The global electric vehicle fever of the past few years has paved the way for China’s EV industry to achieve remarkable growth and emerge as one of the powerhouses in the EV space. However, the industry’s rapid growth in China is now facing significant challenges, from domestic overproduction issues to mounting international trade barriers.

The Boom of China’s Electric Vehicle Industry

The development of China’s EV industry is a result of a combination of national industrial policies and strong support from local governments. Cities like Hefei and Wuhan have become important EV manufacturing hubs, attracting significant investment and creating complete industrial clusters.

The Xiaomi SU7 electric car, a company that started with smartphones

The strong government support has attracted not only traditional automakers such as SAIC, BAIC, and Geely to enter the EV market but also “outsider” companies like Huawei and Xiaomi to establish their own EV brands. Even real estate companies like Evergrande had plans to venture into the EV industry before their collapse.

A prime example is Hefei, which has become the “electric vehicle capital” of China. The city government facilitated the construction of BYD’s mega-factory and established an investment fund worth over 100 billion yuan to support the EV industry. The support is not just financial but also policy-related.

For instance, to accommodate BYD’s mega-factory, over 1,000 trucks were mobilized overnight to transport and level the land, creating a sufficiently flat surface for the factory. When Nio, an EV maker, encountered difficulties, the Hefei provincial government invested 11.2 billion yuan for the company to relocate its headquarters, vehicle and battery manufacturing plants, and research center to the region. As a result, Hefei now hosts six EV manufacturers and over 500 EV component suppliers.

However, Hefei’s success was quickly emulated by other local governments, leading to the construction of numerous EV manufacturing facilities across the country. Even when companies performed inefficiently, local governments continued to inject investment funds to keep them afloat. Ultimately, this has led the Chinese EV industry into a state of overproduction and a severe supply glut.

BYD electric vehicles waiting to be loaded onto a train at Suzhou Port, Anhui Province, China, February 2024.

The consequence of this overproduction is an intense “price war” among Chinese EV manufacturers. Companies are forced to cut costs by all means, putting pressure on the entire supply chain. This not only affects profitability but also hampers the industry’s innovation capacity.

International Trade Barriers

With the domestic market already oversaturated, EV manufacturers have no choice but to turn to international markets. However, this escape route is not without its challenges as foreign markets do not offer the same preferential treatment as the home market.

Soon after entering major markets like the US and Europe, EV makers faced a series of stringent protectionist measures. The US imposed a 100% tariff on EVs imported from China, while the European Union levied a 37.6% duty. These tariffs have effectively shut the doors to two of the largest export markets for Chinese EVs, forcing manufacturers to seek new markets.

Trade protectionist measures are leaving Chinese EVs stranded at European ports.

Facing barriers in developed markets, Chinese EV manufacturers have shifted their focus to emerging markets, particularly in Southeast Asia, with promising markets like Thailand and Vietnam. However, Chinese EV makers themselves are displaying a certain degree of indifference towards these new markets.

For instance, BYD, China’s largest EV manufacturer, has started introducing and selling its vehicles in Vietnam but has not invested in a charging station system, which is crucial for EVs today. While VinFast has developed around 150,000 charging stations in Vietnam, BYD relies on third-party providers, which are currently scarce.

