performance in the second quarter, only Petrolimex achieved profit growth in the first half of the year. The other three giants experienced declines, with BSR facing the steepest drop of 35%, resulting in a net profit of over 1,900 billion VND. However, staying true to their tradition of setting conservative targets, all three giants, PLX, GAS, and BSR, surpassed their full-year plans after just six months. PV Oil, on the other hand, achieved only 57% of its full-year net profit target.

|

First-half results of the gasoline-oil-gas giants in 2024

|

Segment-wise Performance

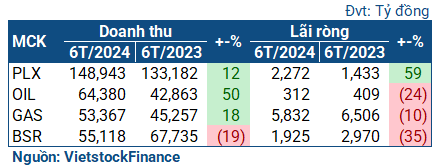

Among the remaining enterprises, the second-quarter results exhibited a clear segmentation among upstream (exploration and production services), midstream (resource collection and transportation), and downstream (refining) companies.

|

Performance of gasoline-oil-gas companies in Q2 2024

|

The upstream group witnessed a slight decline compared to the previous year. For instance, PVS reported a net profit of 195 billion VND, a 13% decrease, mainly due to a reduction in financial revenue as interest income fell.

PVD also experienced a 16% decline, with a net profit of 136 billion VND, despite a robust 60% increase in revenue to nearly 2,300 billion VND. The company attributed the revenue growth to an additional drilling rig for lease and increased workload at its subsidiaries. However, the second quarter of 2023 included a one-time income from a contract termination agreement with a customer, which was not recorded in the current quarter. Additionally, reduced work at the joint venture, along with increased financial expenses due to interest and exchange rates, dragged down PVD’s profit in the second quarter.

| Other losses caused PVD’s profit to turn from growth to decline in Q2 2024 |

An exception was PVB, a company specializing in oil and gas pipe coating, which reported a threefold increase in profit compared to the same period last year, reaching 5.2 billion VND in the second quarter. This growth was attributed to the implementation of high-profit service contracts.

In the midstream segment, PV Trans (HOSE: PVT) also reported a slight decline in profit. In reality, PVT’s business performance in the second quarter was quite positive, with a net profit of over 522 billion VND, a 20% increase from the previous year. However, the company incurred a significant loss of 63 billion VND (compared to a profit of 57 billion VND in the same period last year), causing a reversal in the quarterly results, with a net profit of 287 billion VND, a 9% decrease. Nonetheless, this result was not disappointing for PVT as it outperformed most recent quarters.

In contrast, the second quarter proved favorable for downstream companies. For instance, PGD, a PVN gas distributor, reported a net profit of 117 billion VND, an impressive 86% increase. The company attributed this growth to a slight decrease in gas volume but a significant 53% increase in revenue due to higher gas prices and timely price adjustments. Comeco (HOSE: COM) even achieved an eightfold increase in profit, reaching 4.8 billion VND.

| Downstream companies like Comeco shone in Q2 2024 |

However, there were also some companies that incurred losses, with Nam Song Hau (HOSE: PSH) being a notable example. In the second quarter, the “Western Fuel Giant” experienced a 92% drop in revenue and a net loss of 368 billion VND, the highest loss since 2018.

One of the main reasons for PSH’s losses was tax-related issues. In late 2023, PSH received enforcement notices from the Tax Departments of Hau Giang and Can Tho provinces, totaling over 1,200 billion VND. As of July 2024, the company still owed nearly 1,140 billion VND in taxes in Hau Giang and almost 93 billion VND in Can Tho. Although the Ministry of Finance provided a path forward and extended the payment deadline, this situation negatively impacted the company’s business performance and contributed to the warning status of PSH’s stock due to the 2023 audited financial statements, which included a qualified opinion.

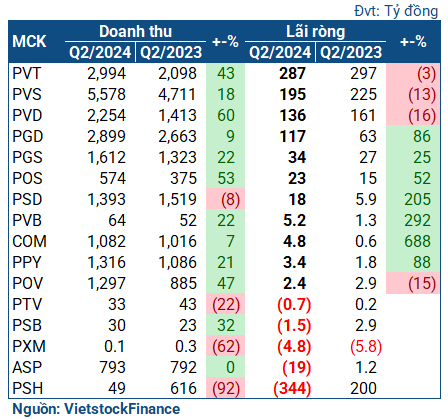

When considering the cumulative results for the first six months of the year, there was a reversal in performance, with upstream (PVS, PVD) and midstream (such as PVT) companies achieving profit growth, while some downstream companies like PGD experienced declines. However, the overall trend remained largely unchanged, with most downstream companies reporting significant profit increases.

|

First-half results of gasoline-oil-gas companies in 2024

|

Upstream Prospects from the Lot B – O Mon Project

According to KBSV Securities, with the Brent crude oil benchmark price averaging $83 per barrel in 2024 (unchanged from the previous year), the oil supply balance is expected to remain favorable until the end of the year. Oil consumption is anticipated to be positive in the third quarter of 2024 due to increased road and air travel during the holiday season. Additionally, global oil consumption is forecast to continue growing, supported by factors such as the recovery of China’s manufacturing sector, low investment in production expansion in the US, OPEC+’s production cuts, and supply disruptions in the Red Sea and Black Sea due to military conflicts.

Notably, KBSV Securities assessed that the prospects for the upstream oil and gas group would be boosted by the Lot B – O Mon power project. In April 2024, the Ministry of Industry and Trade proposed a mechanism to convert gas prices to electricity prices for key projects, including LNG Thi Vai, Lot B – O Mon, and Ca Voi Xanh. This mechanism has not been approved yet, but if it is, it will resolve a critical obstacle for the project, paving the way for the final investment decision (FID) in the second half of the year.

The Lot B – O Mon project has a total investment of approximately $12 billion, of which the upstream segment accounts for $7 billion, the midstream segment for $1.3 billion, and the downstream segment (power plants) for about $3.7 billion.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.