The stock market on August 15 witnessed narrow fluctuations and a retracement amid low liquidity. By the end of the trading session, the VN-Index closed at 1,223.56 points, a decline of 6.8 points or -0.55%. Foreign investors continued to net buy over a hundred billion VND.

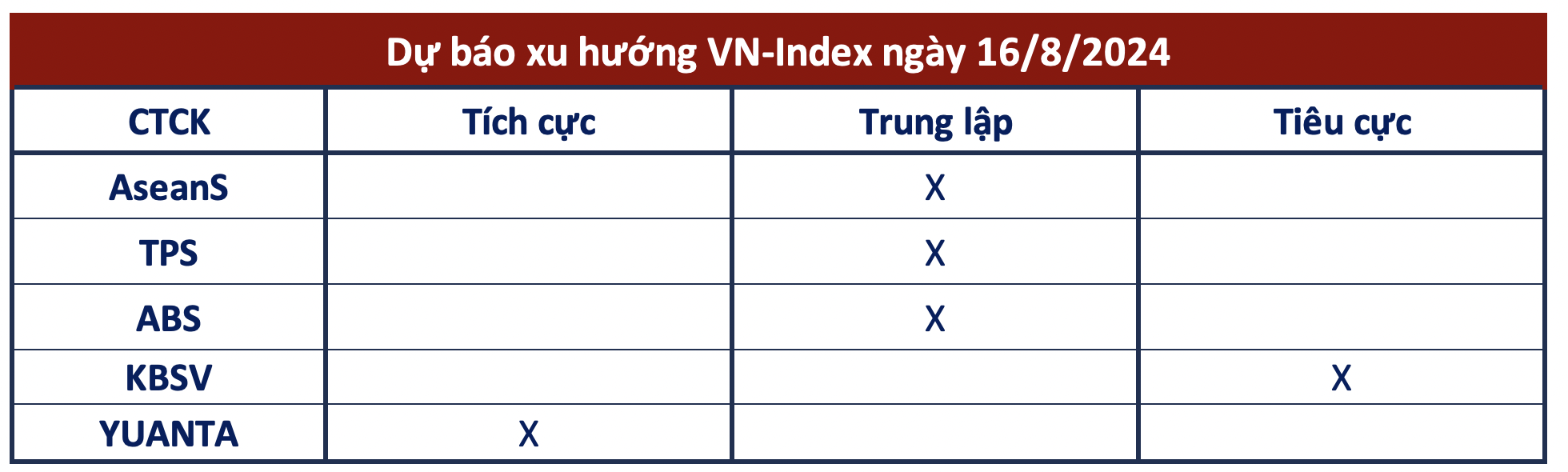

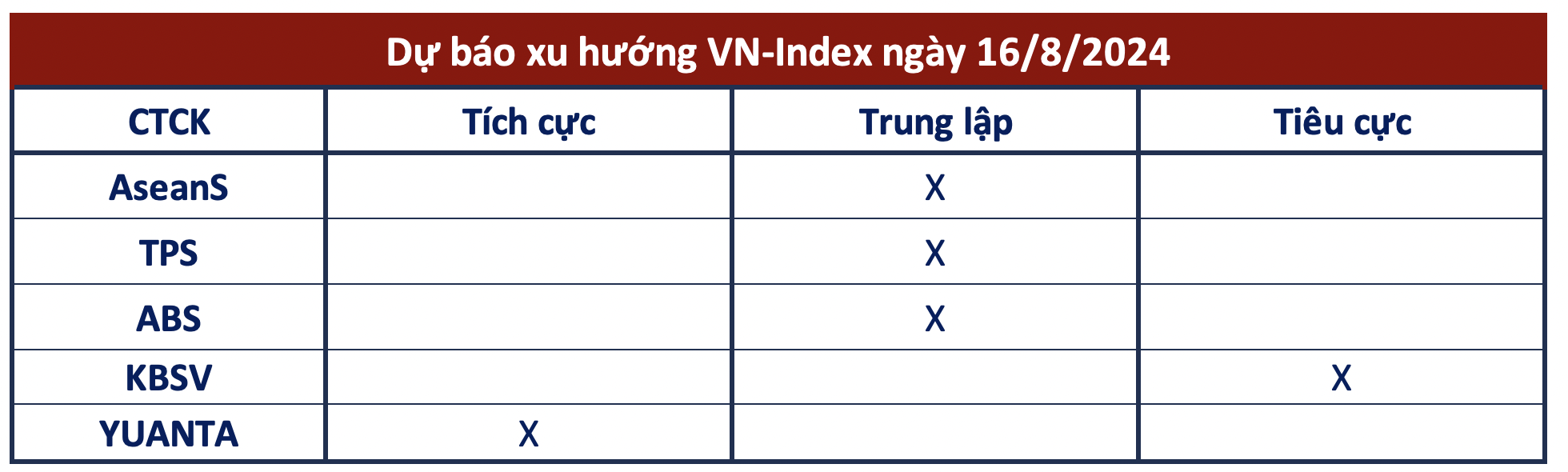

Most securities companies were cautious and believed that the market would continue to fluctuate as capital flows were not yet ready to participate.

According to TPS Securities, the market retreated to the support zone of 1,220 points on the last trading day of the week with weak liquidity. The current trading week is experiencing a significant drop in liquidity compared to the previous week, reflecting the cautious and doubtful sentiment of investors. TPS believes that the VN-Index needs a leading stock with large liquidity, and investors are advised to consider disbursement at the 1,220-point zone, especially aggressive disbursement if liquidity increases.

Sharing the same view, Asean Securities noticed investors’ caution and the market’s indifference to capital flows. However, low volume also indicated that selling pressure was easing. The trend will continue to fluctuate, with the important support zone being 1,220 points. If this zone is broken, the index may continue to fall to the 1,180 – 1,190 zone.

Asean Securities recommended that investors temporarily hold a moderate portfolio and closely monitor the support zone of 1,215-1,220 points. They should only consider increasing their holdings if there are more positive signs of capital flows.

In the opinion of ABS Securities, the market is likely to experience fluctuations in the next session. This short-term recovery will be more solid if the market forms another bottom to consolidate the uptrend. Liquidity gradually tightened as the VN-Index approached the resistance zone, so risky investors who participated in the recent rebound need to manage their capital well.

KBSV Securities assessed that with the main index closing near the session’s low, the market is facing increasing downside risks. Although the decline did not trigger a panic selling situation, the lack of bottom-fishing cash flow and support from large-cap stocks could lead to a continuation of the short-term downtrend. Investors are advised to reduce their portfolio allocation to a safe level during early rebounds and only consider repurchasing when the index/stock retraces to their respective support levels.

More positively, Yuanta Securities believed that the market could rebound in the next session, and the VN-Index might retest the 1,230-point level. Meanwhile, the market is still in a short-term accumulation phase, so liquidity remains low, and stock performance is mixed.

Yuanta recommended that investors maintain a low stockholding ratio and consider new purchases with a low ratio.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.