The stock market traded poorly during the August 15 session. The VN-Index fell for most of the day, closing 6.8 points (0.55%) lower at 1,223.56. Foreign exchange transactions were a downside, with net buying exceeding VND 130 billion across all markets.

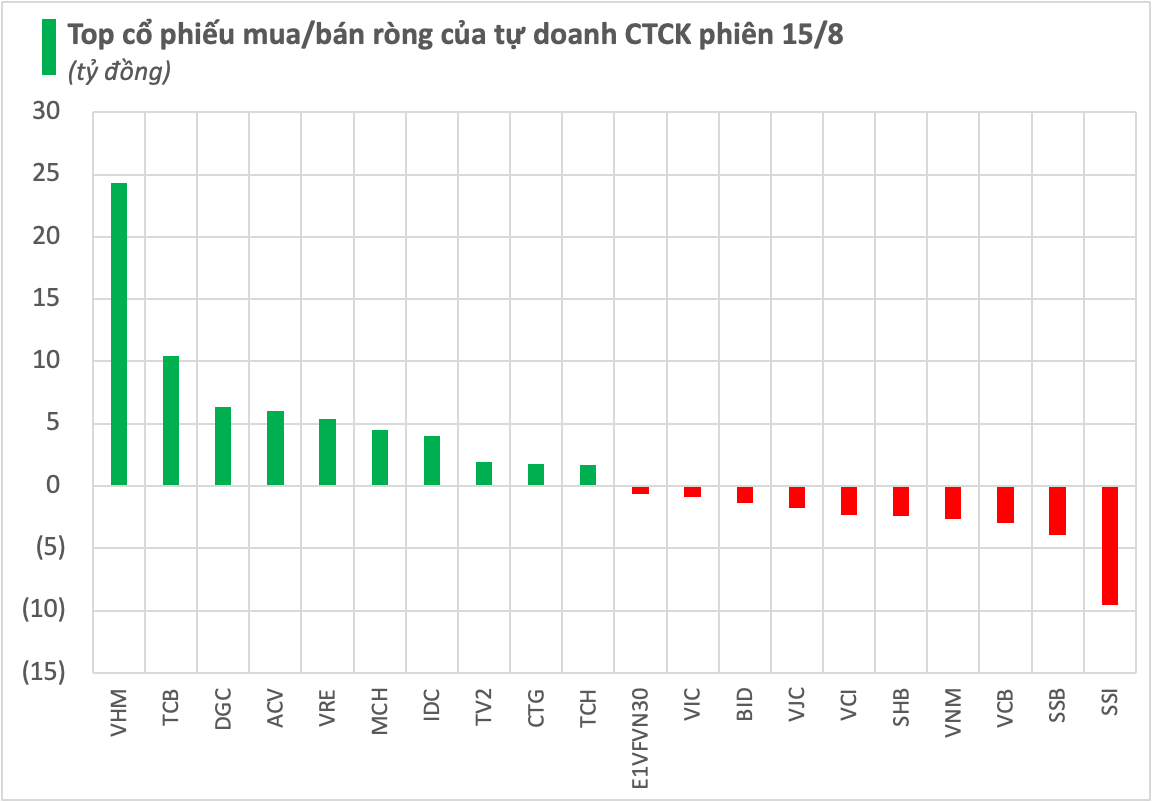

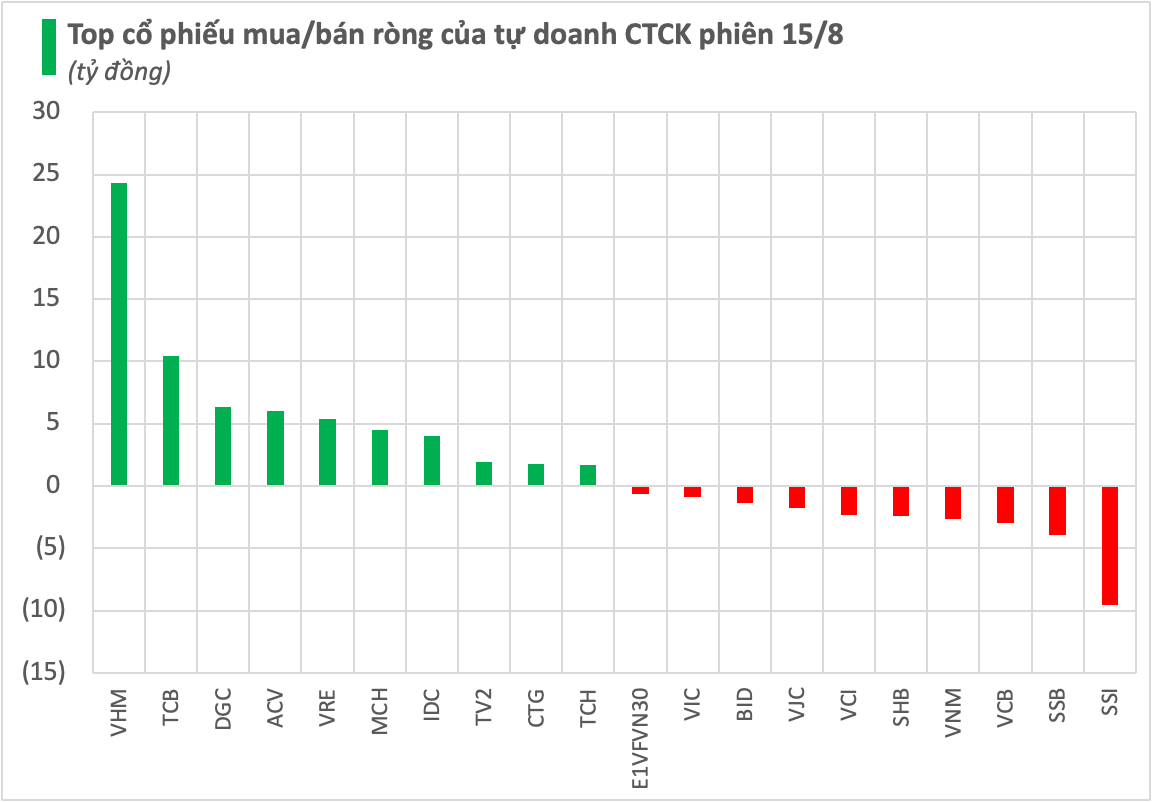

In this context, securities companies’ proprietary trading bought a net VND 38 billion on the three exchanges.

On the HoSE, securities companies’ proprietary trading bought a net VND 24 billion, including net buying of VND 57 billion on the matching channel but net selling of VND 33 billion on the negotiated channel.

Specifically, the strongest net buying by securities companies was in VHM and TCB, with respective values of VND 24 billion and VND 10 billion. Additionally, stocks like DGC, VRE, and TV2 were also net bought on August 15.

Conversely, SSI and SSB witnessed the heaviest net selling by securities companies, with respective values of VND 10 billion and VND 4 billion. VCB, VNM, SHB, and others were also among the stocks that experienced net selling during this session.

On the HNX, securities companies’ proprietary trading bought a net VND 2 billion, with IDC being the focus as it was net bought for approximately VND 4 billion, while PVI was net sold for VND 3 billion.

On UPCoM, securities companies’ proprietary trading bought a net VND 12 billion, with ACV and MCH being the highlights. ACV was net bought for over VND 6 billion, while MCH was net bought for nearly VND 5 billion.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.