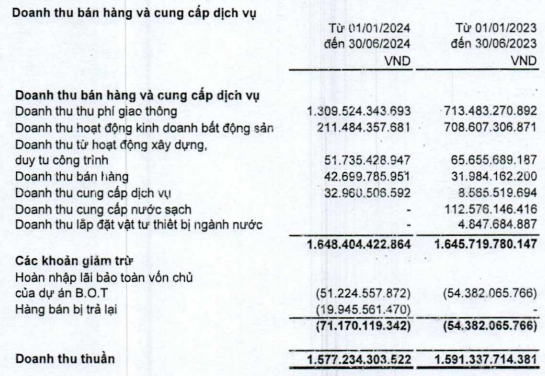

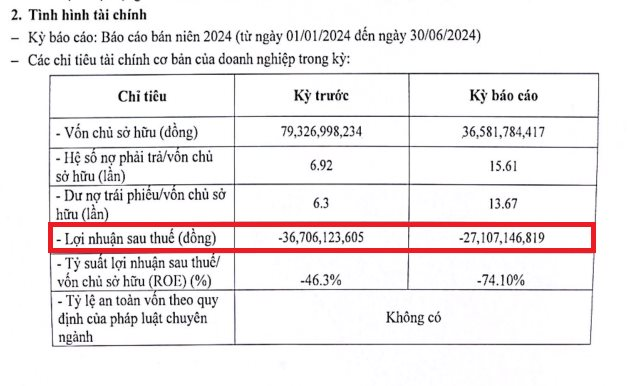

Hoanh Son 2 Energy Investment Joint Stock Company (Hoanh Son 2 Energy) has released its periodic financial report for the first half of 2024, revealing a dismal performance with a loss of VND 27 billion.

While this figure shows a significant improvement compared to the same period last year, with a loss of VND 36.7 billion, it is worth noting that this is the company’s fourth consecutive year of reporting losses. From 2021 to 2023, Hoanh Son 2 Energy reported successive after-tax losses of VND 80 billion, VND 66 billion, and VND 77 billion.

As a consequence of these continuous losses, the company’s equity capital has experienced a substantial decline, falling from VND 148 billion in 2021 to VND 36 billion as of the end of June 2024.

As of the end of June, Hoanh Son 2 Energy’s debt-to-equity ratio stood at 15.61, with total liabilities exceeding VND 571 billion, a 4% increase compared to the previous year. Notably, the bond debt remained unchanged at VND 500 billion.

Hoanh Son 2 Energy reports a loss of over VND 27 billion in the first half of 2024. (Source: HNX)

The aforementioned bond debt corresponds to the value of the HS2.H.20.23.001 bond series issued by Hoanh Son 2 Energy. On October 25, 2020, the company issued this bond series with a volume of 5 million bonds, a face value of VND 100,000 per bond, resulting in a total issuance value of VND 500 billion, and an interest rate of 10.3% per annum.

The HS2.H.20.23.001 bond series has a term of 51 months, making the maturity date March 25, 2025. The bond registrar for this series is Tan Viet Securities Joint Stock Company (OTC: TVSI).

TVSI has attracted particular attention recently as one of the legal entities involved in the case of the bond issuance by Truong My Lan and her associates. According to the investigation conclusions of the Van Thinh Phat case’s second phase, Truong My Lan directed the issuance of bonds, resulting in the appropriation of more than VND 30,000 billion from over 35,000 investors.

Hoanh Son 2 Energy repurchased a portion of the HS2.H.20.23.001 bond series ahead of schedule in July and August 2024. (Source: HNX)

In a separate development, data from the Hanoi Stock Exchange (HNX) reveals that despite its poor financial performance, Hoanh Son 2 Energy repurchased a portion of the HS2.H.20.23.001 bond series ahead of schedule on July 5 and August 1, 2024, with values of VND 35.7 billion and VND 13.3 billion, respectively. As a result, the outstanding value of the HS2.H.20.23.001 bond series currently stands at over VND 462.8 billion.

Hoanh Son 2 Energy was established in March 2019 and is headquartered at A203, The Manor Tower, Me Tri Street, My Dinh 1 Ward, Nam Tu Liem District, Hanoi. Mr. Vu Quang Bao currently serves as the company’s Chairman of the Board of Directors and legal representative.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.