On August 6, 2024, the Board of Directors of PVI decided to relieve Mr. Nguyen Xuan Hoa from his duties as Vice Chairman and CEO to assume a different role assigned by the Vietnam Oil and Gas Group (PVN). Mr. Nguyen Tuan Tu, born in 1972, was appointed as the new CEO of PVI. Mr. Tu is PVN’s representative at PVI, holding their portion of the company’s capital.

These decisions will come into effect after the PVI General Meeting of Shareholders approves the Board of Management personnel and ratifies the CEO appointment, as per their authority.

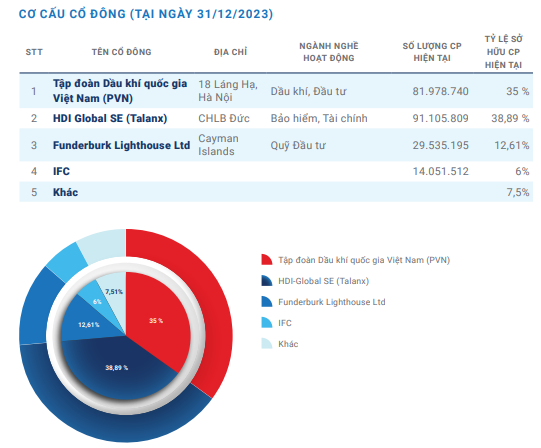

According to the 2023 Annual Report, PVI has three large foreign shareholders and one large domestic shareholder. HDI Global SE is the largest shareholder, followed by PVN, which held 35% of PVI’s capital as of December 31, 2023. Funderburk Lighthouse, part of the HDI Global SE group, owns 12.61%, while IFC holds 6% of PVI’s capital.

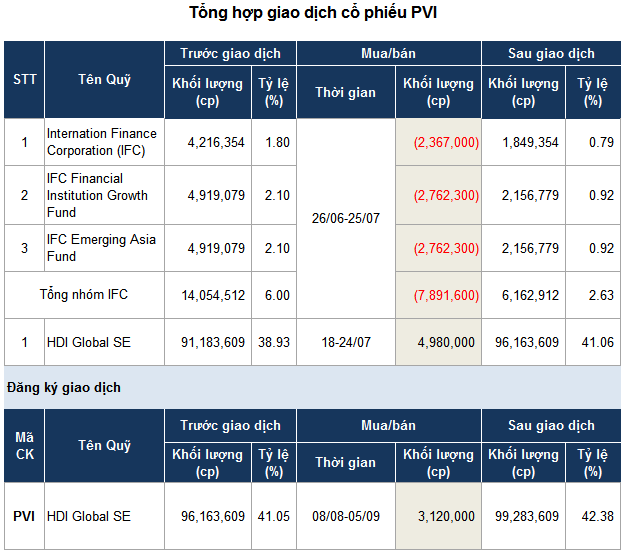

Prior to these leadership changes at PVI, IFC, a major foreign shareholder, announced its plan to sell 9 million PVI shares between June 26 and July 25, 2024.

Source: VietstockFinance

|

During this period, foreign investors sold a total of nearly 8 million shares out of the 9 million registered, falling short by 1.1 million shares. IFC attributed this to “unfavorable market conditions.”

As of July 25, 2024, IFC’s sale of PVI shares resulted in a reduction of their ownership to 2.63%, equivalent to more than 6 million shares, potentially earning them approximately VND 406 billion.

On the other hand, HDI Global SE moved to acquire additional PVI shares, purchasing 4.98 million shares out of the 7 million registered. This transaction, valued at an estimated VND 262 billion, took place over two days, July 18 and July 24, 2024.

Following this transaction, HDI Global SE’s ownership increased from 38.93% (91.2 million shares) to 41.05% (96.2 million shares), solidifying their position as PVI’s largest shareholder.

HDI Global SE has further registered to purchase an additional 3.12 million PVI shares between August 8 and September 5, 2024, intending to increase their ownership to above 42%, nearing 100 million PVI shares.

In the first half of 2024, PVI recorded a net profit of over VND 639 billion, a 13% increase compared to the same period last year. This growth was attributed to a 26% rise in profits from insurance business operations, totaling more than VND 653 billion.

As of June 30, 2024, PVI’s total assets exceeded VND 31,545 billion, a 17% increase from the beginning of the year. The company held over VND 10,800 billion in bank deposits, an increase of nearly VND 1,400 billion, or 15%, compared to the start of the year.

Khang Di

Mango and Xemesis Sell 40% Stake in Beef Selling Avocado, Xemesis’s Brother Inherits as New Owner

The reason for the couple’s retreat to Bơ Bán Bò is revealed by Xoài Non, due to the unresolved issues of the shareholders.

Large shareholders absent, Viet Tin Securities fails to hold extraordinary shareholders’ meeting

The extraordinary Annual General Meeting of Viet Tin Securities Joint Stock Company (VTSS) scheduled on February 5th, 2024, was unsuccessful due to insufficient attendance rate to meet the required quorum.