According to the recent investor meeting of Mobile World Investment Corporation (stock code: MWG), the company’s leadership revealed that revenue for July 2024 exceeded VND 11,000 billion, nearly the same as the previous month and a 10% increase compared to July 2023.

The Mobile World and Dien May Xanh chains (including Topzone) recorded revenue of over VND 7,000 billion, a slight decrease from the previous month. The main reason for this decline was the company passing the peak season for air conditioners and a decrease in TV demand after the conclusion of sporting events. The product categories that saw positive growth this month were mobile phones, laptops, and washing machines.

Bach Hoa Xanh, the company’s grocery store chain, achieved revenue of more than VND 3,600 billion, a slight increase from the previous month and a 28% jump from July 2023. The average revenue per store remained at VND 2.1 billion.

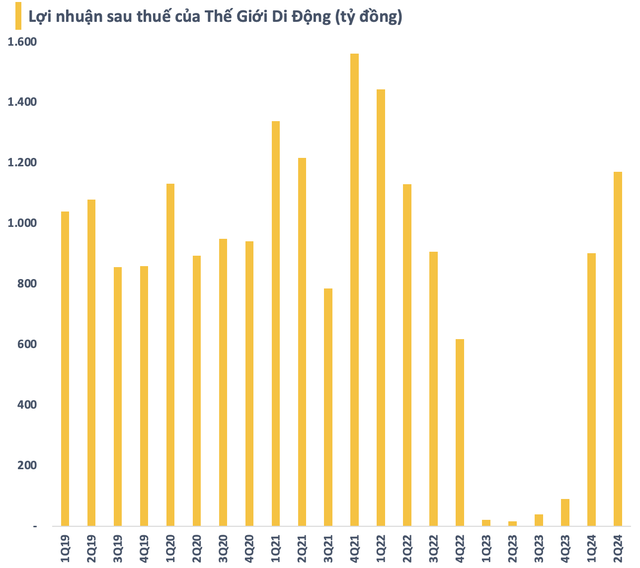

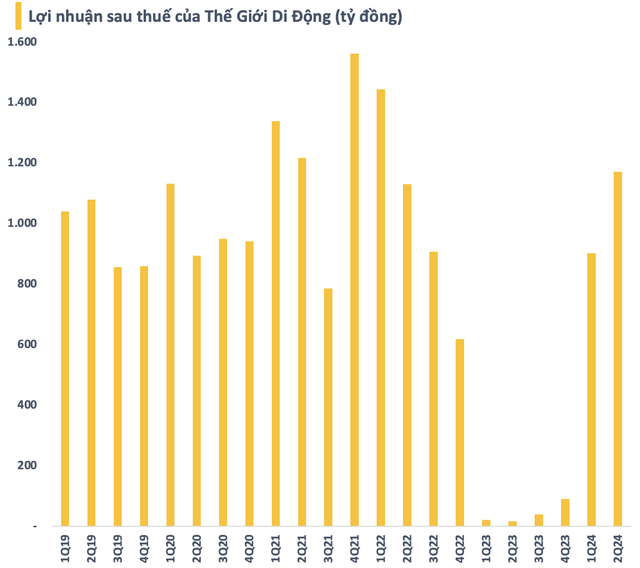

Looking back at the first half of the year, MWG recorded impressive results with revenue reaching VND 65,621 billion and after-tax profit reaching VND 2,075 billion, representing a 16% and 5200% year-over-year increase, respectively.

Commenting on the retail market for the second half of 2024, Mr. Nguyen Duc Tai, Chairman of MWG’s Board of Directors, stated that there would be an increase in consumer spending. However, the market is unlikely to see a breakthrough as some important macroeconomic indicators are recovering slowly.

“However, the current situation is better than our predictions. While things may still be uncertain in some parts of the world, I feel it is better than imagined”, shared Mr. Nguyen Duc Tai.

Looking ahead to 2025, Mr. Tai expressed his optimism, stating that the retail market will be better than 2024. This prediction is based on the assumption that there are no new wars or significant geopolitical issues.

During the investor meeting, a shareholder asked when MWG’s net profit could return to its peak level of 2021. The Chairman responded that if the company maintains a growth rate of 15%-30%, it will achieve a profit of nearly VND 5,000 billion in the next two years.

MWG’s growth depends on various factors. Firstly, a favorable macroeconomic environment is necessary for the company to aim for 20% annual growth. If the macroeconomic conditions are not favorable, the growth rate will be lower. Additionally, both external market conditions and internal efforts within MWG will contribute to achieving these results, but external conditions need to be conducive.

Mr. Nguyen Duc Tai shared his ambition to reach a revenue of USD 10 billion for MWG in the next 5-10 years. However, he acknowledged that achieving this goal would be challenging and might require expanding into new business areas.

On August 17, MWG’s stock continued its upward momentum, reaching VND 69,000/share, the highest level in nearly two years since September 2022. The market capitalization surpassed VND 100,000 billion, a more than 60% increase since the beginning of the year, and is only about 12% lower than the peak in mid-April 2022.