Price Cuts to Clear Inventory

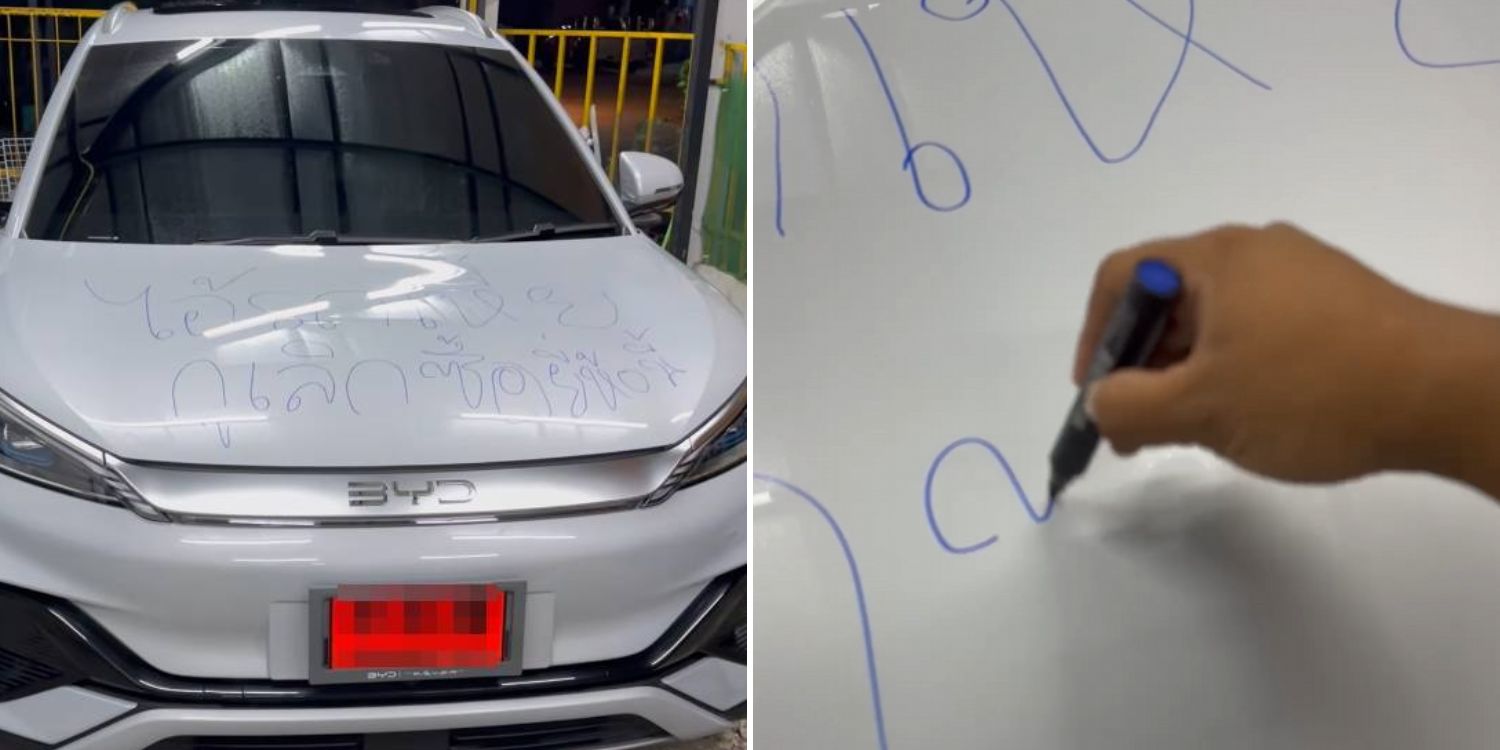

Even in Thailand, where BYD has established a manufacturing plant, the company’s policies have turned off potential customers. Specifically, to quickly gain an edge in Thailand’s competitive market, BYD resorted to a familiar tactic—price cuts.

In January 2023, the BYD Atto 3 model was priced at 1.2 million baht, but as of now, the company has reduced the price by an additional 340,000 baht, equivalent to a decrease of over 30% in just one year, infuriating consumers. This has led to an investigation by Thailand’s consumer protection agency after receiving dozens of complaints from car buyers.

Thai consumer Surasit Juksuwanitcha expressed his anger by writing on his own BYD car after the company slashed prices shortly after his purchase.

A similar story is unfolding in Vietnam as the Wuling Mini EV, considered the cheapest EV in the country, continues to see price cuts of up to 60 million dong, bringing the price below 200 million dong for the first time ever (197 million dong). Despite being the most affordable model in the market, the Wuling Mini EV’s sales performance is not impressive. This has raised concerns that Chinese EV makers are attempting to clear their excess inventory by drastically reducing prices.

Instead of demonstrating long-term commitment and fostering a sustainable market, the actions of Wuling and other Chinese EV brands indicate that they are not yet prepared to invest for the long haul in Vietnam. Many worry that, in reality, neighboring emerging markets are becoming dumping grounds for a flood of cheap Chinese EVs—a surplus resulting from their own domestic market saturation.

The Risk of an “EV Graveyard”

With shrinking export markets and a saturated domestic market, China’s EV industry faces a concerning outlook. Will this overproduction lead to an “EV graveyard,” similar to the “bicycle graveyard” that occurred previously?

These “bicycle graveyards” were a haunting sight in many cities as numerous bike-sharing startups went bankrupt and had no choice but to discard their bicycles. A similar fate could await China’s EV industry if the current overproduction issue remains unresolved.

Fueled by massive government investments and support, China’s EV industry now finds itself at a crossroads. The breakneck growth pace has led to an oversaturated domestic market in a short span, and breaking into international markets is not without its challenges, as the perks enjoyed in the Chinese market are absent abroad.

The battle of prices and the wave of electronics store closures – how long will it last?

In 2023, the electronics and technology industry faced significant challenges with a sharp decline in purchasing power. However, in 2024, there is hope for a recovery.